News

Energy Market Radar (11th edition, October 2025)

You can now download the 11th edition of our Energy Market Radar here.

The key takeaways are as follows:

- Global energy-related emissions have risen from 21.5 billion tons of CO2 in 1992 to 35.5 billion tons in 2024, an increase of 65%. While emissions increased in most regions, Europe is the only region with a significant decline.

- Energy-related emissions are directly linked to power generation technologies. While South America & Europe are focusing on low-carbon technologies, Middle East, Africa, Asia/Pacific and CIS are heavily relying on generation fired by fossil fuels.

- In energy outlooks published by BP, Equinor, ExxonMobil and Shell, global primary energy consumption by 2050 only declines in scenarios in which climate targets are reached (-1.0 % on average); other scenarios see a slight growth.

- The share of renewables in global primary energy consumption in 2050 varies greatly between scenarios, from 25% to 68%.

- Asia/Pacific and Africa dominate the production of key mineral resources that are important for the energy transition. China produces 12 of the 16 raw materials considered and is the largest producer of five different minerals.

Energy Market Radar (10th edition, July 2025)

The 10th edition of our Energy Market Radar is now available for download here.

Heating is the key topic in the current edition. With regards to regulatory enforced municipal heat planning, there are considerable regional differences in the implementation. A detailed analysis district heating prices surprises with its wide range of fluctuation.

The key takeaways are as follows:

- The status of municipal heat planning varies considerably from region to region. In addition to the pioneer Baden-Württemberg, planning is well advanced in Saarland, North Rhine-Westphalia (NRW) and Rhineland-Palatinate.

- In total, 76% of Germany's inhabitants live in municipalities in which heat planning has begun or has already been completed. In Baden-Württemberg, a quarter of all municipalities already have a heating plan.

- District heating prices in Germany fluctuate widely, regardless of customer category and annual consumption. The maximum price is 3.5 times higher than the minimum price.

- Regionally, there is a clear price differential from the north and east to the south and west. The lowest prices can be found in Rhineland-Palatinate, Bavaria & NRW - Brandenburg & Schleswig-Holstein show the highest prices.

Feature article by Prof. Graham Weale on the ramp-up of hydrogen

Prof. Graham Weale considers the current challenges to the ramp-up of hydrogen in a feature article for Tagesspiegel Background. He proposes different measures that would facilitate and accelerate the ramp-up.

Central points identified by Prof. Weale are the costs and the (timely) availability of "green" hydrogen at the required scale. He argues that any hurdles limiting the use of "blue" hydrogen should be removed because this would help reduce emissions considerably compared to "grey" hydrogen or natural gas.

The entire article is available online here (in German language only).

Professor Graham Weale joins Team Consult

We are happy to announce that Professor Graham Weale has joined Team Consult as Senior Advisor. Prof. Weale has over 40 years of experience in the energy sector. Prof. Weale supports our team with his great experience in questions relating to the decarbonization of the German industry, the ramp-up of an international hydrogen economy and long-term energy contracts. More details can be found here.

Corona Energy Market Radar Germany, 7th edition

June 2021

The latest edition of our Corona Energy Market Radar is available for download here. The key points are:

- The post-pandemic boom is driving energy consumption and commodity prices and causes a scarcity of energies and raw materials.

- German electricity consumption has stabilized at pre-pandemic levels in recent months after a slow start into the year (below the 2017-19 average in January and February).

- German gas consumption by RLM customers (power plants and industry) is significantly above pre-pandemic levels. Gas power plants are increasingly replacing power generation from coal and lignite. Gas consumption in the industry has sharply increased in recent months.

- The commodity markets are in a price rally – the prices of coal, natural gas, electricity and CO2 emission allowances are all above the price range seen in the last four years. The oil price is still in that range, albeit close to its upper boundary.

- Despite the scarcity and high prices of commodities, there is a considerable economic upturn in the manufacturing industries in Germany. The incoming orders index is currently higher than at any point in the last 4 years, and the ifo indices of different branches are above the level at which they were directly before the pandemic hit.

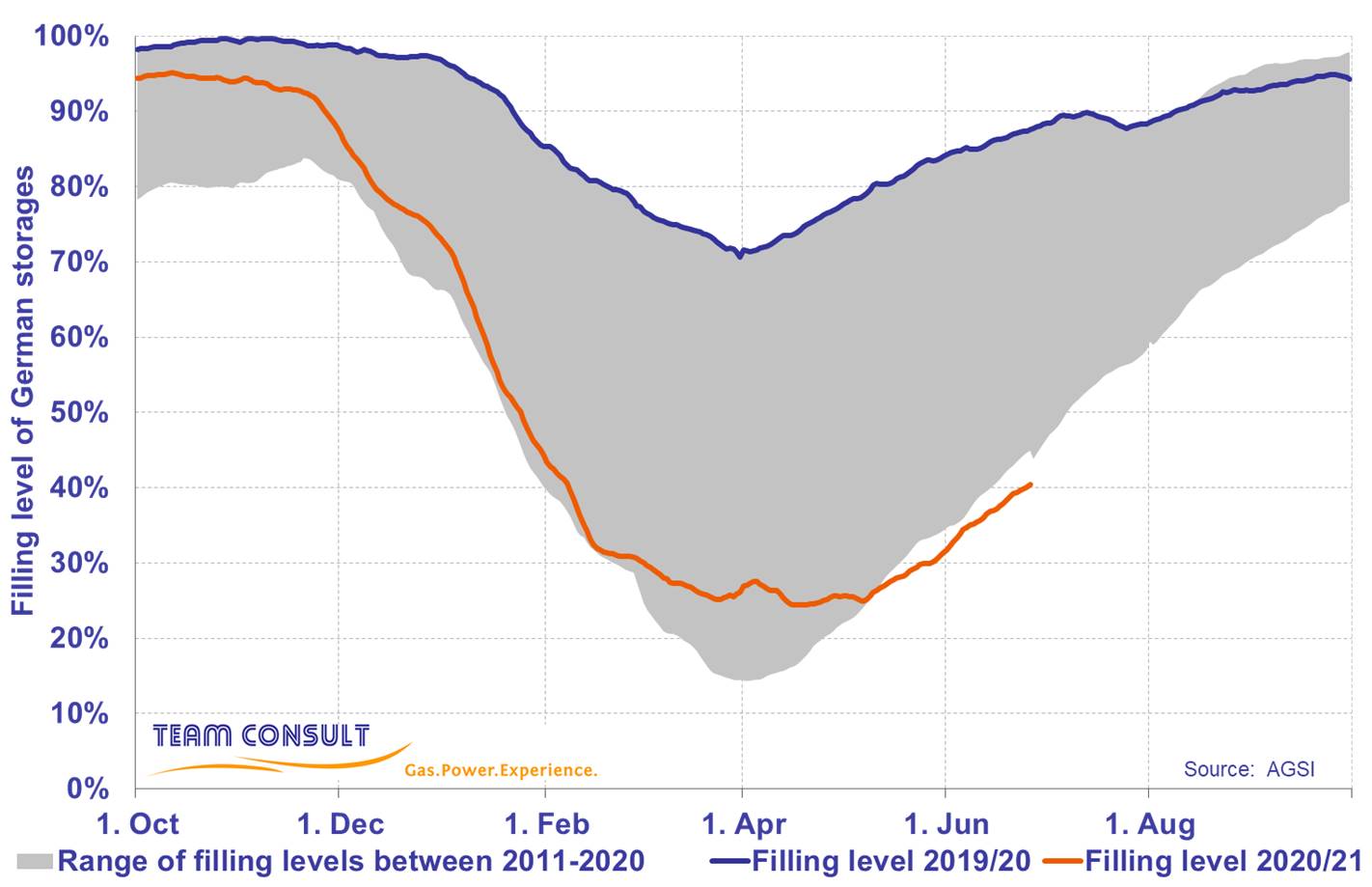

- An end to the price rally is currently not in sight. The filling level of German gas storages are currently lower than ever in the last 10 years at this time of year. Gas demand remains high, not just from the industry and power plants, but also to fill up the storages in the summer and for heating purposes in the fall and winter, since the storage filling levels will still be limited at the beginning of the heating season this year.

- High commodity prices and the scarcity of raw materials as well as some intermediate goods (such as semiconductor chips) are considered to be risks to the further economic recovery, along with the further progression of the pandemic, especially in countries with limited access to vaccines.

Current filling levels of natural gas storages in Germany

June 2021

Corona Energy Market Radar Germany, 6th edition

March 2021

After one year of (varying) pandemic-related restrictions, we look back on last year and also want to look ahead a bit in the latest edition of our Corona Energy Market Radar Germany. The key findings are:

- A significant growth in GDP is expected for 2021, however, this will not fully make up for the GDP slump that occurred in 2020.

- In the first few months of 2021, electricity consumption and the industry’s gas consumption were again (after an intermediate return to normal) below pre-crisis levels.

- However, overall the pandemic does not seem to hurt gas consumption, since gas-fired power plants are running above pre-crisis levels. Given that commodity prices are back at regular levels, this is a bit surprising. The reason may be the high level of EUA CO2 emission allowance prices that favors gas plants (over coal plants).

- Compared to 2020, effects from the pandemic on the energy market will not be very pronounced in 2021.

- In different branches of the manufacturing industry, the effects from the pandemic were very different. The automotive industry was hit the hardest, followed by the metal industry. While in all sectors the ifo-index (representing the business situation and expectations) is above pre-crisis levels again, the Destatis production index in the automotive and metal industries has not yet fully recovered.

The latest edition of the Corona Energy Market Radar Germany is available for download here.

Corona Energy Market Radar

November 2020

The latest edition of our Corona Energy Market Radar Germany is now available for download here. The key takeaways are as follows:

- The latest increase in cases of coronavirus infections since the beginning of autumn has not yet led to a visible impact on energy consumption and the general economy, as far as available data suggests. Consumption of electricity and gas had returned to normal over the summer and early autumn, and commodity prices had recovered at least partly from their collapse in the second quarter.

- GDP growth forecasts by the leading economic research institutes had most recently been revised upwards and converged to a level of -5% to -6%; i.e., the forecasts for the entire year of 2020 are still heavily negative. Moreover, any effects from the new pandemic-related restrictions of public life (which came into effect on November 2nd) are not yet reflected in these forecasts.

- The business climate in key branches of the industry had returned to the regular range (again, before the new measures came into effect). However, the production indices published by the German Statistical Office, which currently are available up to September for the different branches, are still by a few percentage points below pre-pandemic levels.

- For the time period of March to October, there is a significant negative correlation between wholesale electricity prices (German month-ahead price) and coronavirus cases in Germany. The coefficient of determination is approx. 50%, the slope -2 EUR/MWh per 1,000 cases/day.

- For electricity consumption, we expect a decrease over the next few months which in all likelihood will not be as steep as the decrease in the second quarter, since the new pandemic-related measures are (up to now) less drastic than those taken in the spring. Gas consumption has been rather inconspicuous since the start of the pandemic, due to opposed developments within the group of large customers (decrease in industry consumption, increase in power plant consumption). This can be seen from consumption data for different customer groups (which are now temperature-adjusted for the SLP segment, i.e. heating customers). Predictability is therefore rather low, which is why we don’t show gas consumption scenarios in this edition.

Corona Energy Market Radar

August 2020

The latest edition of our Corona Energy Market Radar is now available for download here. The key takeaways are as follows:

- The pandemic and its consequences have faded from the spotlight as economic indicators show that a recovery is underway. At least this is what the ifo business climate index indicates. It showed substantial increases for key industry branches in June as well as in July.

- The recovery of power consumption is progressing rather slowly. Power consumption hit a low at the end of May, at -12% underconsumption compared to previous years (4-week moving average). Since then, consumption showed an increasing trend and most recently stood at -8% compared to previous years (in calendar week 32).

- The consumption of gas did not suffer as much as power from pandemic-related effects. Due to favorable commodity prices (lower gas prices, higher prices for CO2 emission allowances), utilization of gas-fired power plants was considerably higher than in previous years. As a consequence, total gas consumption in the months of June and July was actually higher compared to previous years. This can be explained by comparing Germany’s Merit Order of power plants for 2017 (the first year of our reference period) to that of 2020: gas-fired power plants moved to the front, while those fired by hard coal moved further to the back.

- For the entire year of 2020, we therefore expect only a slight drop in gas consumption compared to previous years – despite the Coronavirus pandemic and despite above-average temperatures in the first quarter. Decreases in gas demand were at times overcompensated by above-average consumption in the power sector, and this made up for part of the temperature-related under-consumption in the first quarter of 2020.

Corona Energy Market Radar

June 2020

A month has passed since we published the last issue of our Energy Market Radar. That means it’s time for a new issue (no. 3), that you can find here. It contains our updated scenarios, based on the latest data on the development of business expectations in the industry as well as expectations for GDP growth.

We have used the time since the previous issue for a deeper analysis as to whether the observed reduction in energy demand could also have been caused by factors other than Covid-19 and the partial lockdown and if there are any effects working in the opposite direction (demand increase). The finding in brief:

- In the gas market, a substantial part of the reduction in consumption so far was temperature-related (i.e. temperatures in 2020 have so far mostly been higher than in previous years 2017-2019)

- For large consumers (industry and power plants), there are effects at place which are driving gas demand in opposite directions. While demand by the industry has substantially decreased, the record-low gas prices have stimulated gas demand for power generation

One additional note on how to understand our scenarios and evaluations – our scenarios on gas and power consumption (page 1) show the pandemic-related effects we expect for the entire year 2020. The analysis of key branches of the manufacturing industry (page 2) are a snapshot in time of how things currently stand (based on historical correlations of business expectations, industry production and energy consumption).

The decline in wholesale commodity prices on the spot market seems to have come to a halt, and some prices even show a slight trend reversal. Nevertheless, some prices are still more than 50% below forward prices in 2019 for deliveries in 2020. This is particularly problematic for companies that have to sell excess volumes on the spot market these days.

Corona Energy Market Radar

April 2020

Since early March we have been dealing with the impacts of the Coronavirus pandemic.

As an essential infrastructure, the energy industry has not been directly affected by the restrictions of public life. As the crisis drags on, however, the question arises which economic risks the current situation entails for the energy industry.

The number one necessity for companies engaging in the purchase and resale of energy is to keep the purchase and sales portfolios in balance volume-wise and price-wise at all times. In times of crisis with consumption of energy plummeting, however, this important balance can turn into a severe imbalance quickly. When a company’s energy portfolio is long and energy has to be sold on the trading market at prices significantly below purchase costs, this can pose a substantial threat.

To assist affected companies in evaluating the situation and coming to the right decisions quickly, we have developed the “Corona Energy Market Radar”. It translates general economic data into outlooks for the energy sector and summarizes the relevant information in a brief, easy-to-digest overview.

The newsletter contains scenarios for the development of electricity and gas consumption in 2020. Moreover, an estimation is given regarding the decrease of energy consumption in the most important branches of the industry segment. This is based on the ifo institute’s business climate index (as the leading indicator) and the respective DESTATIS production index (as the trailing indicator) for each branch.

For further information, please refer to our Newsletter Corona Energy Market Radar. In case you would like to receive this information on a regular basis via e-mail in the future, please let us know by emailing us to info@teamconsult.net.

We mourn for Bernhard Witschen

April 2020

On Holy Saturday we received the sad message that our longtime colleague Bernhard Witschen had passed away.

On Holy Saturday we received the sad message that our longtime colleague Bernhard Witschen had passed away.

With Bernhard’s passing away, we are losing an exceptional and endearing person, advisor, mentor and friend.

After his studies of business administration and engineering at RWTH Aachen University, Bernhard Witschen worked in the energy industry for more than 40 years. Mr. Witschen served in the management of various holding companies in the RWE group for many years, including as executive director of Thyssengas from 1998 to 2003. Moreover, he was accountable as board member at RheinEnergie AG for the purchase and sale of energy and for the power plant segment from 2003 until his retirement in 2008.

After his official farewell, Bernhard continued to share his longtime experience in different roles. Since 2008, he supported Team Consult as an independent consultant and senior advisor.

His unmatched mix of empathy and expertise of the energy industry was highly appreciated by colleagues as well as clients.

He will always have a special place in our memories.

New EU emission limits for capacity mechanisms

January 2019

At the end of December, the EU institutions have provisionally agreed on new rules for future back-up power plants. According to the new regulation, power stations emitting more than 550 grams of CO2 per kilowatt hour of electricity shall not be eligible to be used in regulated capacity markets.

Team Consult has performed a brief analysis on the effects of the new EU rules on the German power market. The article was published on the energy information portal www.europeangashub.com. It can also be downloaded free of charge via the link below.

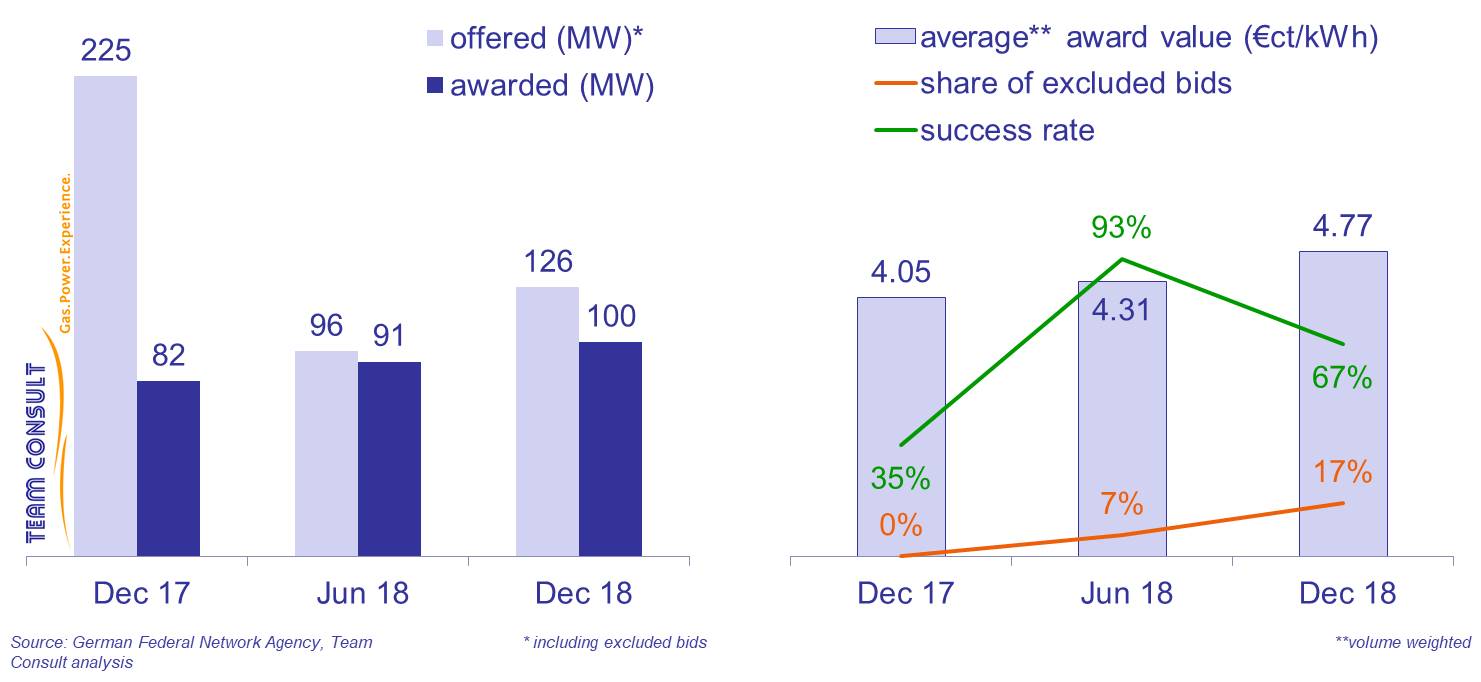

Results of the auctions for CHP plants

December 2018

On December 12th, the German Federal Network Agency (Bundesnetzagentur) published the results of the third auction for combined heat and power (CHP) plants according to the Combined Heat and Power Act (KWKG) (published in German). Following the initial publication, the results were modified on December 17th.

18 bids were submitted to the auction, which took place in December 2018. This is an increase with respect to the previous round (15 bids), even though the tendered volume of 77 MW was significantly below the value of the previous auction (93 MW). With 126 MW, the total bid volume was above the previous value (96 MW) as well.

Three submitted bids had to be excluded from the auction. 12 of the remaining 15 bids received an award, corresponding to a success rate of 67%.

The average award value amounted to 4.77 €ct/kWh and has thus increased by about 11% with respect to the previous round. The lowest award value was 3.49 €ct/kWh, the highest award value 5.25 €ct/kWh. In spite of the relatively low competition, the award values were thus again considerably below the bid limit of 7 €ct/kWh.

The average award value amounted to 4.77 €ct/kWh and has thus increased by about 11% with respect to the previous round. The lowest award value was 3.49 €ct/kWh, the highest award value 5.25 €ct/kWh. In spite of the relatively low competition, the award values were thus again considerably below the bid limit of 7 €ct/kWh.

Amendments to the Combined Heat and Power Act: New Opportunities for CHP plants?

December 2018

On last Thursday (14 December 2018), the Federal Council of Germany announced its final approval for the so-called “Energiesammelgesetz”, which had been previously passed by the German Federal Parliament. The bill will enact extensive changes to the German energy law, in particular with respect to the further development of renewable energies and the funding for combined heat and power (CHP) plants.

What opportunities arise for operators of CHP plants? Team Consult has assessed the implications in a short study, the conclusions of our analysis can be found here (PDF download, in German). If you are interested in an English version of our analysis, please do not hesitate to contact us.

Team Consult successfully supports in the CHP tendering process

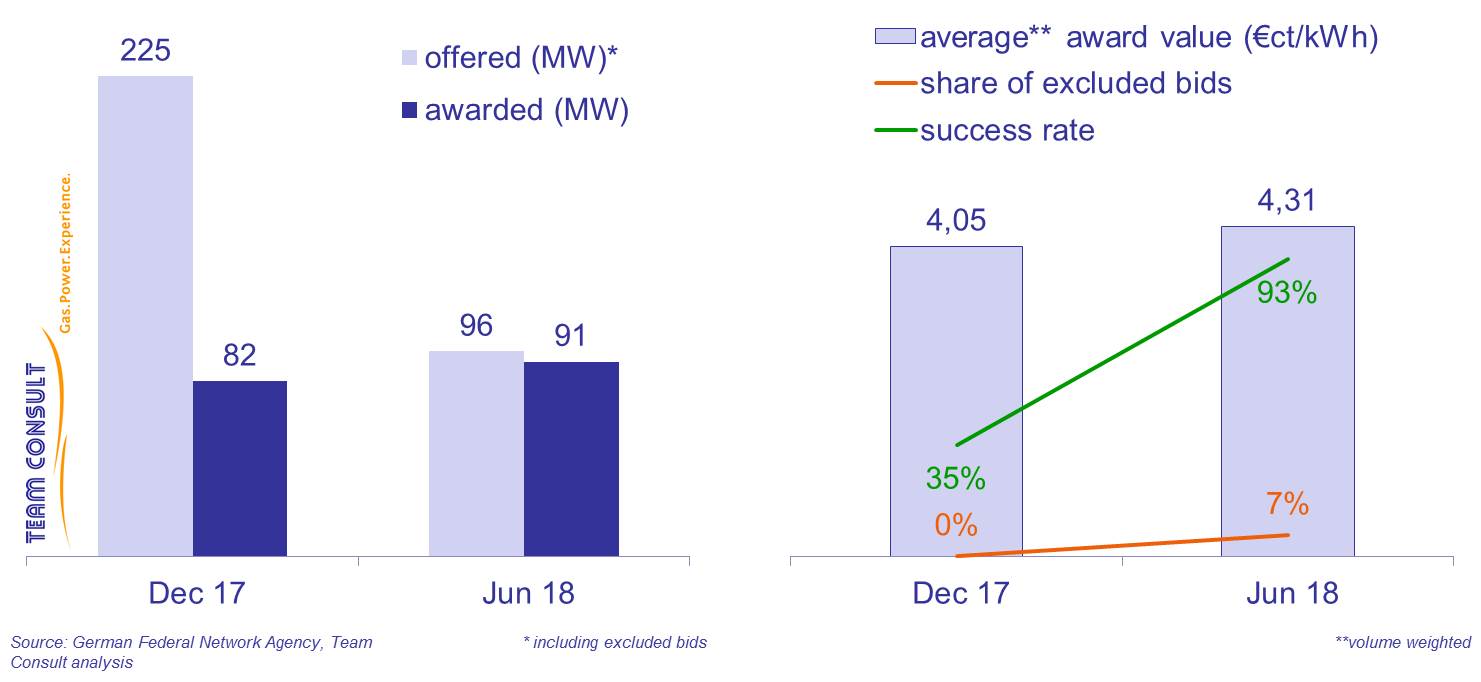

June 2018

On June 12th, the German Federal Network Agency (Bundesnetzagentur) published the results of the second auction for combined heat and power (CHP) plants according to the Combined Heat and Power Act (KWKG). Prior to the auction, Team Consult advised a local distribution company regarding the investment decision for a CHP plant and supported the client in developing a bidding strategy. We are pleased that the jointly developed strategy was successful and that the bid of our client received an award.

15 bids were submitted to the auction, which took place in June 2018. This is a decrease with respect to the previous round (20 bids), even though the tendered volume of 93 MW was only slightly below the value of the previous auction (100 MW). With 96 MW, the total bid volume decreased by more than 50 % compared to the previous round (225 MW).

Only one submitted bid had to be excluded from the auction. All remaining 14 bids received an award, corresponding to a success rate of 93 %. The average award value amounted to 4.31 €ct/kWh and has thus increased by about 6 % with respect to the previous round. The lowest award value was 2.99 €ct/kWh, the highest award value 5.20 €ct/kWh.

The average award value amounted to 4.31 €ct/kWh and has thus increased by about 6 % with respect to the previous round. The lowest award value was 2.99 €ct/kWh, the highest award value 5.20 €ct/kWh.

Publication of dena's pilot study "Integrated Energy Transition"

June 2018

The German Energy Agency (Deutsche Energieagentur, dena) has published the final results of its pilot study “Integrated Energy Transition”. As a study partner, Team Consult has actively contributed to the study. The scope of the study was the development of scenarios for the transformation of the German energy system until 2050. Scenarios of a “pure electrification” were contrasted with scenarios of a “technology mix”. Key takeaways are:

- In order to reach its climate targets (80 to 95 per cent emission reduction by 2050 in comparison to 1990), Germany will have to speed up emission reduction significantly compared with previous years

- In the technology mix scenarios, climate targets can be met at lower costs than in the electrification scenarios

- In all scenarios Germany will remain a net importer of energy

- Gas-fired power plants and energy storages are essential contributors to system stability

- The climate targets in the transport sector require synthetic (carbon neutral) fuels, especially in the case of heavy duty trucks

We are convinced that the study will have a substantial impact on the energy policy debate in the years to come. We are prepared to discuss the energy economic and corporate strategy consequences with you.

A summary of the results can be found here (link to dena).

Interview with “energate messenger+” on the deal between E.ON and RWE

May 2018

In the German energy industry, there is a continued discussion going on about the deal announced by E.ON and RWE. One particular question in dispute is whether (and, if so, to what extent) the new entities are becoming too powerful in their respective markets. Team Consult has analyzed the consequences of the deal for the German energy landscape within the scope of a multi-client study. In an interview with “energate messenger+”, Jens Völler, member of the management team of Team Consult and one of the authors of the study, gives insight into the results.

Interview for download as PDF, in German language only (Source: energate messenger+, May 14, 2018)

Energy & Natural Resources 2018 Virtual Round Table

March 2018

The Energy & Natural Resources Roundtable 2018 features seven experts from around the world. In this roundtable, managing director Madjid Kübler and the other experts outline how to attract capital in the current stressed financial climate, discuss the current M&A landscape, and detail recent regulatory changes and developments. Highlighted topics include: hydropower, oil and gas, mining, and the trend towards cleaner energy sources.

Full article for download as PDF

Article “Arbitration” published by “Lawyer Monthly” magazine

December 2017

In an interview at “Lawyers Monthly” magazine, Madjid Kübler comments on the changes in arbitration proceedings and provides an answer to the question of how to prepare best for arbitration hearings.

Article on European LNG terminal infrastructure published

June 2017

The energy industry will likely face the occurrence of a global oversupply of natural gas for the next years to come as further liquefaction capacities are under construction. Europe with its liquid trading hubs is well-positioned to receive additional LNG volumes due to surplus regasification capacity. However, regasification costs and access conditions of European LNG terminals vary greatly and might have a major commercial impact on future LNG volumes. These differences have been analysed by TEAM CONSULT in an article, which provides an overview of the LNG regasification infrastructure in the European Union and gives some brief insights on regasification tariffs as well.

The article was published on the energy information portals www.europeangashub.com and www.globallnghub.com. It can also be downloaded free of charge via the link below.

Full article for download in PDF format

Madjid Kübler as chairman at the FLAME 2017 in Amsterdam

May 2017

As in previous years TEAM CONSULT will take an active role at the FLAME. Madjid Kübler will be chairman of the stream “Gas Demand & Competitiveness” and therefore be in discussion with several experts of the energy industry.

Europe’s largest gas event will be taking place on 8-11 May 2017 at the Okura Hotel in Amsterdam.

Industry professionals from across the globe will be meeting at FLAME and discuss the latest market trends, challenges and developments worldwide.

For more information click here

Presentation published on whether German gas storages are regaining importance as a provider of flexibility in Europe

April 2017

In recent years, Europe and Germany have experienced an oversupply of gas storage capacity. In contrast, despite high filling levels in October 2016, we saw critical stock levels of the European and German gas storages in February 2017. These were the lowest levels in February since European-wide recording has been conducted by Gas Infrastructure Europe. In our presentation we identify and analyse the drivers for this development, which in sum led to these low stock levels.

Our analyses shows that German gas storages are regaining importance as a provider of flexibility in Europe. However, further developments, which can either have a positive or adverse effect on storages, have to be considered and analysed before the conclusion can be drawn that storages have seen the end of the dry spell.

The presentation was published on the energy information portal www.europeangashub.com and can also be downloaded free of charge via the link below.

Presentation for download in PDF format.

New Article on renewable energy auctions published

March 2017

Since 2017, the German funding for electricity generated from wind, solar or biomass energy is determined by auctions. Auctions increase the cost pressure and pose new challenges to project developers and investors. Team Consult has identified several key aspects that should be considered from the initial project development decision until the final investment decision and realization of the project. Important factors are the required upfront investments, the total costs and the realization probability of the project, the bidding dynamics and the volume of the current and future auction rounds.

The highlights of our findings have been published in the March edition of the German journal “Energiewirtschaftliche Tagesfragen“.

Download publication in “Energiewirtschaftliche Tagesfragen”, March 2017 as PDF (in German)

Source: www.et-energie-online.de

Article on Dispute Resolution in Gas Contract Renegotiations published

February 2017

Buyers’ strong desire for the transition from oil-indexation to gas hub pricing has been the driver for the disputes in Europe with some 100 billion cubic meters (around 3.5 trillion cubic feet) of annual contract quantities renegotiated, and billions of dollars in dispute. Europe's experience with renegotiations of long-term gas contracts may provide some lessons for the emerging Asian natural gas market which Team Consult discusses in an article.

The article was published on the energy information portals www.europeangashub.com and www.globallnghub.com. It can also be downloaded free of charge via the link below.

Full article for download in PDF format

New Article on renewable energy auctions published

January 2017

Since 2017, the German funding for electricity generated from wind, solar or biomass energy is determined by auctions. This leads to new questions for market participants: How will the market environment develop? When is it expedient to make the upfront investments which are necessary to submit a bid? Team Consult has analyzed the results of the auctions for photovoltaics installations that have taken place so far. Our analysis shows that economies of scale play an important role, but the decisive factors for a successful bid are the proper timing of the bid submission and the optimal bidding strategy.

The highlights of our analysis have been published in the January edition of the German journal “Energie & Management“.

Download “Energie & Management” article as PDF (in German).

Source: www.energie-und-management.de

New BWK article published (in German)

July 2016

The article provides an overview on the developments and perspectives of the gas industry in the past year. 2015 turned out to be another turbulent year for the gas and energy industry and the sector continuous to face several challenges. For the future security of supply of Europe several pipeline projects were planned or rejected but intensely debated in any case. Tackling climate change took a new step forward after the UN Climate Change Conference in Paris which established the aim of limiting global warming to 2°C or even 1.5°C. Further important issues were discussions on the digitalisation of the energy industry as well as sector coupling. This will put gas in the heating market in direct competition to power from renewable energies. All of these developments have the potential to change the existing business models of energy suppliers. At the same time new opportunities appear on the horizon, e.g. by using LNG as a transport fuel.

Download BWK article as PDF.

Source: www.eBWK.de

New BWK article published

Developments such as the collapse of the price of crude oil, EEG reform in Germany, increasing decentralisation of energy production and, last but not least, the split up of E.ON at the end of 2014 have made 2014 an eventful year for natural gas. The many positive attributes of gas, such as its low CO2 emissions, flexibility, storability, network operability, as well as its many possible uses make it the ideal partner for renewable energies. However, these qualities, which complement wind and photovoltaics, are valued differently nationally and internationally. The situation in gas power stations remains tense. The use of LNG, on the other hand, is greatly increasing.