Energy transition

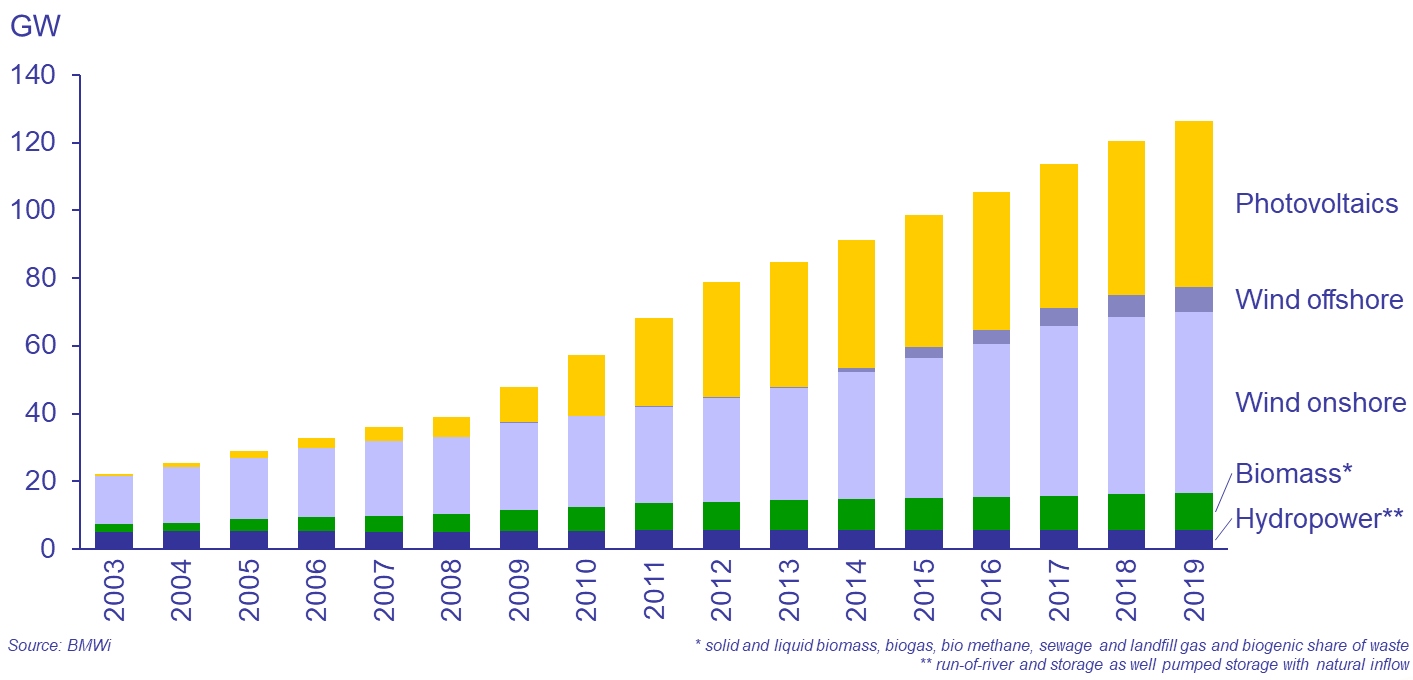

Since the introduction of the Renewable Energy Act (EEG) in the year 2000, Germany has seen a steady and significant expansion of renewable energy capacities for power generation and heat supply.

Installed capacity of renewables in Germany

Germany’s expansion of renewable energies is often referred to as a role model in the international context. At the same time, however, many problems for the entire energy system become apparent: Management of load fluctuations caused by renewables in the power grid has become a difficult task for the grid operators, curtailment of renewables has substantially increased and costs for renewable expansion (to be borne by end customers) have risen from year to year since introduction of the EEG. Planned power grid expansion for transport of renewable power to the consumption centres will lead to enormous costs.

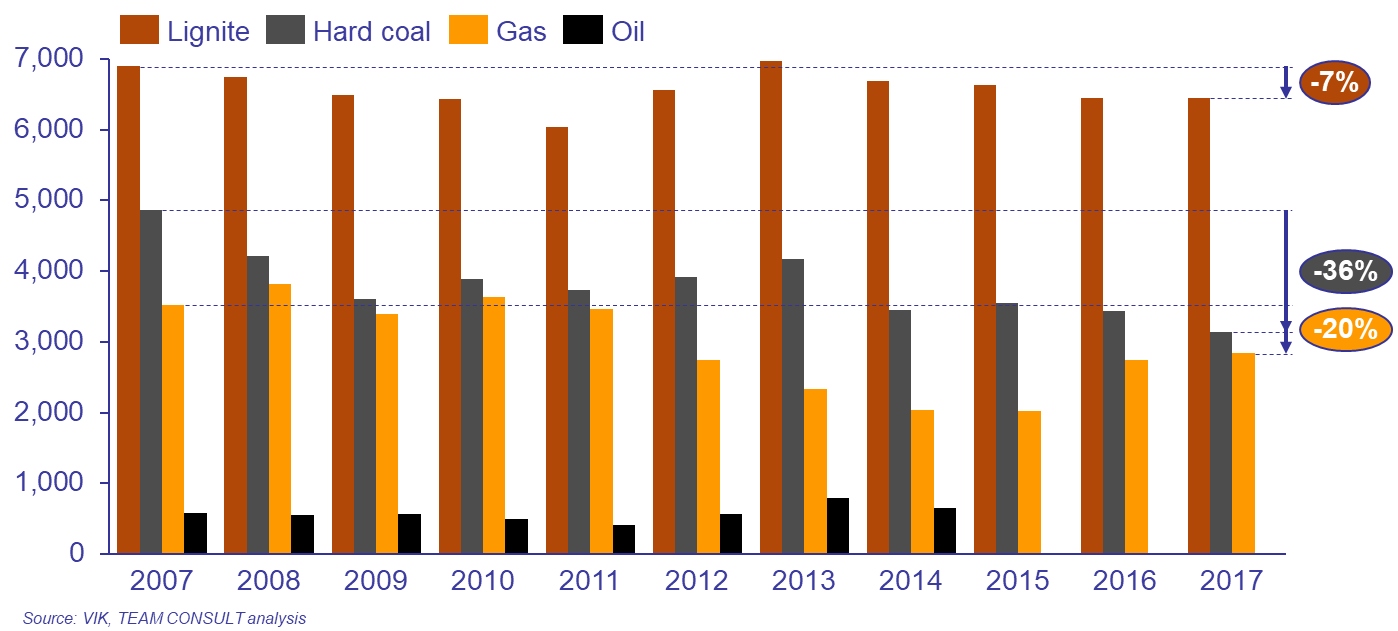

Under these circumstances, operators of conventional power plants have to face a difficult economic situation. Full load hours of conventional plants have decreased significantly over the last 10 years (see figure below). A decreasing utilisation puts pressure on the value of existing plants, impacting the extent to which necessary reinvestments are evaluated before realization.

Full load hours of conventional power plants in Germany

In the near future, however, conventional power plants will be needed to safeguard a reliable power supply in a system affected by highly fluctuating feed-in of renewable energies. Furthermore, combined heat & power generation (CHP) is considered to be an important element of the Energy Transition and enjoys legal support.

Moreover, in the last couple of years, the energy industry has experienced a dynamic innovation process never seen before. This will drive further actions of decision makers as well as market structures. New competitors from other industries, equipped with a strong capital base and a focused on innovation are getting into the German energy market.

Uncertainty about future development paths is high. These new conditions are involving new challenges on many established energy suppliers to adapt their business models and corporate culture.

In this context, TEAM CONSULT offers the following consulting services:

- Support of the preparation and implementation of auctions of wind, photovoltaics, biomass and combined heat & power plants

- Due Diligence for investments in conventional and renewable power and heat generation plants

- Business models and asset management strategies for power plants in the context of the Energy Transition (conventional and renewable, in particular for repowering of wind farms)

- Strategies for realigning and focussing the business activities of energy suppliers in accordance with national and international climate protection goals

- Preparation of repots for commercial negotiations and legal disputes related to the remuneration of renewable power and cooperation agreements

- Workshops and technical visits for international actors with interest in the German Energy Transition, especially with regard to the integration of renewable energies into the energy system

Publications

Feature article by Ralf Dickel on CCS as an essential instrument of climate and energy policy

Ralf Dickel argues in a feature article for Tagesspiegel Background Energy and Climate that CCS is an essential instrument of climate and energy policy. He points out that an infrastructure for CO2 collection and transport should be designed from the outset to have sufficient capacity for CO2 not only from unavoidable process-related emissions but also from energy-related emissions.

As main reasons he identifies:

- seasonal fluctuations in energy demand which cannot be covered by renewables or electricity,

- the rather short time period of only 20 years until the objective of climate neutrality must be reached which requires the utilization of existing and reliable infrastructure,

- the fact that fossil energy will be required for backup purposes for a long time and the necessity to minimize the climate impact that would result from the cumulation of avoidable emissions by means of CO2 capture and sequestration, and

- the substantial uncertainties regarding the scalability and feasibility of green hydrogen production and maritime transport.

The entire article is available online here (in German language only).

Meta study of existing scenario analyses on volume and cost expectations regarding renewable and decarbonized gases

For the joint project “Ways to a resilient and climate neutral energy system – transformation path for the new gases”, Team Consult has prepared a meta study on behalf of BDEW, DVGW and Zukunft Gas. The purpose of the study was the survey of existing scenario analyses on demand, volume and cost expectations regarding renewable and decarbonized gases in 2030 and 2045. Renewable and decarbonized gases include biomethane as well as hydrogen from different production paths. The study is available for download here.

Realistic projection of the heat transition by 2045

January 2022

Germany aims to become climate neutral by 2045. All sectors will have to contribute - the heating sector has the chance to accomplish the climate goal if all available decarbonization measures are made use of. Team Consult has developed a projection for the heating market which is economically viable and timewise achievable. However, to start moving forward some political decisions will be needed promptly.

The article was published in ‘ew’ (edition 01/2022): www.ew-magazin.de

Mobility market radar Germany

November 2021

First Edition: Team Consult analyzes the dynamics in the mobility sector!

Electric passenger cars, Bio-LNG for trucks, hydrogen for the maritime sector and synthetic aviation fuels – the mobility sector is facing a tremendous transformation. Team Consult observes the latest developments and provides exciting analysis and insights.

Our first edition of the Mobility Market Radar highlights the following findings:

- High numbers of electric vehicle registrations since the middle of last year have caused fewer free spaces at public charging points. However, Germany is still in line with the target value of the EU commission (regarding the ratio of charging stations to EVs)

- A closer look at different sizes of villages and cities shows an even development of the number of charging stations. Rural communities take part in this development.

- Across Germany, there are over 2,000 operators of charging stations. However, several cities have a high market concentration of local operators. High consumer prices might be the consequence.

More details on these topics can be found in the first edition of the Mobility Market Radar. Enjoy reading!

Expansion of the charging infrastructure for electric vehicles in Germany

April 2021

In its Climate Protection Program 2030, the German government has set a target of 1 million charging points for electric vehicles (EVs) in Germany for 2030. The next few years will show whether and how quickly the target will be reached.

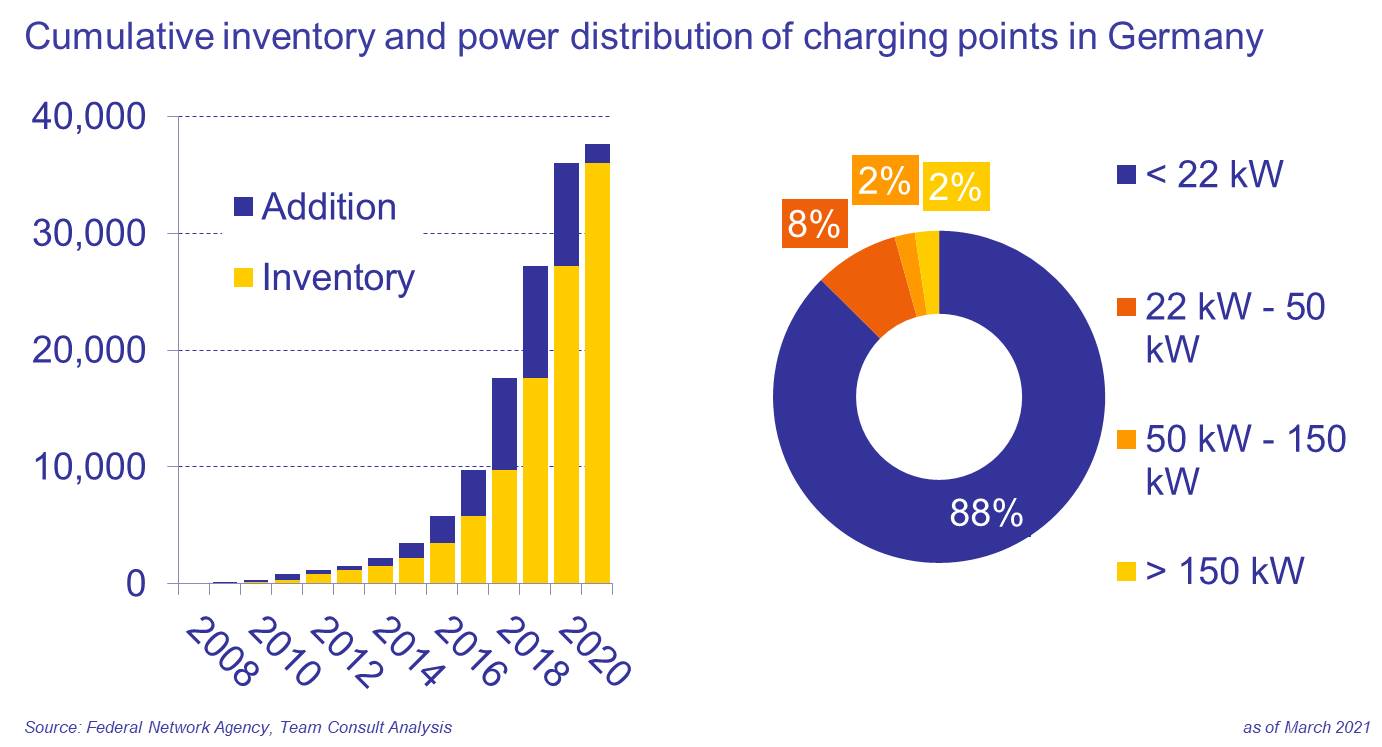

The number of charging points in Germany has increased continuously in recent years. The annual addition of publicly registered charging points increased significantly and reached just under 9,500 newly installed charging points in 2019. In 2020, the addition of around 8,800 charging points was less than in the previous year. It is possible that this decline is only temporary, as around 1,700 new charging points were already installed in January and February 2021.

On average, two charging points are installed per charging station, i.e. two electric vehicles can be charged simultaneously. The total number of public charging points in Germany is 37,700. However, the connection capacities of the charging stations are often limited, which reduces the charging capacity per electric vehicle when several electric vehicles are charged at the same time.

With an inventory of just under 350,000 electric vehicles at the end of February 2021, this means that there are currently 9 electric vehicles registered per charging point in Germany. Germany is thus close to the target defined by the EU Commission in 2014 for the ratio of charging points to electric vehicles of 1:10 for 2020.

Around 9 out of 10 charging points installed have a charging capacity of 22 kW or less. With a battery capacity of approx. 40 kWh, a charging process from 0 to 100% state of charge takes approx. 2 hours. Only about 2% of the existing charging points have a charging capacity of more than 150 kW, which means that full charging is possible within several minutes. The total, accumulated charging capacity of German charging points reached a total of 1.04 GW at the beginning of March 2021. With around 350,000 electric vehicles registered in Germany, an annual mileage of just over 10,500 km and an average consumption of around 17 kWh/100 km per electric vehicle, the public charging stations achieve a utilization rate of around 580 hours or 7% per year. For simplification, charging in the private sector was neglected here, i.e. the utilization of the public charging points is in reality less than 580 hours.

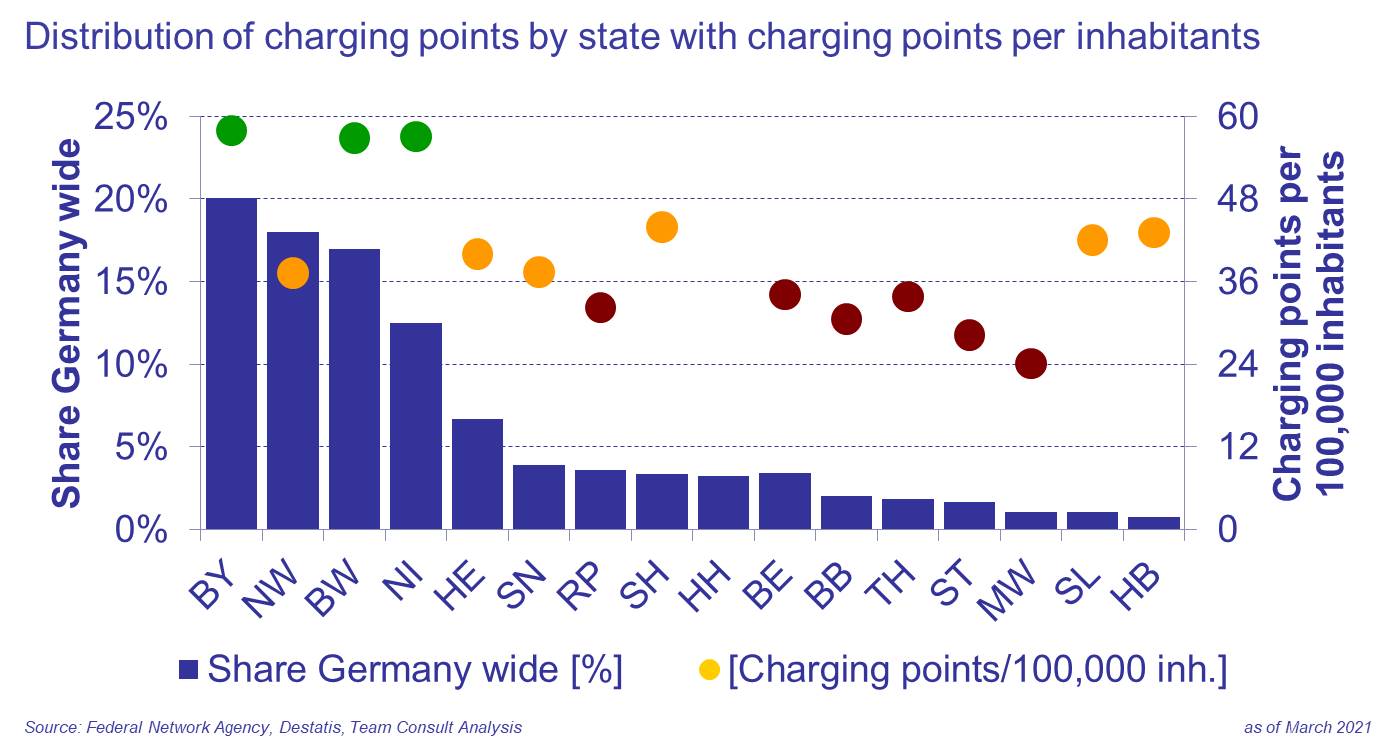

The regional distribution of charging points in Germany is concentrated in four federal states, which together account for 67% of the total number of charging points in Germany. These four states are Bavaria (20%), North Rhine-Westphalia (18%), Baden-Württemberg (17%) and Lower Saxony (12%). Given the large differences in area between the various federal states and also very different number of inhabitants, this is not surprising.

A more complete picture is obtained by also considering the availability of charging points for the inhabitants of the respective federal state (charging points per 100,000 inhabitants). Also in this case, Bavaria, Baden-Württemberg and Lower Saxony show the highest values in Germany with around 60 charging points per 100,000 inhabitants. However, North Rhine-Westphalia (37 charging points/100,000 inhabitants) is only in the average of the German states in this regard and has fewer charging points per inhabitant than Saarland and Bremen (42 and 43 charging points/100,000 inhabitants), which in absolute terms have the least charging stations. Saxony-Anhalt and Mecklenburg-Western Pomerania show the lowest availability in this relative view with 28 and 24 charging stations per 100,000 inhabitants, respectively.

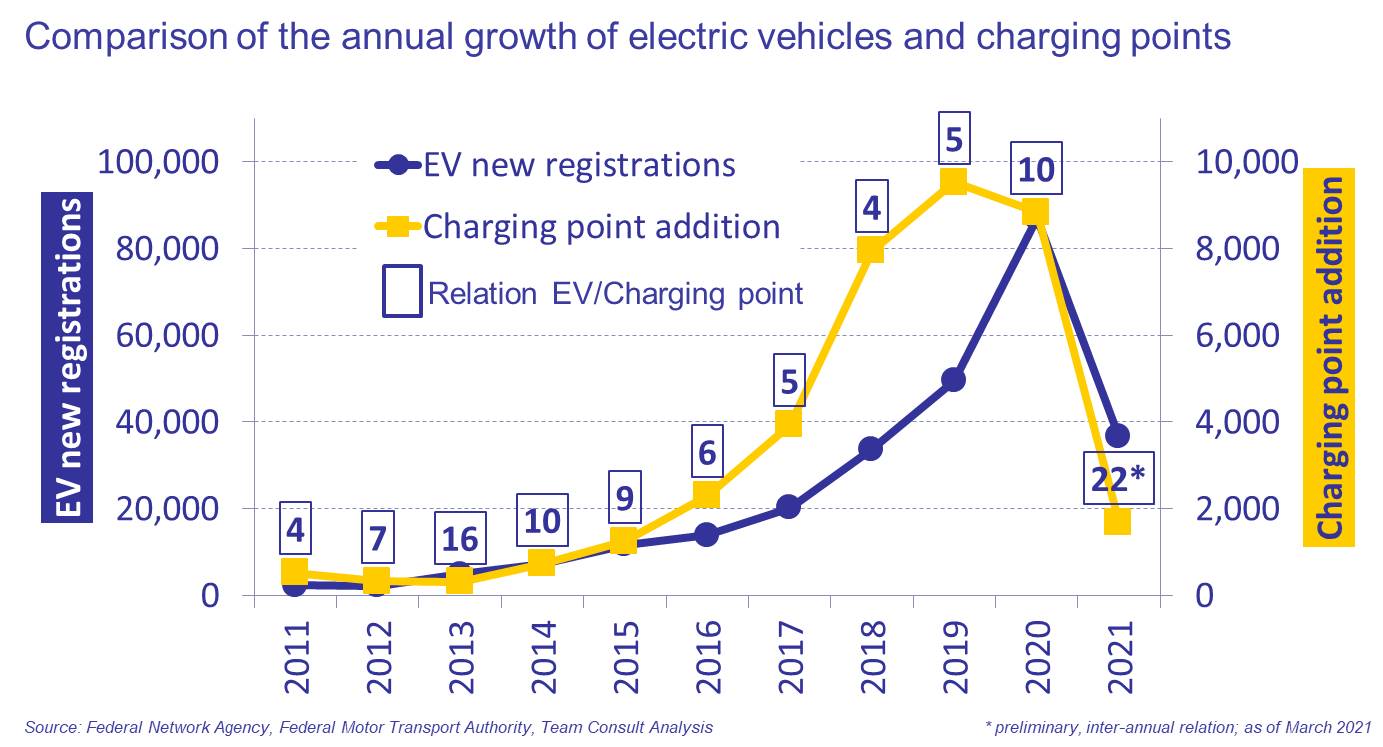

The comparison of the annual growth rates of EVs and charging points shows that the development of charging points outpaced the growth of electric vehicles until 2019. There have always been fewer than 10 new electric vehicles registered per charging point addition in recent years up to 2019 (with the exception of 2013). The ratio of EV to charging point growth on an annual basis has fluctuated in the range of 4 to 16 electric vehicles per charging point in Germany since 2011. However, the current trend shows that since the strong charging point expansion from 2015 to 2019, the expansion of charging points has not been able to keep up with new electric vehicle registrations since 2020, resulting in an increase in the ratio of EVs to charging points. In the case of new registrations or new constructions, the ratio is currently 22 EVs per charging point, but this figure is put into perspective in the cumulative view to around 9 EVs per charging point in the existing inventory. However, the ratio of newly registered EVs to new charging points has also increased significantly since the minimum of 5 new EVs per new charging point in 2018.

In a 2020 study, the National Platform for the Future of Mobility (NPM) assumes that around 10.5 million electric vehicles will be registered in Germany in 2030. The working group’s scenarios for the development of the charging infrastructure show a broad spectrum of total charging points required. This spectrum ranges from 180,000 to 950,000 charging points throughout Germany. This corresponds to 5 or just under 26 times the number of charging points currently installed.

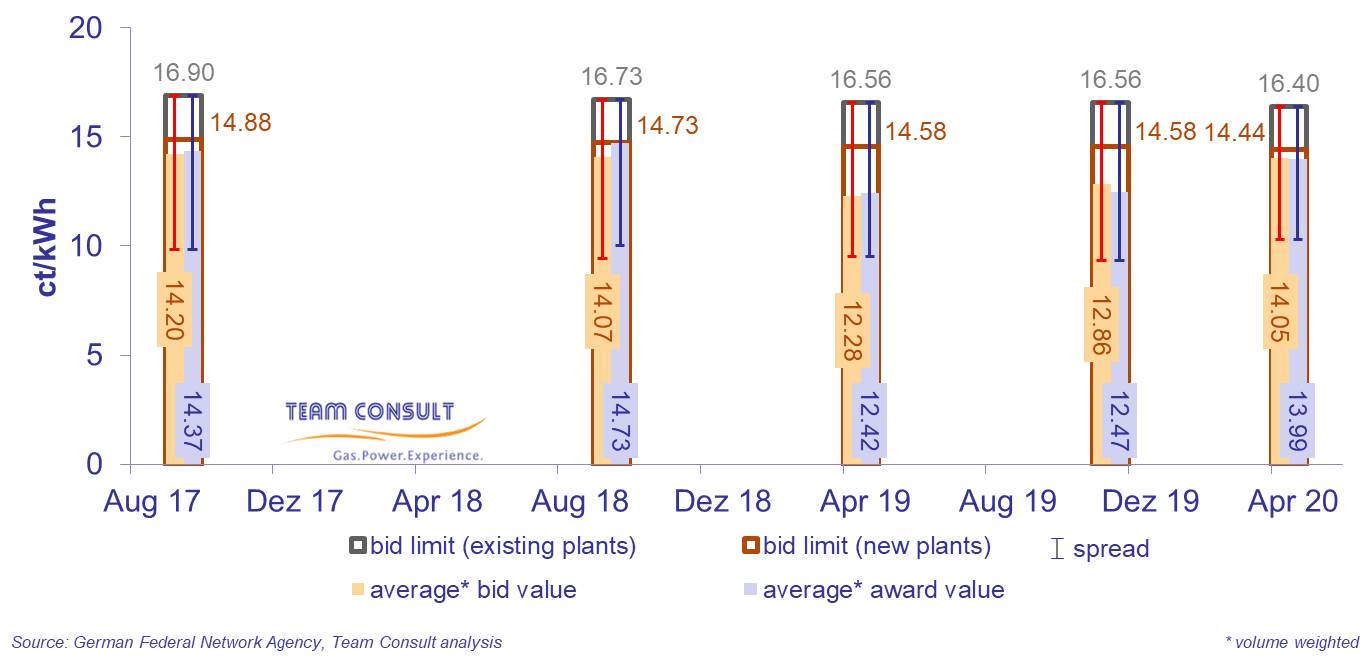

Results of the auctions for biomass under the Renewable Energy Act

July 2020

The coronavirus pandemic has led to an exceptional situation for the realization of renewable energy and co-generation projects. Therefore, the Federal Network Agency (Bundesnetzagentur, BNetzA) adapted the auction procedures to meet the current situation. For the time being, the decisions on the awarded bids are not immediately published on the internet, whereby the deadlines for the realization of projects, penalties and payments of secondary guaranties are extended. This procedural change concerns biomass facilities as well solar, onshore wind, co-generation and innovative co-generation auctions. Exceptions apply to existing biomass facilities and to tenderers who specifically request an individual publishing. Currently, the BNetzA is planning to return to the regular auction procedure from 1st September 2020 on.

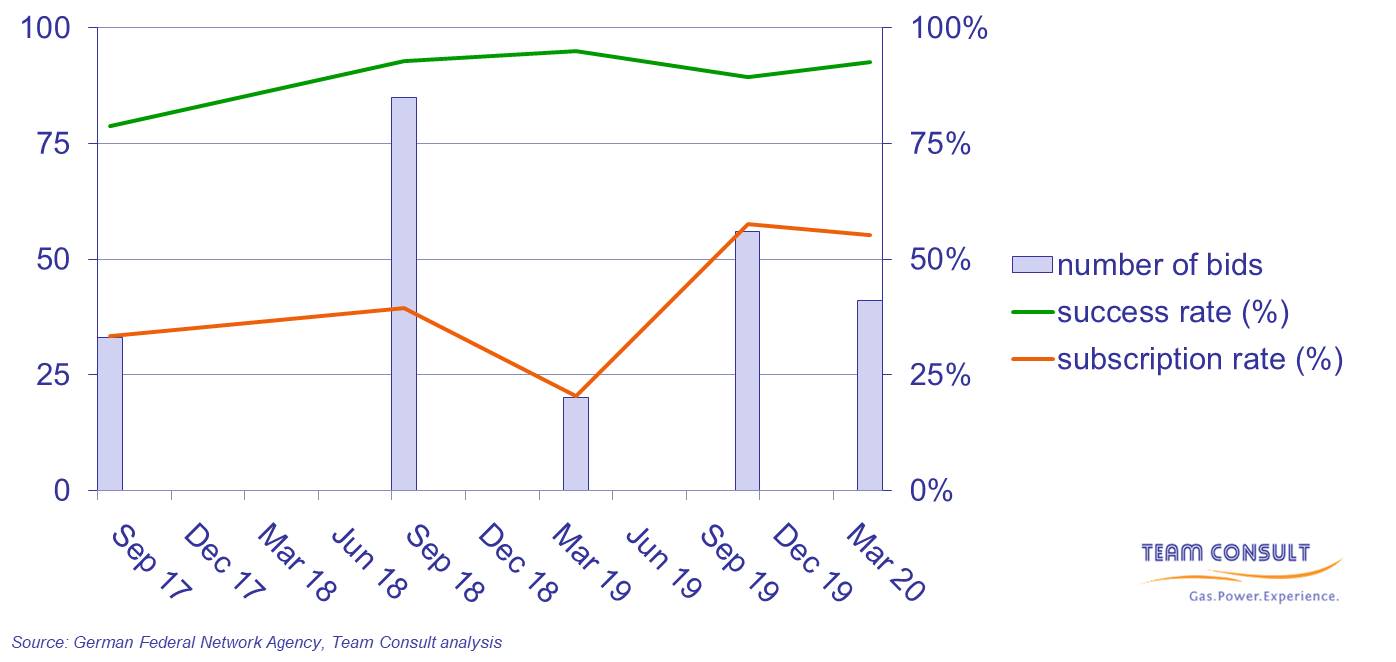

So far, five tenders for power generation from biomass have been conducted. The most recent biomass auction took place in April 2020. 41 bids were submitted during that auction with a total volume of 92 MW. This meant that once again the auction was undersubscribed by about the same margin as the previous auction November 2019. Bids were placed for 55% of the announced volume in both auctions. This, however, marks an improvement compared to the first three tenders, in which bids were placed for only 31% of the announced volume on average.

Based on calculations of the German Biomass Research Center, the German Federal Association of Bioenergy argues that the maximum auction price set by the BNetzA is in many cases below the electricity production costs. Therefore, according to the association, more than 80% of biomass facilities are unable to participate in the auction process.

During the April tender, three bids were excluded. All other 38 bids were awarded, resulting in a success rate of 93%.

The volume-weighted average price of awarded bids amounts to 13.99 ct/kWh in April 2020 which is more than 1 ct/kWh higher compared to the 2019 auctions.