Natural Gas

Natural gas is an important source of energy in the heating sector in many European countries. In power generation, natural gas also assumes an increasingly important role due to highly flexible power plants and relatively low carbon emissions. However, in some places it is facing challenges due to an overall decline in residual load, low CO2 allowance prices and competition with inexpensive coal. Despite numerous economic and environmental benefits the energy source plays a minor role in the plans of many governments and the EU as well.

Gas companies are confronted with a variety of challenges. The gas market is characterized by high competition, declining consumption and high pressure on sales margins. Additionally there are technical and regulatory changes. These developments pose difficult challenges to market participants. At the same time, changes have occurred and are still underway in the structure of the value chain itself. New models in the procurement and marketing of gas have been established, especially regarding the sale of gas to end customers in connection with different energy services. Interdependencies with other sectors of the energy industry are increasing significantly.

Company perspective

In this environment gas supply companies have to ask themselves which business model they should pursue to ensure business success in the future. Examples of relevant questions for individual companies are:

- What is the value of infrastructure assets today and how will it develop under different scenarios for the future of the energy industry?

- How have relevant competitors in the market positioned themselves along the value chain and which strategy are they pursuing?

- Are there niches with decent margins in the gas sales business and, if so, where can they be found?

- What is the minimum product portfolio required to be able to play a role at all in the business of selling gas to end costumers in the future?

- How does successful gas procurement look like today? How can a gas company procure flexibility and structuring services at favorable prices without having available a full-scale procurement department (i.e. traders, portfolio management, balancing group management etc.) of their own?

- Are there ways to reduce the carbon footprint per kilowatt-hour of gas sold and to comply with increasingly challenging regulation in this regard – be it through efficiency technologies, the combination with renewable heating technologies or by increasing the share of renewable gases? How cost-efficient are the different options?

- Are there perspectives for natural gas beyond the traditional consumption segments (residential households, commercial customers, industry customers and power generation) and, if so, what are those?

System perspective

In addition to the above-mentioned questions relevant from an individual company’s perspective, there are also several issues concerning the gas market and gas supply from a system perspective. For instance, in the light of declining European natural gas production the topic of security of supply is regularly the subject of controversial discussions. Furthermore, gas is expected to play a more or less important role in the context of a transformation of the energy system and a growing convergence with other energy sectors (“sector coupling”) – opinions about the potential role of gaseous fuels in the future energy system deviate considerably.

Consulting Services

In the context of these upheavals in the gas market we offer the following consulting services:

- Optimization of gas procurement along the entire process, e.g. through support in the preparation and conduct of tenders as well as in the negotiation of gas supply contracts

- Market and competition analyses, including the examination of long-term trends and developments of gas and energy markets

- Strategy development for companies of the gas and energy industry

- Gas industry expertise for individual issues of contractual, strategic or economic nature

- Surveys on issues concerning the overall gas system, for example on the topic of security of supply or on the transformation of the gas and energy system

Publications

Balancing neutrality charge accounts for natural gas

On October 1, Trading Hub Europe, the operator of the German gas market area, published the documents regarding the basis for the calculation of the balancing neutrality charge for gas year 2025/26. The balancing neutrality charge will remain at 0.00 EUR/MWh both for SLP (standard load profile) and RLM (registered load metering) exit points.

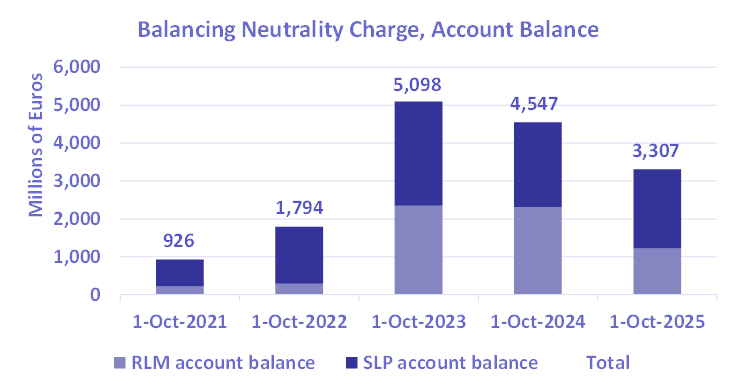

The sum of the balances of the balancing neutrality charge accounts (SLP and RLM combined) is 3.4 billion Euros as of the beginning of the current gas year, of which 1.2 billion Euros are on the RLM account and 2.2 billion Euros on the SLP account.

These balances are below the peak of 5.1 billion Euros (SLP and RLM combined) which occurred at the beginning of gas year 2023/24 (2.3 billion Euros for RLM, 2.8 billion Euros for SLP). Compared to the start of the Germany-wide market area on October 1, 2021, when the sum of the balances was 926 million Euros, the current balances appear high.

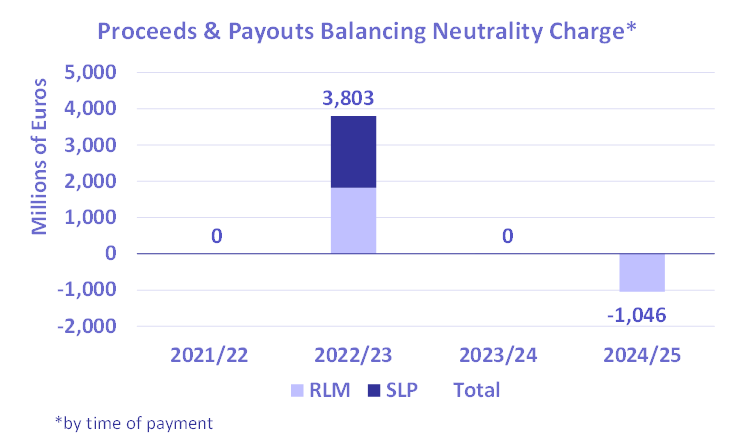

The increase of the balances (compared to the time before the energy crisis of 2022) was mainly caused by proceeds from the balancing neutrality charge in gas year 2022/23, which were 3.8 billion Euros (SLP and RLM combined). A payout of 1.05 billion Euros was made from the RLM account for the balancing period of gas year 2023/24 (the payout occurred in gas year 2024/25).

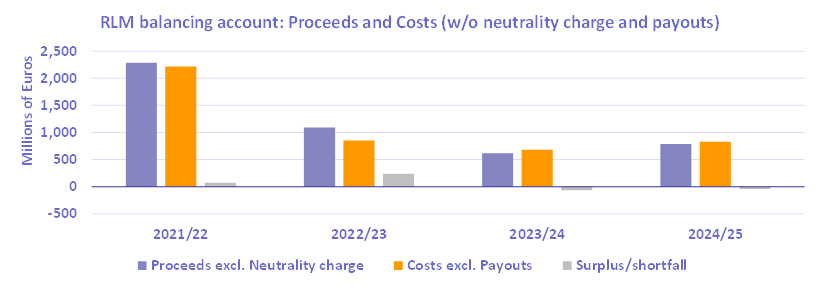

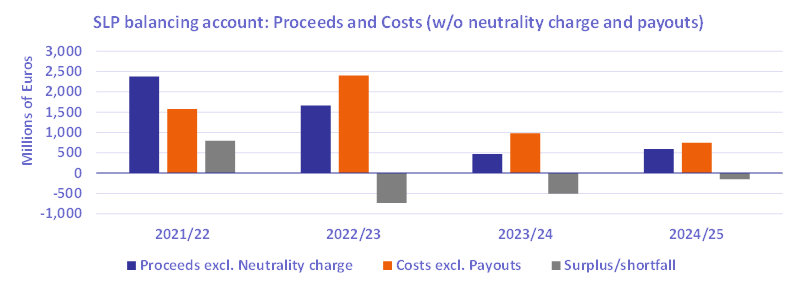

Regardless of proceeds from the neutrality charge and of payouts, proceeds and costs on the RLM account were approximately balanced over the years, i.e., surpluses or shortfalls were very minor, if any. By contrast, a significant surplus of 797 million Euros developed on the SLP account in gas year 2021/22, followed by substantial shortfalls in the following years (of 739 million Euros in 2022/23, 511 million Euros in 2023/24 and 153 million Euros in 2024/25).

Winter Review 2024/25 by FNB Gas in cooperation with Team Consult

On May 28, the German association of gas transmission system operators (FNB Gas) published its winter review 2024/25 which was prepared with support by Team Consult.

The subject of our cooperation with FNB Gas was the question to what extent the minimum gas storage filling requirements and THE's role as storage filling entity of the last resort affect the gas trading market and how the instruments to guarantee security of gas supply in the winter should be developed further.

To avoid market distortions in the future, FNB Gas proposes a combination of a storage-based security reserve and a suppliers' obligation to store gas. Such a combination of different instruments features a low predictability of gas volumes required for filling gas storages in the summer, thereby making speculative trading activities to the detriment of all market participants more difficult.

The winter review 2024/25 can be downloaded from the website of FNB Gas (here). The publication is available in the German language only.

Essay by Hans-Ulrich Meine on the narrative of "cheap gas" from Russia

In this essay (available in German language only), Hans-Ulrich Meine, Senior Advisor for Team Consult and previously a manager in top executive positions in the German gas industry, discusses the narrative of "cheap Russian gas" frequently used in German media and politics.

Regardless of the origin of the gas, the price was always determined according to the prevailing principle of price formation in the gas market in the respective stage of the market's development (fixed prices, oil-indexed prices, gas hub prices), given the respective market situation (buyer's market, balanced market, seller's market).

In the essay, the different phases of the development of the gas market since the 1970s are presented in detail, and the defining elements of each phase are identified; moreover, it is highlighted when a buyer's market with a gas surplus existed and when there was a seller's market with gas shortages. In the paper, no indications are found that Russian gas in specific was particularly "cheap" in the sense that it was sold at a lower price compared to the general market value.

Energy Market Radar Germany (8th edition, August 2022)

The latest edition of our Energy Market Radar Germany is available for download here. The key points are:

- The temperature-adjusted gas consumption from January to July 2022 was 20 TWh lower compared to the average across the same period in years 2017-2019; the only segment featuring a reduction in gas consumption is the industry segment while the consumption by gas power plants and SLP customers was higher than in the reference period

- In the Netherlands and Germany, gas prices in the spot market are particularly high in the second quarter of 2022 compared to other European markets. The spread to the Belgian Zeebrugge hub amounts to 100 EUR/MWh on some days.

- The spreads obviously cannot be eliminated by arbitrage. This is due to a lack of spare capacity. Pipeline connections into the Netherlands (e.g., on the BBL pipeline and the VIP Belgium-Netherlands) as well as the Gate LNG terminal are working at capacity.

- An alleviation of the tense situation is not to be expected before the start-up of floating LNG terminals (FSRUs) in Germany in late 2022 or early 2023.

BDEW publishes „Kompendium Grünes Gas“ (compendium of green gas)

June 2019

The Bundesverband der Energie- und Wasserwirtschaft e.V. (BDEW), the German Energy and Water Association, has published a compendium of green gas. Team Consult has developed the compendium in cooperation with BDEW. It highlights different possibilities to decarbonize natural gas. The compendium can be downloaded from the BDEW’s website (LINK). It is available in German language only.

Trading Activity at the TTF

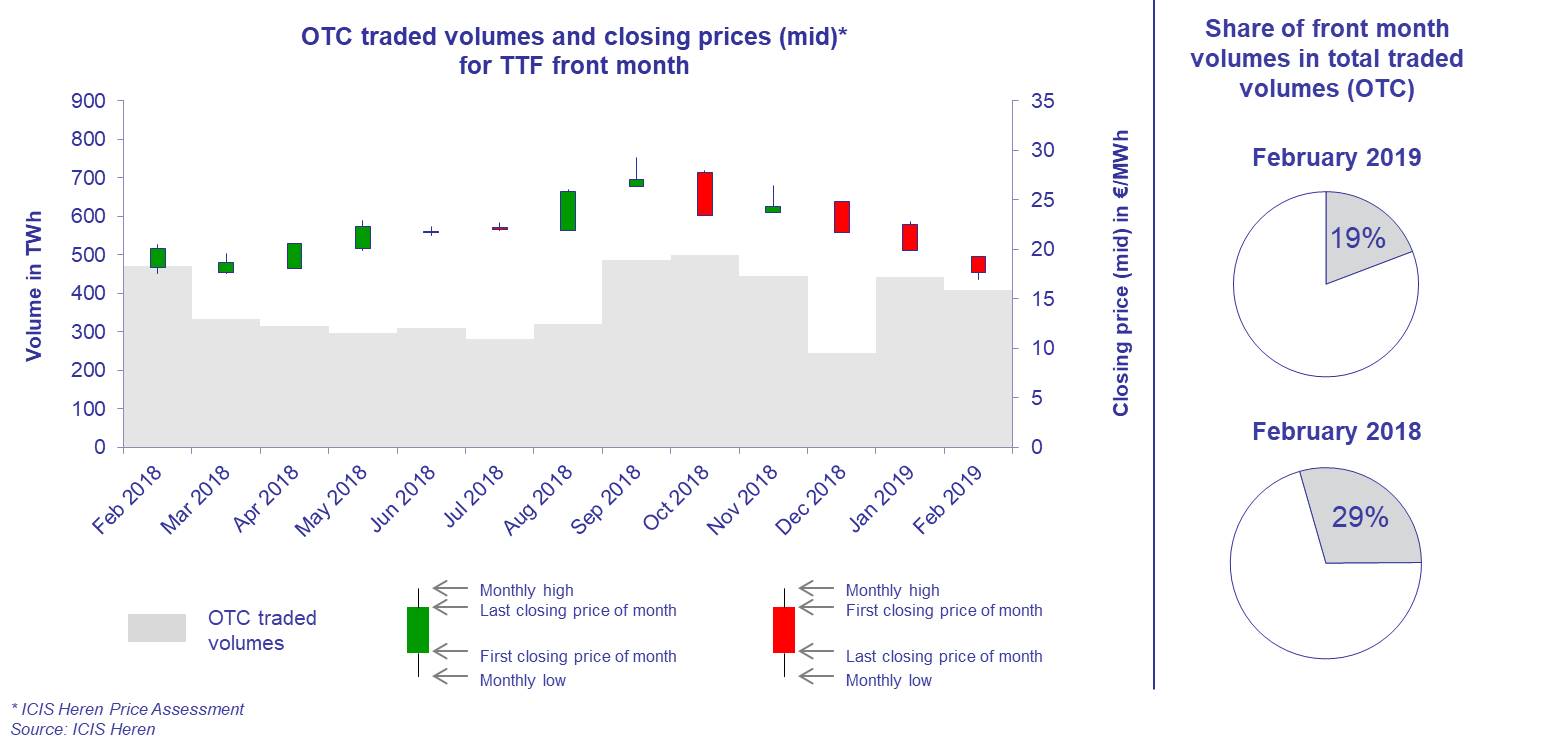

March 2019

The trend of falling prices at Western European hubs continued in February 2019. The front month contract with delivery at the TTF changed hands at 22.51 EUR/MWh with start of the year and closed at 17.65 EUR/MWh on February 28th. This price level was last seen about one year ago. Above average temperatures during the usually coldest month of the year led to weak demand, while supply with pipeline gas and LNG was plentiful. Traded volumes were slightly below previous month’s level.

The trend of falling prices at Western European hubs continued in February 2019. The front month contract with delivery at the TTF changed hands at 22.51 EUR/MWh with start of the year and closed at 17.65 EUR/MWh on February 28th. This price level was last seen about one year ago. Above average temperatures during the usually coldest month of the year led to weak demand, while supply with pipeline gas and LNG was plentiful. Traded volumes were slightly below previous month’s level.

Natural gas supply ensures security of supply of European energy systems

March 2017

Low filling levels of European gas storages fuel the discussion on the security of gas supply in the winter season. Madjid Kübler, managing director of TEAM CONSULT, assesses the situation in a guest commentary for the energate messenger+ of 7 March 2017.

Download energate messenger+ guest commentary as PDF.

Study published on how much additional gas the North-West European gas market can absorb

January 2017

At the moment, the energy industry is discussing the occurrence of a significant worldwide oversupply of natural gas. It is expected that the oversupply of gas will be the dominant situation also for the years to come and will be a key market driver for gas industry players. In a study, Team Consult finds that, if prices are right, the European electricity sector could absorb around 40 billion cubic meters (31 million tons per annum) of additional gas volumes per year by substituting coal-fired power generation.

The study was published on the energy information portals www.europeangashub.com, www.globallnghub.com and www.thecoalhub.com was quoted by Thomson Reuters. It can also be downloaded free of charge via the link below.

Full study for download in PDF format.