Electricity market

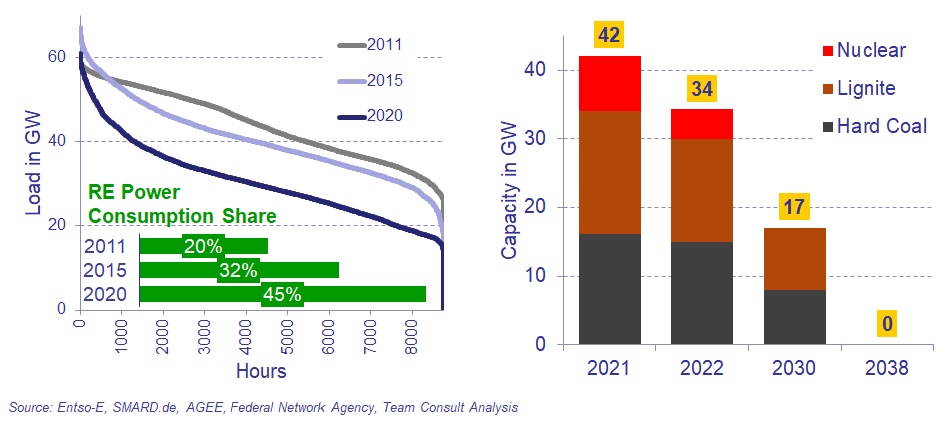

The power system in Germany is undergoing major transformations. Renewable energies (RE) reached a share of 45% of Germany's gross power consumption in 2020; in 2011, this share was still 20%. The share of RE will continue to grow strongly according to political targets. The increasing share of renewables in the power system is reflected, among other things, in the decrease of the residual load. The residual load is the share of power demand that is covered by conventional power plants. The expansion of renewable energies is accompanied by the retirement of conventional power plants. As a result of the phase-out of nuclear and coal-fired power plants, a total of 25 GW of installed capacity from conventional, dispatchable power plants will exit the power market between 2021 and 2030.

Load duration curve and capacity of coal-fired and nuclear power plants in Germany

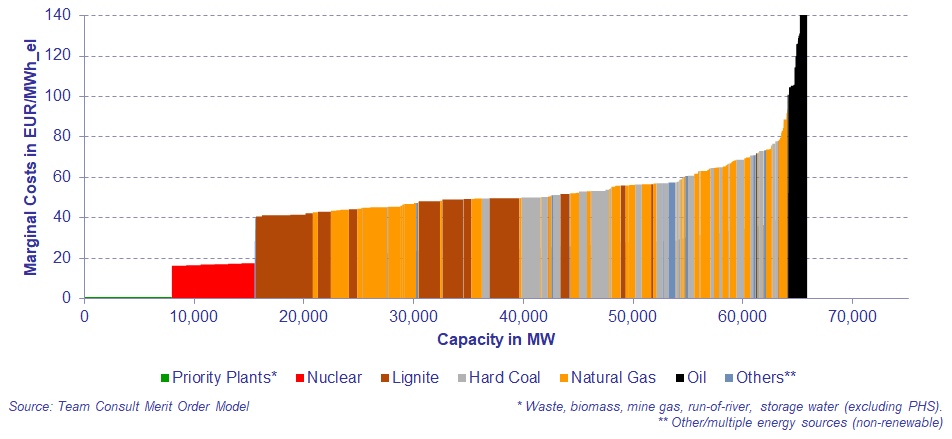

The Merit Order in the power market shows the deployment ranking of different power plants, ordered by ascending marginal costs. The marginal costs are mainly composed of fuel and transport costs, as well as the costs for the procurement of CO2 certificates. Using individual power plant parameters such as the efficiency, the internal Team Consult Merit Order Model determines the marginal costs of power production for each power plant.

Team Consult’s Merit Order Model calculates the power plant-specific marginal costs, lists the power plants in ascending order of marginal costs and shows the cumulative power plant capacity.

Merit order of the German power plant fleet during summer, as of 2021

Since conventional power plants provide the increasingly fluctuating residual load in the power system, they are required to operate in an increasingly flexible mode. The utilization of power plants is mostly brokered through the power exchange, where the demand for electricity is matched with supply, taking into account marginal costs.

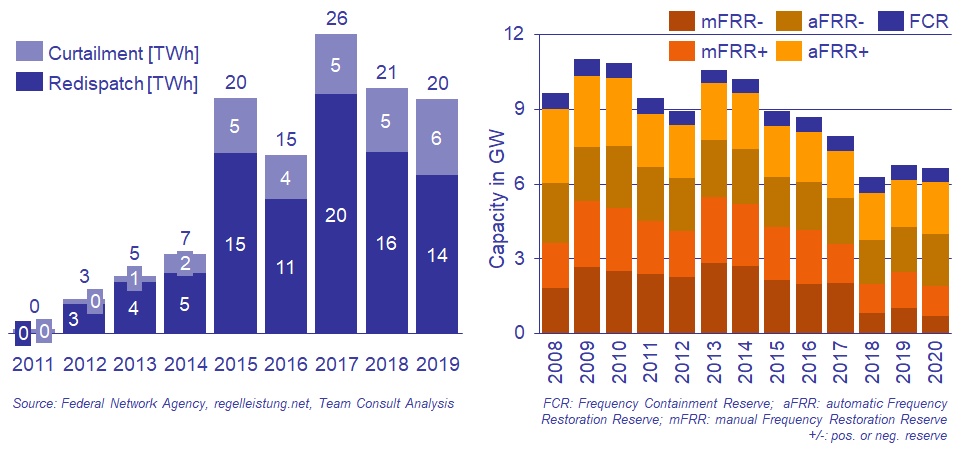

The stability of the power system is ensured by the transmission system operators. To this end, transmission system operators have a number of measures at their disposal. These include re-dispatch of power plants and curtailment of renewable energies. The use of these interventions has increased significantly in recent years. In addition, transmission system operators can procure control energy from other market participants to ensure the balance in the power system. The total tendered capacity of control energy products has fallen from 11 GW in 2009 to around 7 GW in 2020.

Re-dispatch and curtailment (left) and Tendered control energy products (right) in Germany

In this dynamic market environment, we support the various participants in adapting their business activities to current developments in the power market.

Consulting Services

- Market studies and expert opinions

- Development and evaluation of business models

- Provision of parameters for energy system considerations and modeling

- Support for plant operators in assessing opportunities and risks

- Due Diligence for investors

Publications

Energy Market Radar Germany (9th edition, January 2023)

The latest edition of our Energy Market Radar Germany is available for download here. The key points are:

- The globally installed renewable generation capacities have quadrupled in the last 20 years. The share of renewables among the capacities has noted at over 80% in 2021. The strongest growth has been seen for solar/photovoltaics and wind engines.

- Asia is leading the renewable sector in all dimensions (total capacity share, growth rates, installed technologies). In contrast, South America and Africa will have to catch up significantly.

- Asia has a balanced technology mix – whereas the share of solar and wind is highest in Europe at 65% and South America has so far relied primarily on hydropower at 78%.

- The contribution of renewable generation to Germany’s power supply during the wintertime is moderate, although the installed capacity (123 GW) of renewable generation exceeds the total system load (81 GW) by far. The lion’s share (2/3) is still generated by conventional power plants.

Current developments of offshore wind power generation in Germany

January 2023

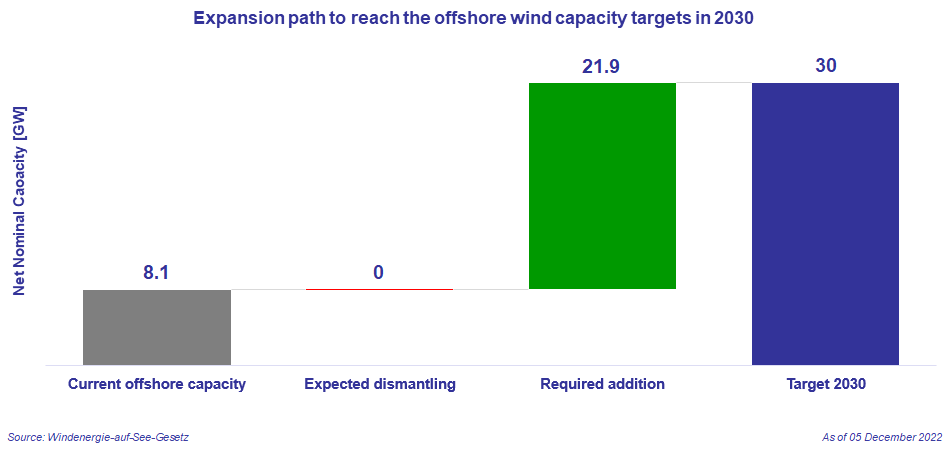

At the end of 2022, over 1,500 offshore wind turbines with a combined capacity of about 8,100 MW (8.1 GW) were connected to the German grid. To accomplish the German climate goals, the offshore wind production law was amended and new targets regarding offshore wind power generation capacity were defined. The goal for offshore capacity in 2030 was raised from 20 GW to at least 30 GW, an increase of 50 %. To reach this goal, additional capacity of 21.9 GW is needed, which means an average capacity increase of 2.7 GW per year. Five years later in 2035, in total 40 GW are supposed to be connected to the grid, and in 2045, at least 70 GW offshore capacity should be operating.

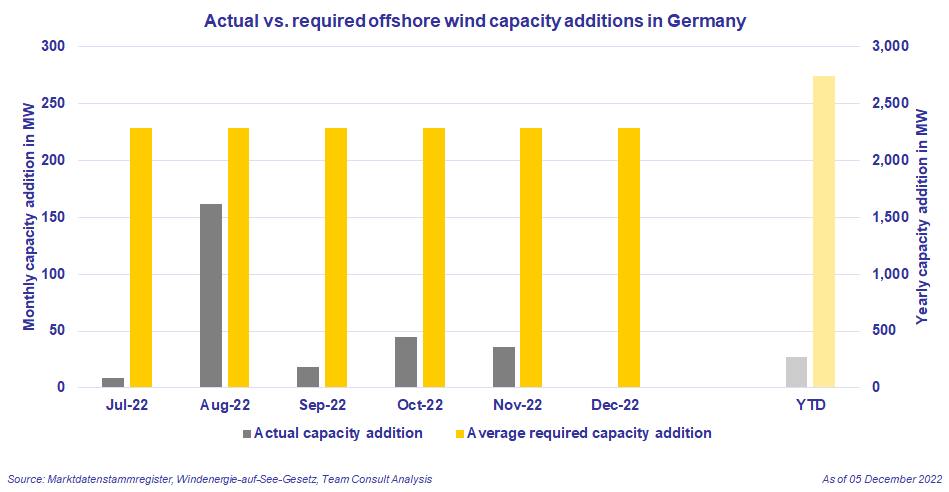

In 2022, the new capacity that has been connected to the grid by early December is 270 MW (0.27 GW), which is equal to only 10 % of the needed average annual addition.

A closer view at the monthly figures shows, that not in one single month the needed average addition pace was achieved. The highest addition was reached in August with a newly installed nominal capacity of 162 MW (0.16 GW), which is equal to 71 % of the needed average monthly addition.

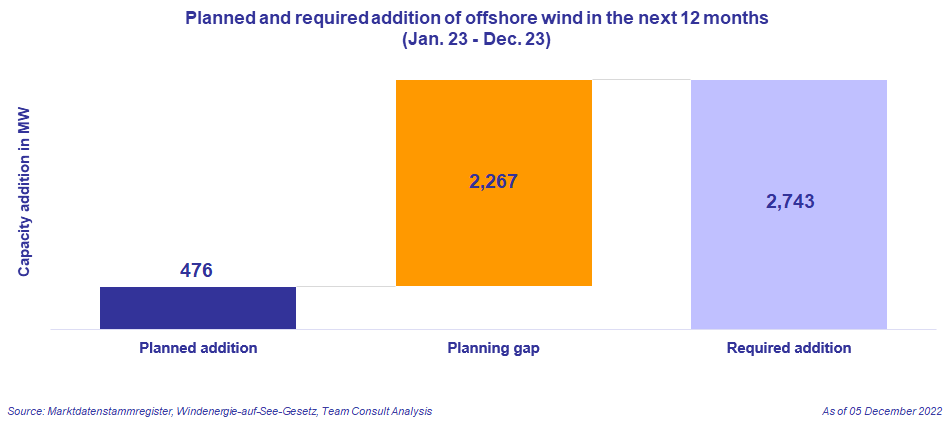

For 2023, 476 MW (0.48 GW) offshore wind capacity is planned to become operational. This is equal to almost twice the new operational nominal capacity of 2022, but it is still only a fraction (17 %) of the needed average annual addition until 2030.

Currently, the pace of planning and building new offshore wind capacities is not sufficient to meet the addition targets of the German government for 2030 and needs to be strongly accelerated. Therefore, new measures to support the addition of new offshore wind capacities were decided. Among other things, environmental scrutiny and residents’ participation rights are supposed to be managed more efficiently as well as time limits for planning approval procedures are expected to be introduced. Whether or not these measures are sufficient to reach the intended yearly offshore capacity additions, only the next few years will show.

Current developments of photovoltaic power generation in Germany

December 2022

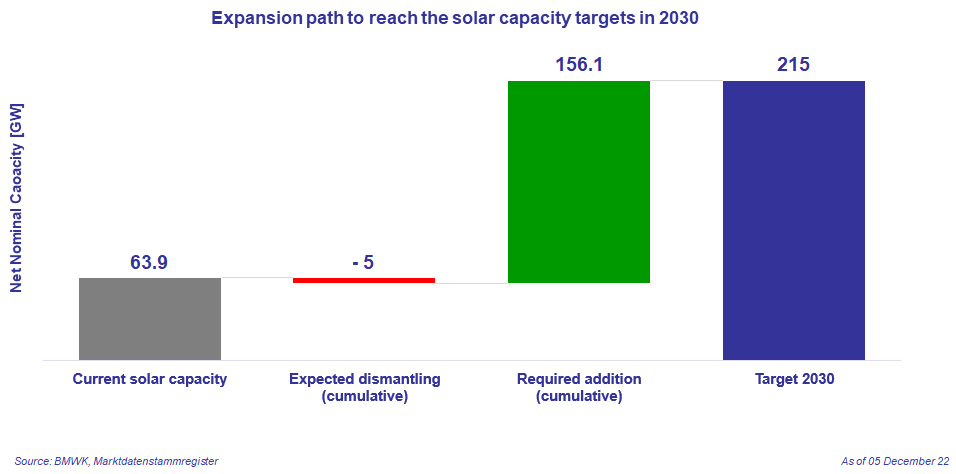

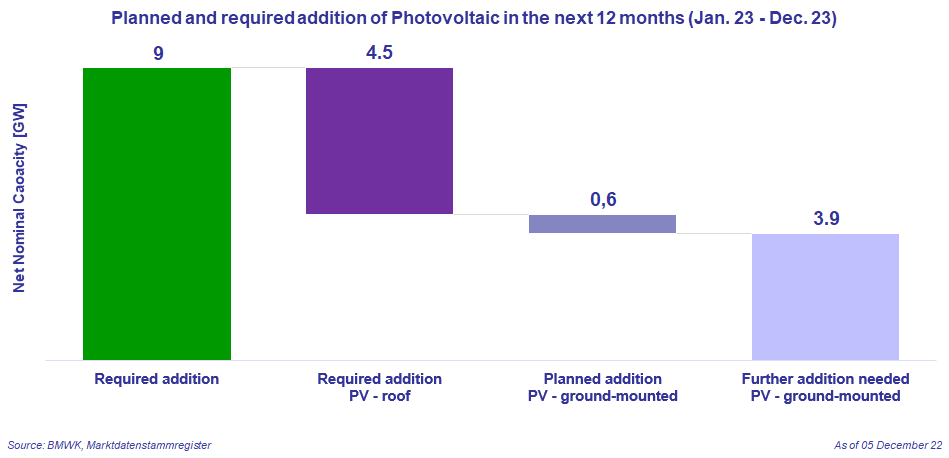

In the ‚Easter Package’ bill, the target of a renewable share of 80 % in 2030 (2021: 42 %) of the gross power consumption was defined, which requires an acceleration of photovoltaic capacity expansion. The new expansion path states an addition of newly installed capacity of 7 GW in 2022, which then increases up to 22 GW/a in 2026 and will then remain constant at this level. The new total expansion target of installed capacity is now 215 GW by 2030, which compared to the old target (98 GW installed capacity until 2030) is more than double. Considering the expected dismantling of 5 GW until 2030, a gross addition of 156.1 GW is needed by 2030, which is approximately 2.5 times the current installed net nominal capacity.

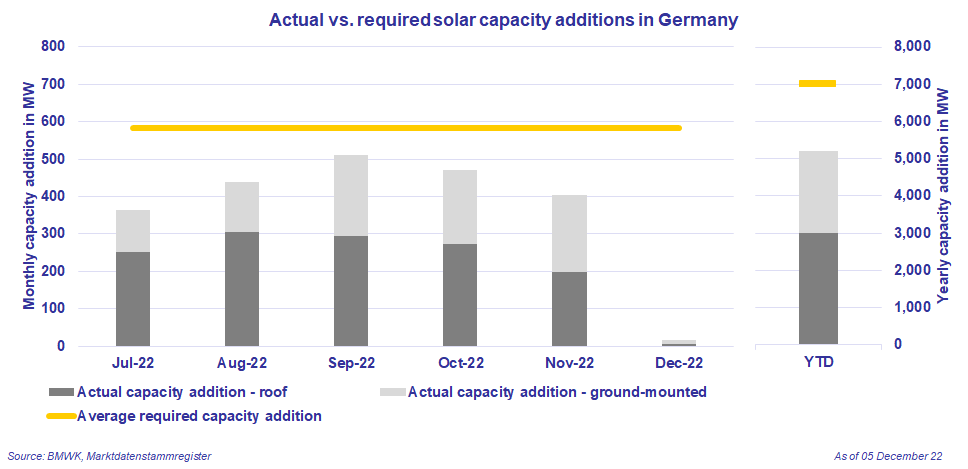

In 2022, in total 5.2 GW net nominal capacity was installed in Germany. The bigger share of 3 GW (58 %) was installed on roofs while the remaining share of 2.2 GW (42 %) was ground-mounted. The target of a capacity addition of 7 GW this year was not achieved (degree of target fulfillment: 74 %). The figure below gives a brief overview of the past few months, where the target, broken down to monthly values, was not reached in one single month.

The ‘Easter package’ bill states that the addition path should be evenly split between roof and ground-mounted Photovoltaic. For planning new roof Photovoltaic in general, an announcement to the Federal Network Agency is not needed while an announcement for ground-mounted Photovoltaic is usually needed. Currently, 0.6 GW of newly installed ground-mounted Photovoltaic capacity is planned for 2023, which is equal to approximately 13 % of the needed addition. It’s an open question, whether the net addition target of 9 GW of PV capacity will be achieved in 2023.

To support the increased addition path of Photovoltaic capacity, various measures were proposed. Among other things, the payments for roof Photovoltaic outside of the regular tenders were increased as well as further area categories were introduced (agri-, Floating-, and swamp-Photovoltaic), which under certain circumstances can get higher subsidies.

Whether or not these measures are sufficient to reach the intended yearly capacity additions, only the next few years will show.

Current developments of onshore wind in Germany

September 2022

In the ‘Easter Package’ bill passed in April this year, the target for the share of renewables in German gross power consumption was increased to 80 % by 2030 (for comparison, the actual share in 2021 was 42 %). To reach this target, the expansion targets for installed renewable generation capacity were massively increased. The former target specified in the Renewable Energy Sources Act 2021 (EEG) for onshore wind energy was 71 GW (EEG 2021: §4 par. 1e) and was increased by more than 60 % to 115 GW in the ‘Easter Package’. The annual capacity addition is set to increase from 3 GW in 2022 to 10 GW in 2025 and then remain at this level.

With an expected dismantling of approximately 17 GW until 2030, a gross addition of 76 GW nominal capacity is required to meet the new targets. This means an expansion that is higher than the total currently installed capacity of 56 GW.

This year, approximately 1.3 GW (1,300 MW) nominal capacity started operations in Germany. The (new) expansion target of 3 GW p.a. (i.e., 250 MW per month on average) was not met in even a single month. In May and June, at least about 90 % of the expansion target was reached. In total, the degree of target achievement (until and including August) is 64 % so far.

In the next 12 months, the initial operational start of wind turbines with a combined net nominal capacity of more than 4.6 GW is planned. If all these wind turbines become operational according to the plan, the target of the government will even be slightly exceeded.

To boost the expansion of onshore wind energy, 2 % of the land area is planned to be made available for onshore wind energy compared to 0.8 % currently. This new target was part of the coalition agreement in the end of 2021 and will be implemented in the new ‘Onshore Wind Act’ (“Wind-an-Land-Gesetz”). In the ‘Easter Package’, some smaller hurdles were already addressed: the degression of the maximum bid value for feed-in compensation in tenders is suspended for two years, the reference yield model for low wind locations is improved and the size constraints for pilot wind turbines are abolished. If these measures are sufficient to reach the intended yearly capacity additions, the next few years will show.

Current developments in the German frequency containment reserve market in May and June 2021

July 2021

The transmission system operators purchase frequency containment reserve to compensate for short-term fluctuations in the grid frequency. For this purpose, the plants that provide the frequency containment reserve are automatically activated. The contracted (prequalified) output of a plant must be available within 30 seconds and provide the contracted power for up to 15 min. The total output of all prequalified plants for frequency containment reserve is currently around 6.85 GW.

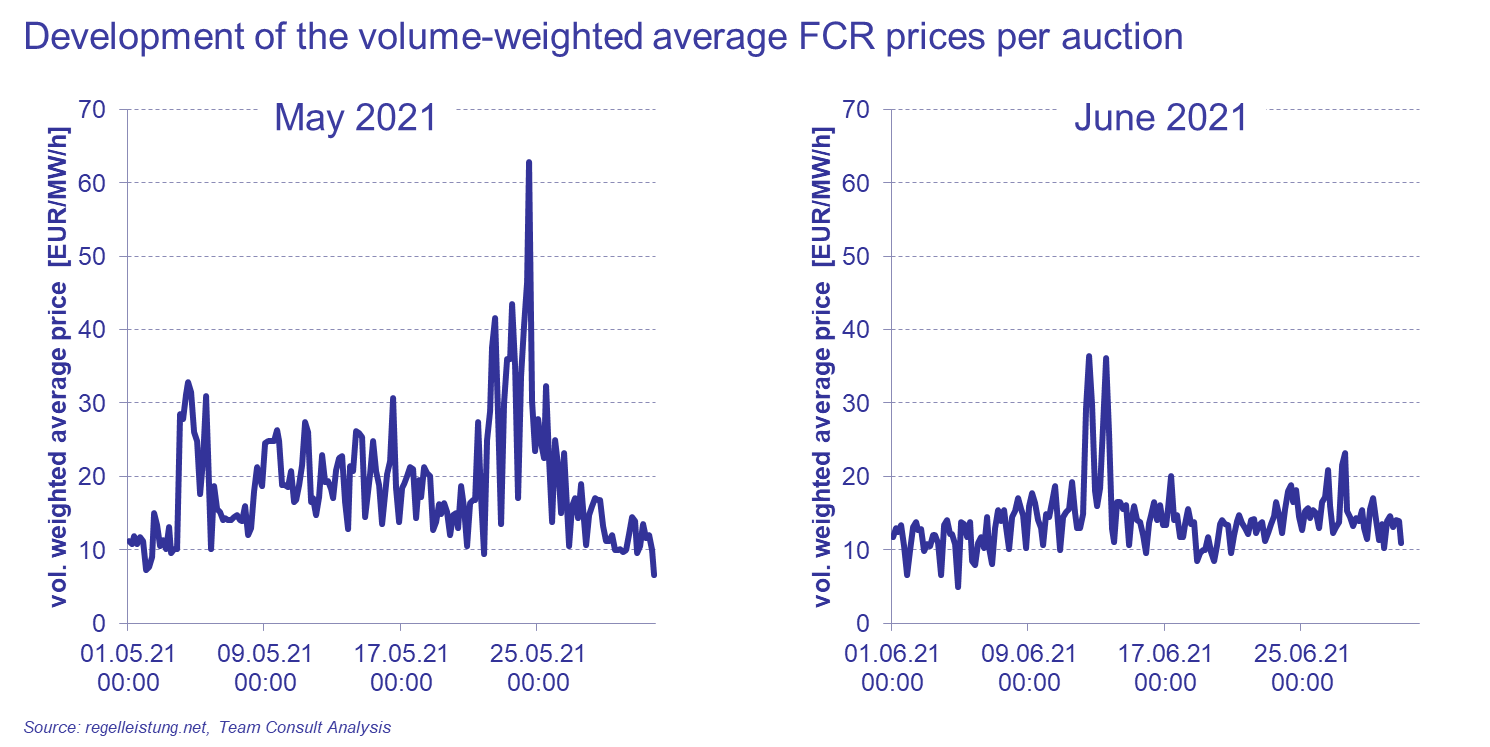

In May, an average of 81 (-13% vs. April) bids per 4-hour product were awarded, with the maximum bid size per auction averaging 57 MW in May (+2% vs. April). The average size of the bids awarded in May was around 6 MW (+24% vs. April). On May 15, there was a maximum awarded bid price of 1,046 EUR/MW/h (+615% vs. April) for a 4-hour block, the highest annual value in 2021 for an awarded bid so far. On average, volume-weighted prices of 20 EUR/MW/h (+52% vs. April) were realized in May. The auction with the maximum volume-weighted price in May was 63 EUR/MW/h (+110% vs. April), the auction with the minimum volume-weighted price was 7 EUR/MW/h (+46% vs. April).

The maximum bid size per auction in June was on average 57 MW (-1% vs. May), the average bid size remained unchanged compared to May at 6 MW per product. As in May, 81 bids were accepted on average. The maximum bid price was 151 EUR/MW/h, 86% lower than in May 2021, with average volume-weighted prices of 14 EUR/MW/h (-28% vs. May). In June, the auction with the maximum volume-weighted price was 36 EUR/MW/h (-42% vs. May), the auction with the minimum volume-weighted price was 5 EUR/MW/h (-32% vs. May).

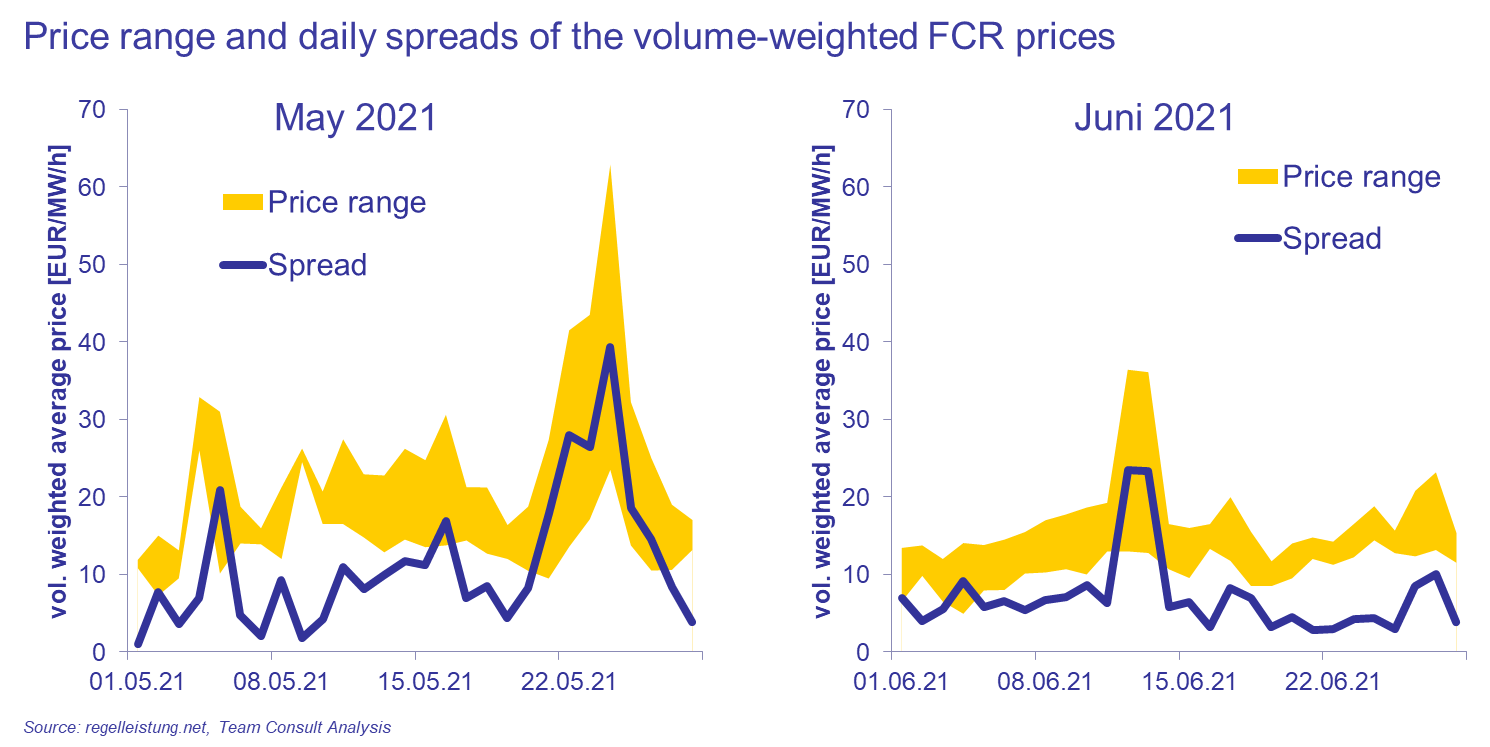

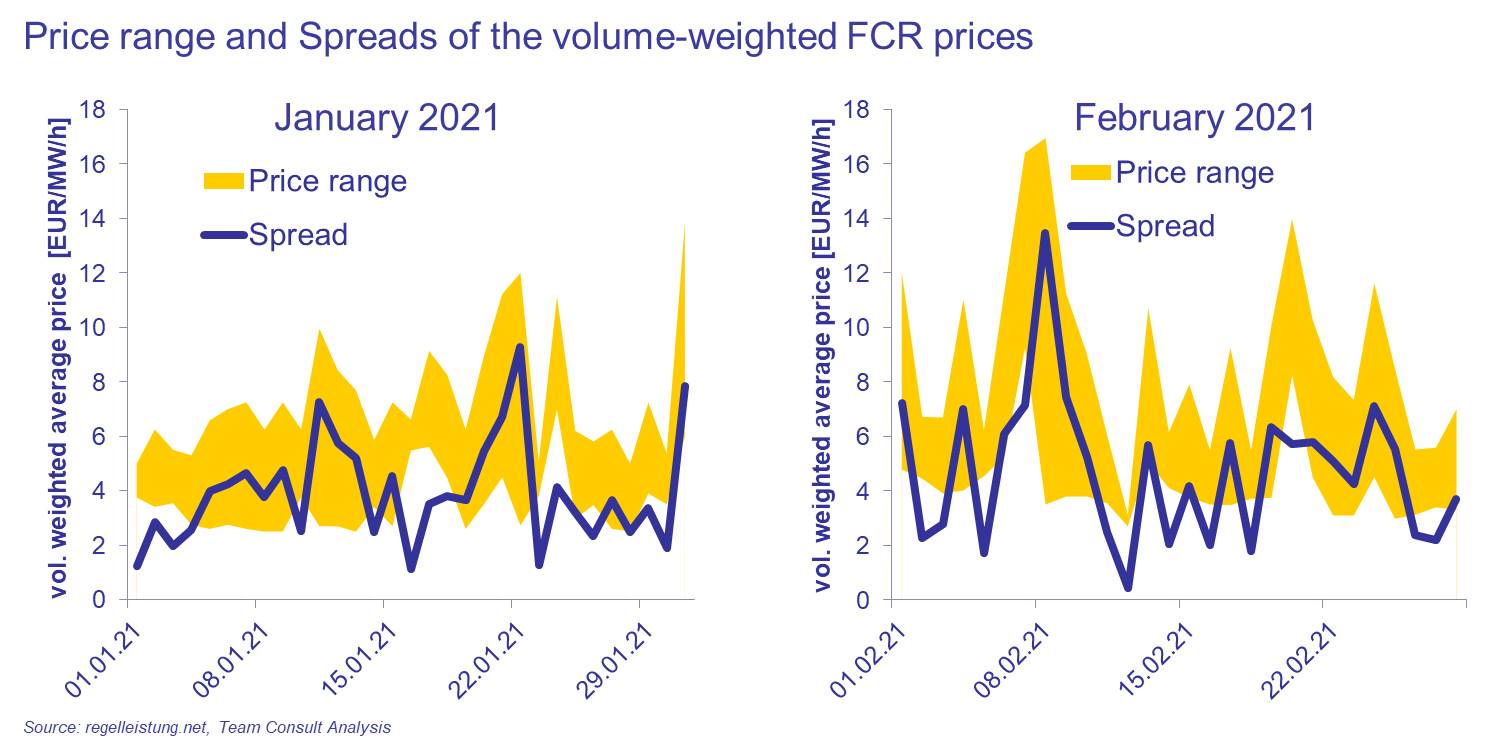

The prices of the different 4-hour blocks of a day also show significant price differences in May and June. In May, the daily spread between the minimum and maximum price of a 4-hour block per day is around 10.8 EUR/MW/h on a monthly average. On May 24th, 2021, the daily spread briefly rises to just under 40 EUR/MW/h. The price spreads are thus significantly above the level of the previous months in 2021, where the daily spreads ranged between 3.9 and 6.7 EUR/MW/h. In June, the fluctuations decrease compared to May and the daily spreads become more stable over the month. As a result, the daily spread is mostly in the range between about 5 and 10 EUR/MW/h. The monthly mean value of the daily spread drops to 6.9 EUR/MW/h, comparable to April 2021.

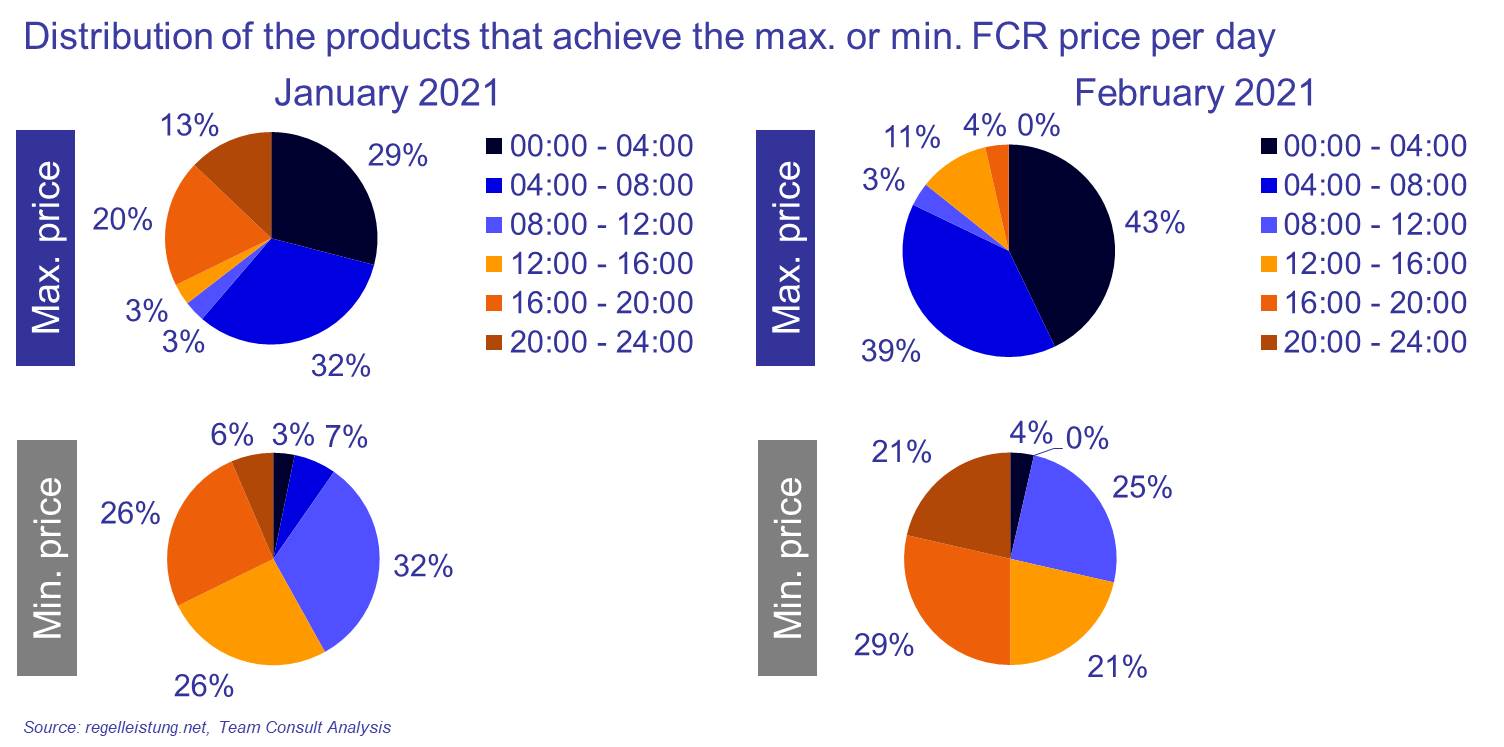

An analysis of the price variance of the 4-hour blocks within a day shows the usual picture of the last months - especially the evening hour blocks achieve the lowest daily prices. In May and June, the range between 8 p.m. and midnight showed the lowest daily prices in 64% and even 87% of the cases, respectively. The distribution of the maximum prices per day among the different times of the day has changed more significantly. While the blocks from 0 a.m. to 12 a.m. dominated the maximum prices from January to March, the distribution is more balanced since April, and the block between noon and 4 p.m. achieves almost 50% of the maximum prices (36% in April, 55% in May and 48% in June 2021).

.png)

The prices have increased significantly in May and June compared to the beginning of the year and are with around 20 EUR/MW/h in May 2021 above the level of the annual average of 2018. The next months will show whether this is a sustainable development or just a short-term increase.

Developments in the primary control reserve market

April 2021

Control power is purchased by the transmission system operators to stabilize the power grid. There are three different categories of control reserve, which differ in the speed at which they are made available or activated. The fastest available control reserve is the primary control reserve or frequency containment reserve (FCR), which is activated within a few seconds and must be made available for up to 15 minutes. It is then replaced by the secondary control reserve (automatic Frequency Restoration Reserve, aFRR) and the minute reserve (manual Frequency Restoration Reserve, mFRR).

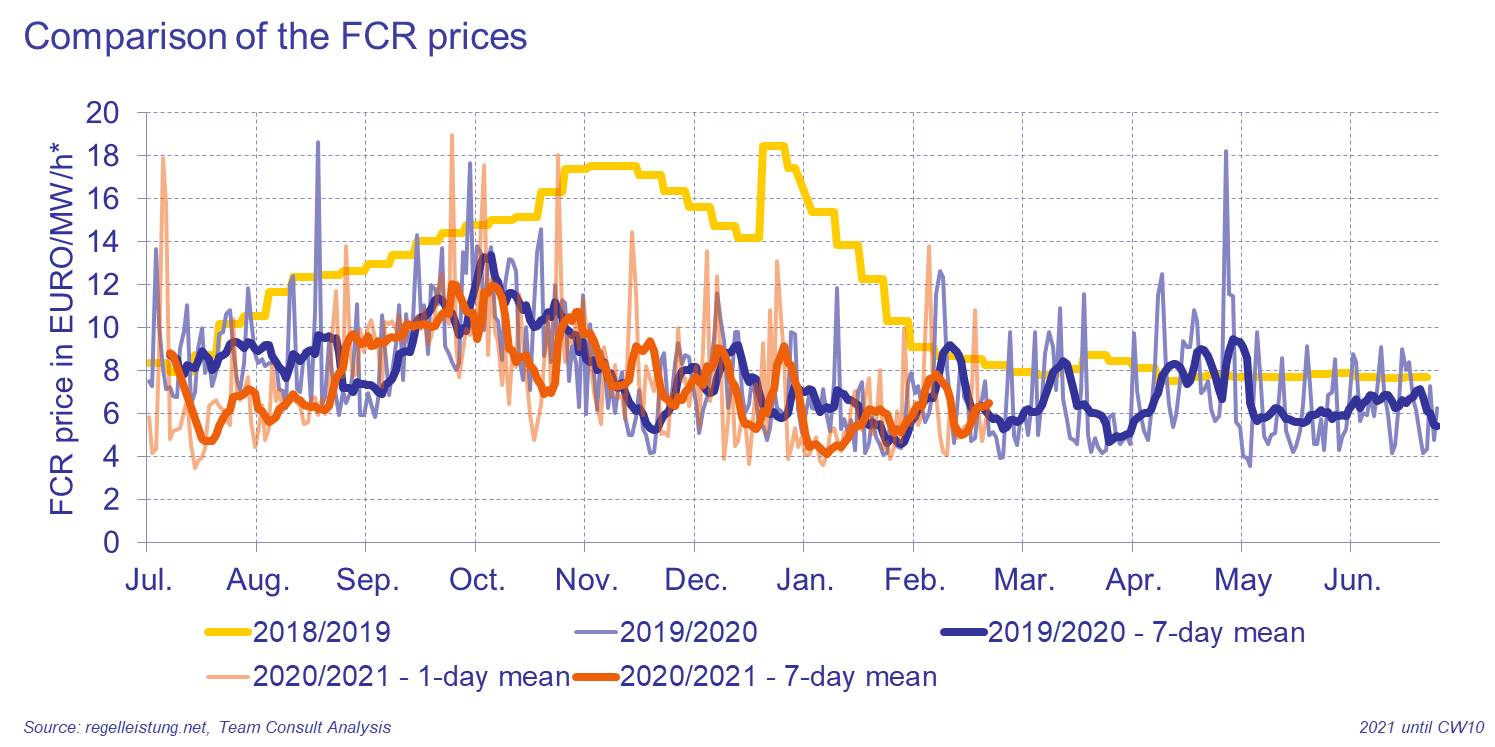

The transition of the auction model for primary control reserve is completed with the last switch to 4-hour blocks in July 2020. Prior to this, the auctions were conducted per week as weekly blocks (until July 2019) or per day as daily blocks (until July 2020). In the following, when considering control power prices, these are always based on the duration of one hour, which ensures comparability of prices for different products (weekly, daily and 4-hour blocks). A decrease in the achieved FCR prices over the last few years can be observed.

The upper graph shows that in 2018/2019 with the weekly product the prices reached 10 EUR/MW/h and more, the average price amounts to 11.40 EUR/MW/h for the period 2018/2019. In the 2019/2020 period with the daily product, the average price fell to 7.60 EUR/MW/h. Since the switch to 4-hour blocks, the average price remained at 7.60 EUR/MW/h until the end of February 2021. However, there are high fluctuations in the power prices between the different blocks, between July and December 2020 the minimum was 2.50 and the maximum was 31.60 EUR/MW/h.

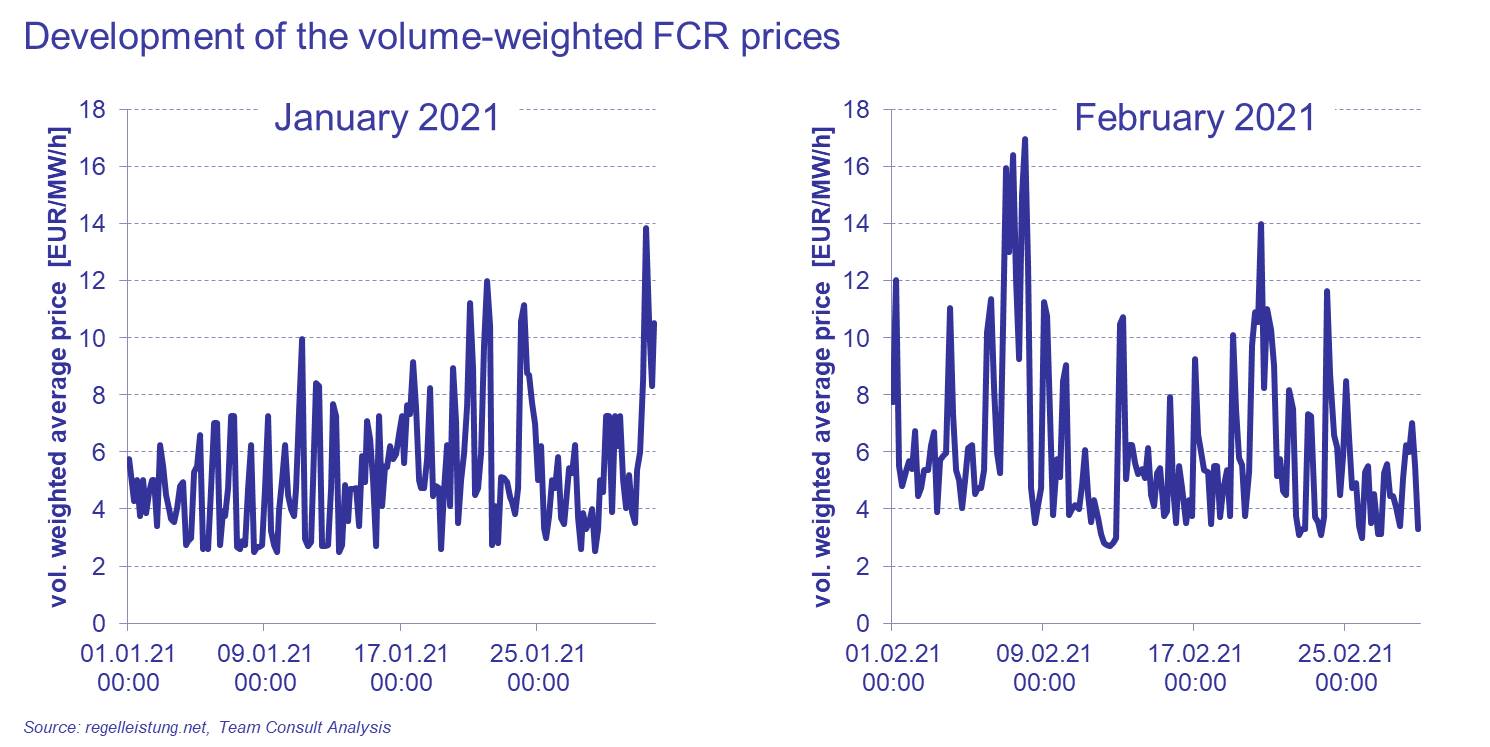

The development of primary control reserve prices from January 2021 on is examined in more detail below. In January, an average of 81 bids per 4-hour product were accepted, with the maximum bid size per auction averaged over all auctions amounting to 58 MW in January. The size of the awarded bids averaged around 2 MW. During January 2021, bid prices of up to 140 EUR/MW/h for a 4-hour unit were awarded temporarily. As the auctions follow the "uniform pricing" model, this results in high costs for the transmission system operators in certain cases, as all bidders receive a uniform price, namely the highest awarded bid price. On average, volume-weighted prices of 5 EUR/MW/h were achieved in January, with a maximum and minimum of 14 and 3 EUR/MW/h, respectively.

In February, the maximum bid size per auction decreased on average across all auctions to 40 MW, however, the average bid size increased to 7 MW per product in February. On average, 81 bids continued to be accepted. The maximum bid price was 16.50 EUR/MW/h, significantly lower than in January 2021, with average volume-weighted prices of 6 EUR/MW/h in February, with maximum and minimum at 17 and 3 EUR/MW/h, respectively.

The prices of the different 4-hour blocks of a day show significant price differences. In January, the daily spread between the minimum and maximum price of a 4-hour block per day is on a monthly average around 3.90 EUR/MW/h, most of the time the daily spread ranges between 2 and 5 EUR/MW/h. In February, on the other hand, there are considerable larger fluctuations, both within individual days and within the month as a whole. As a result, the daily spread is mostly in the range between 2 and 8 EUR/MW/h. The monthly average value of the daily spread rises to 4.80 EUR/MW/h due to the fluctuations.

Looking at the price variations of the different 4-hour blocks, it can be seen that the two earliest blocks between 0 and 8 a.m. regularly achieve the highest prices on a given day. In January, the maximum daily price in the month is reached in 61% of the cases in the first two 4-hour blocks, and in February this value rises to 82%. The midday and evening blocks often achieve the lowest prices. These first two 4-hour blocks regularly show a higher number of bids accepted compared to the remaining four product blocks.

The market for primary control reserve is thus a competitive market in which high prices can be achieved from time to time. Since 2019, the weekly averaged prices have stabilized at a level of mostly below 10 EUR/MW/h. Only on rare occasions prices of more than 10 EUR/MW/h can be achieved.

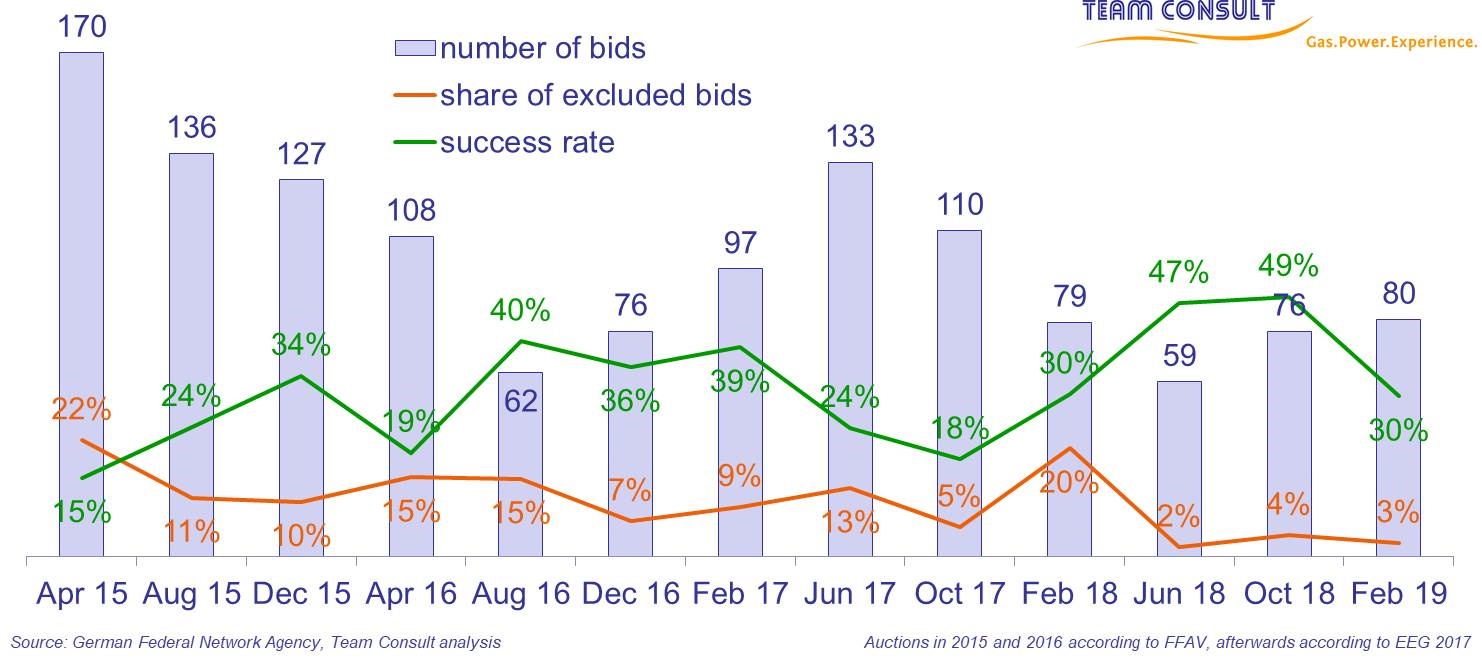

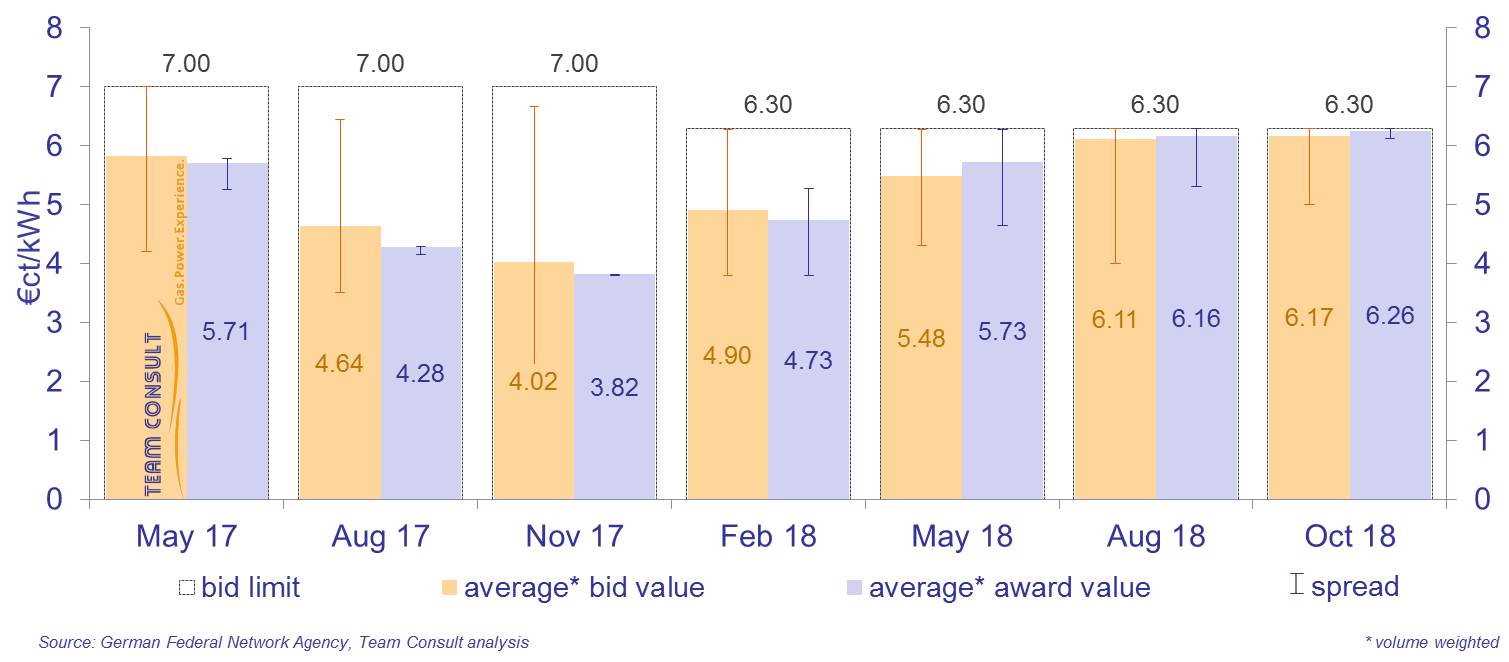

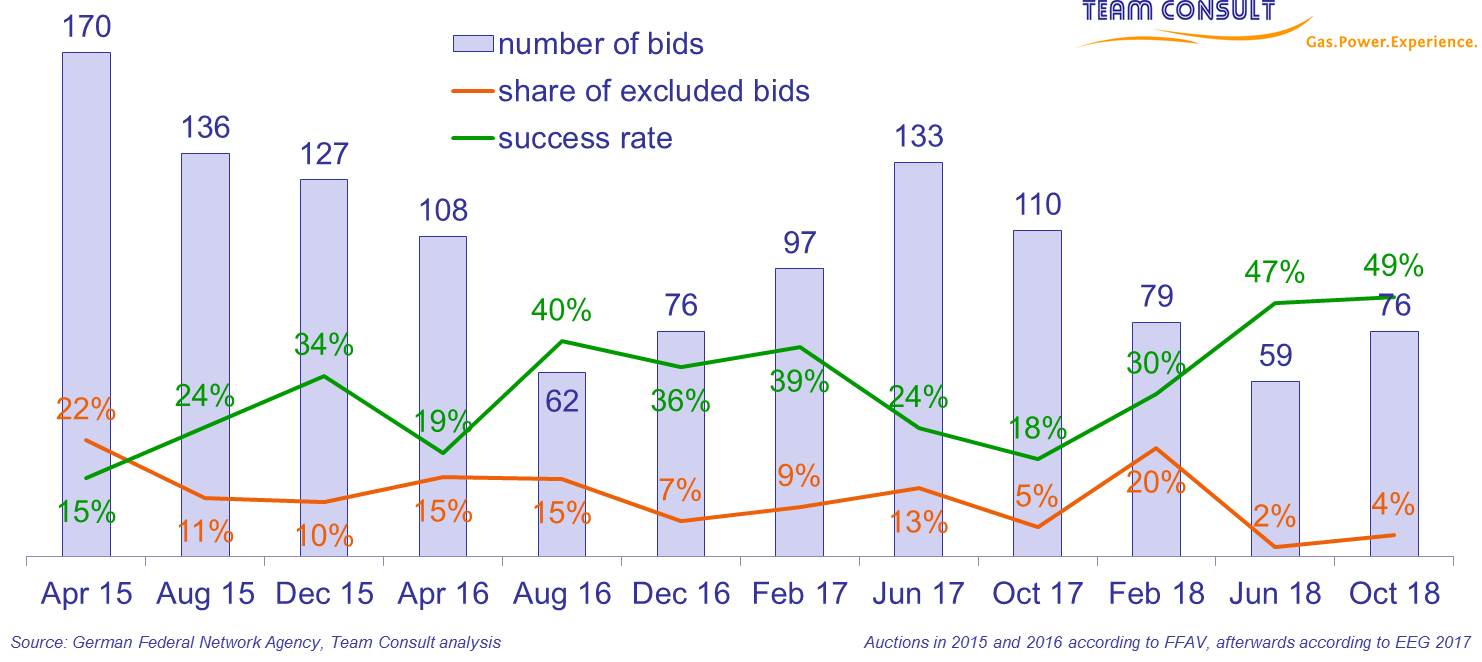

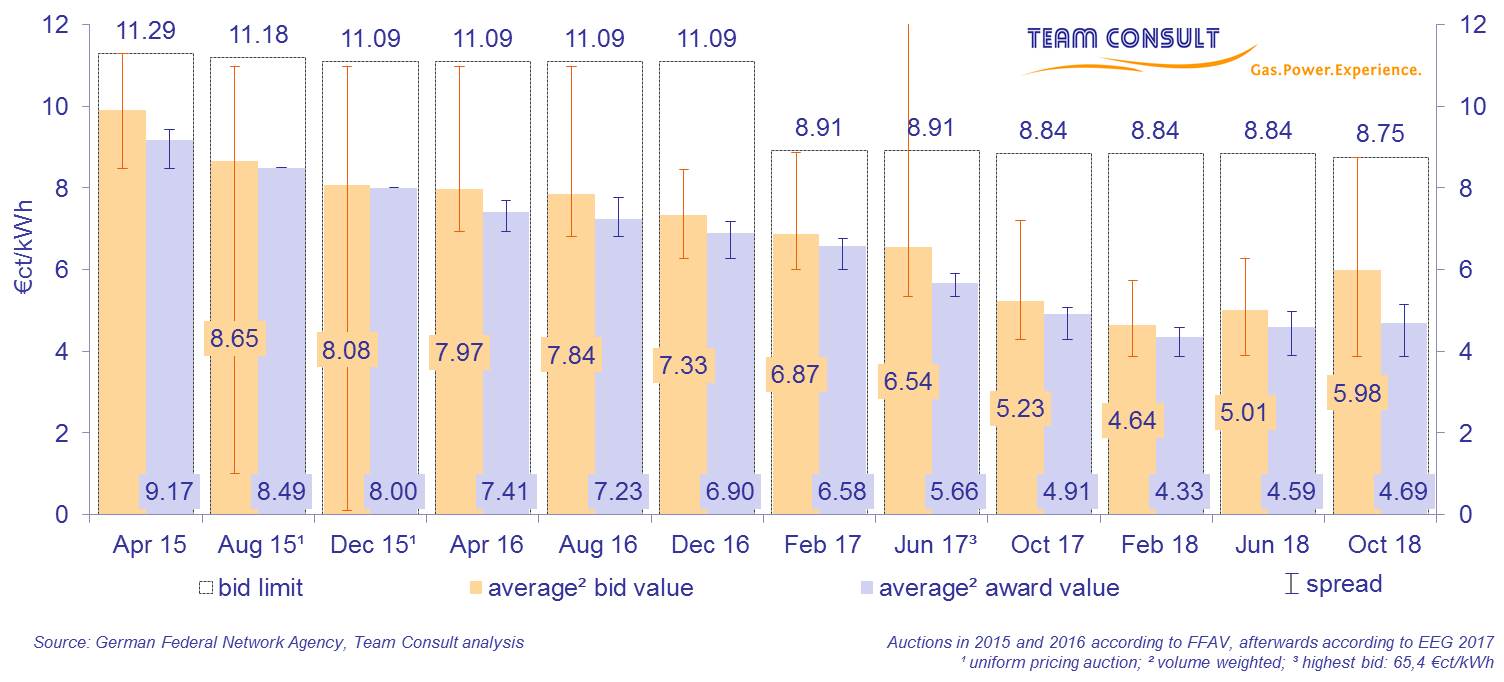

Results of the auctions for photovoltaic installations

October 2020

The German government had originally decided in 2012 to stop supporting new PV systems under the EEG as soon as a total capacity of 52 GW of all EEG-remunerated PV systems was reached. By July 2020, according to the German Federal Network Agency (BNetzA), PV systems with a total capacity of 51.7 GW had already been installed, which means that the 52-GW-cap could be reached if the quantities tendered for the September and October 2020 auction were fully exhausted. Due to the repeal of the 52-GW-cap on July 3rd, 2020 by the Bundesrat, the support scheme for new PV systems will remain in place.

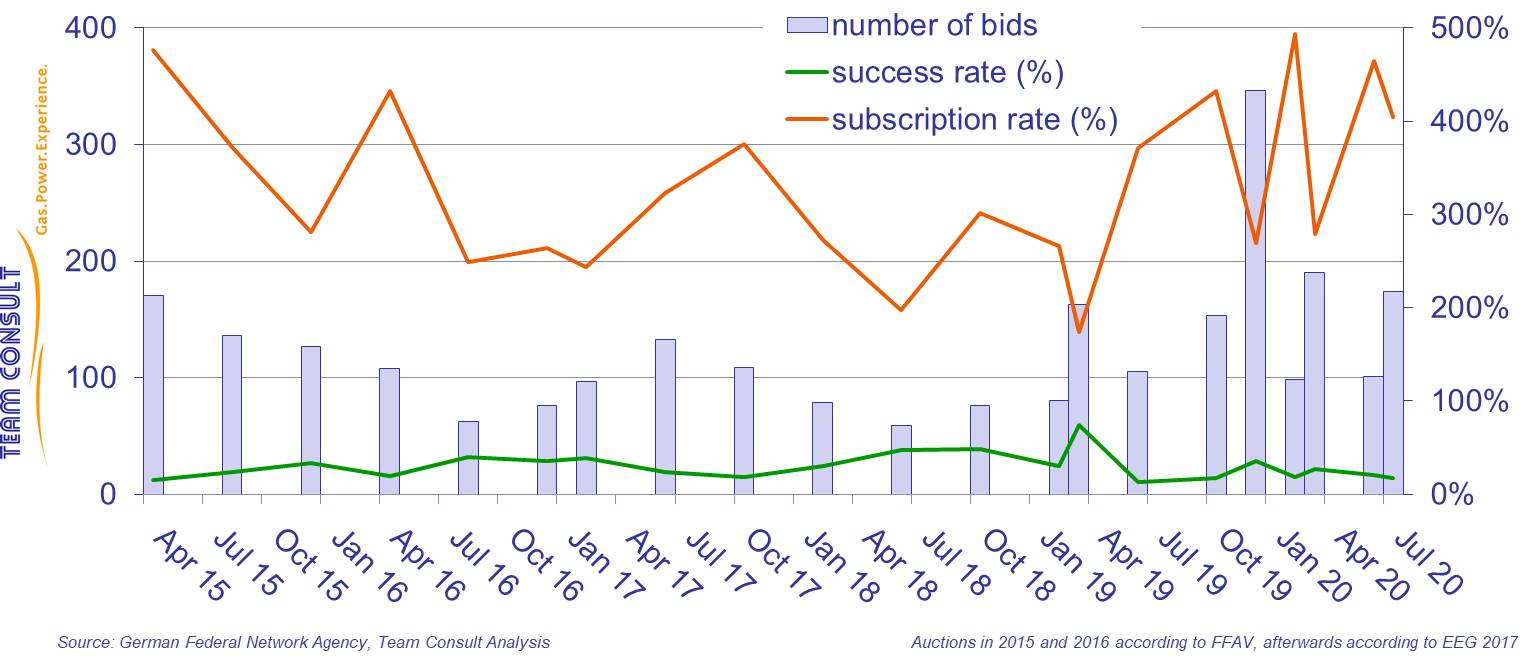

On July 30, the BNetzA published the results of the fourth tender for solar systems in 2020. 174 bids were submitted in the auction in July 2020. This is a significant increase in the number of bids compared to the previous round (101 bids). At the same time, the tender volume doubled by 96.4 MW to 192.7 MW. The subscription rate is 404 %, meaning the total volume of bids exceeds the tender volume by a factor of four.

A total of 18 bids had to be excluded, resulting in an exclusion rate of 10%. In the end, 30 bids with a total volume of 193 MW were accepted, which corresponds to an acceptance rate of 17% - the acceptance rate is thus at a similar level as in the other rounds this year.

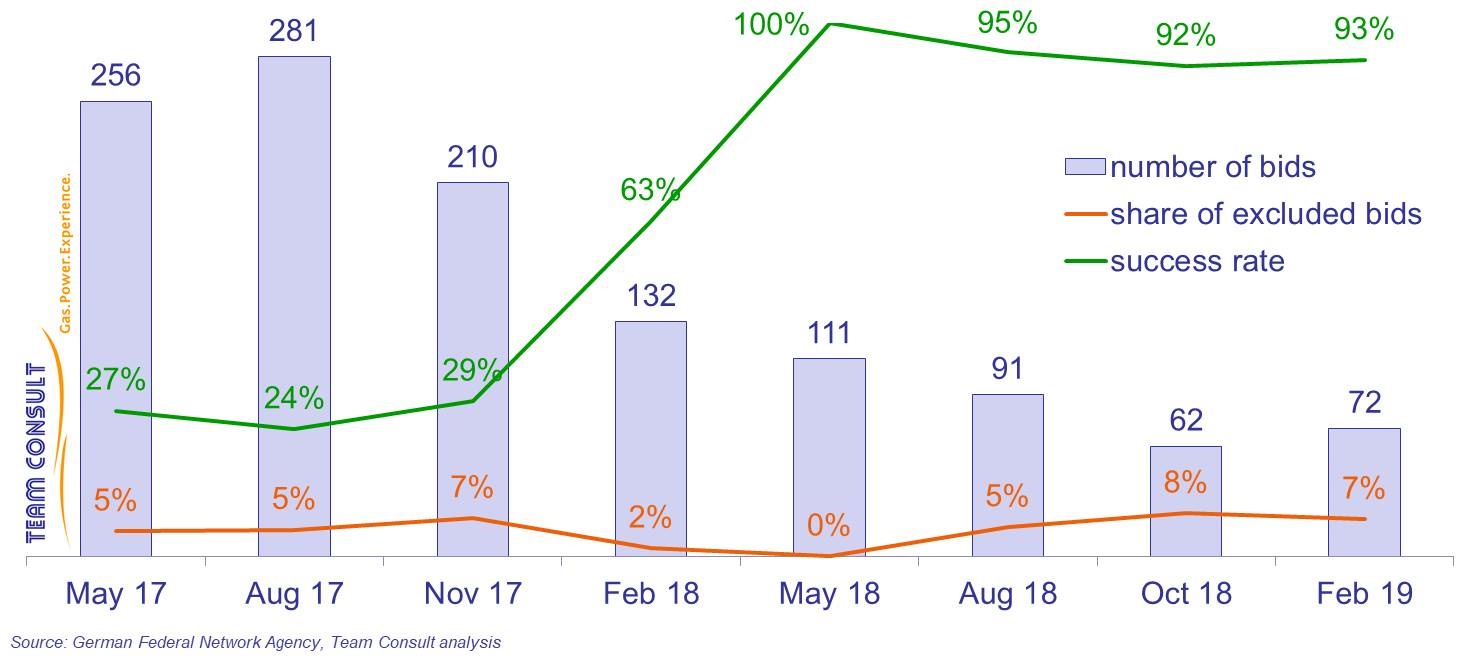

Number of bids, exclusion rate and success rate within the framework of the competitive bidding procedure to determine financial support for photovoltaics installations in Germany

Number of bids, exclusion rate and success rate within the framework of the competitive bidding procedure to determine financial support for photovoltaics installations in Germany

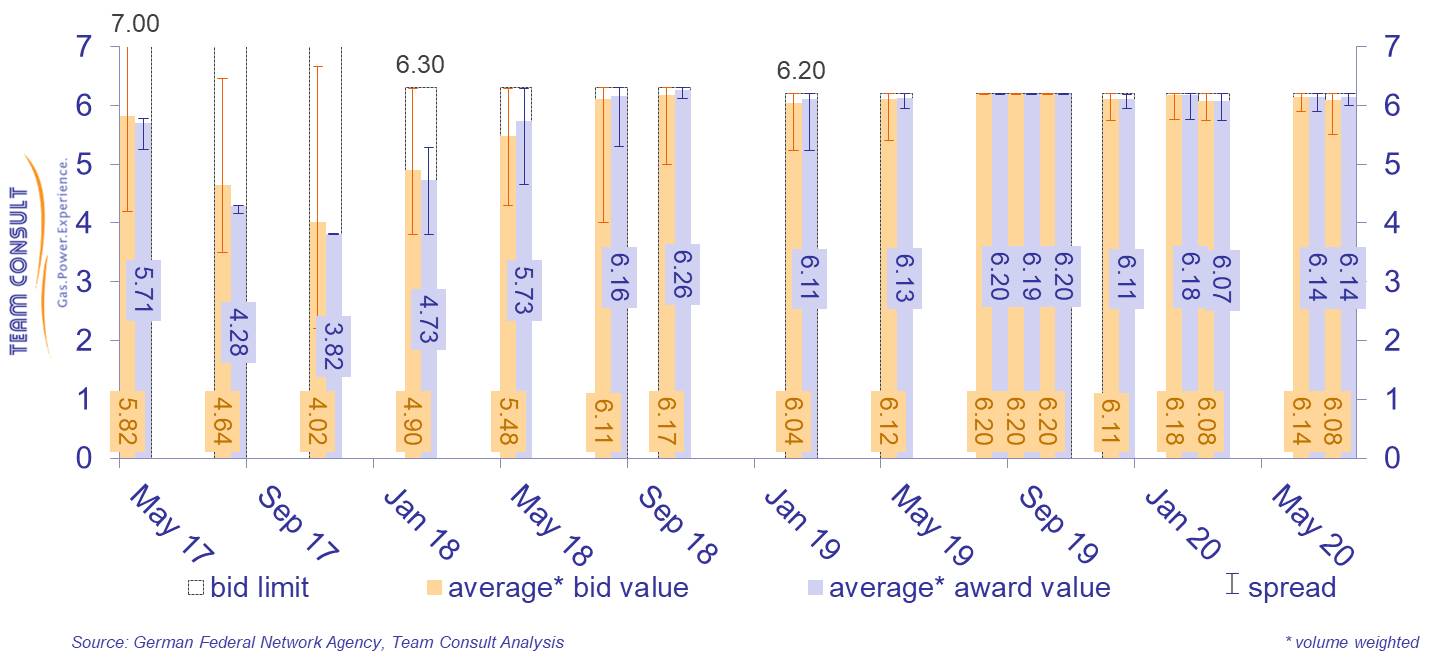

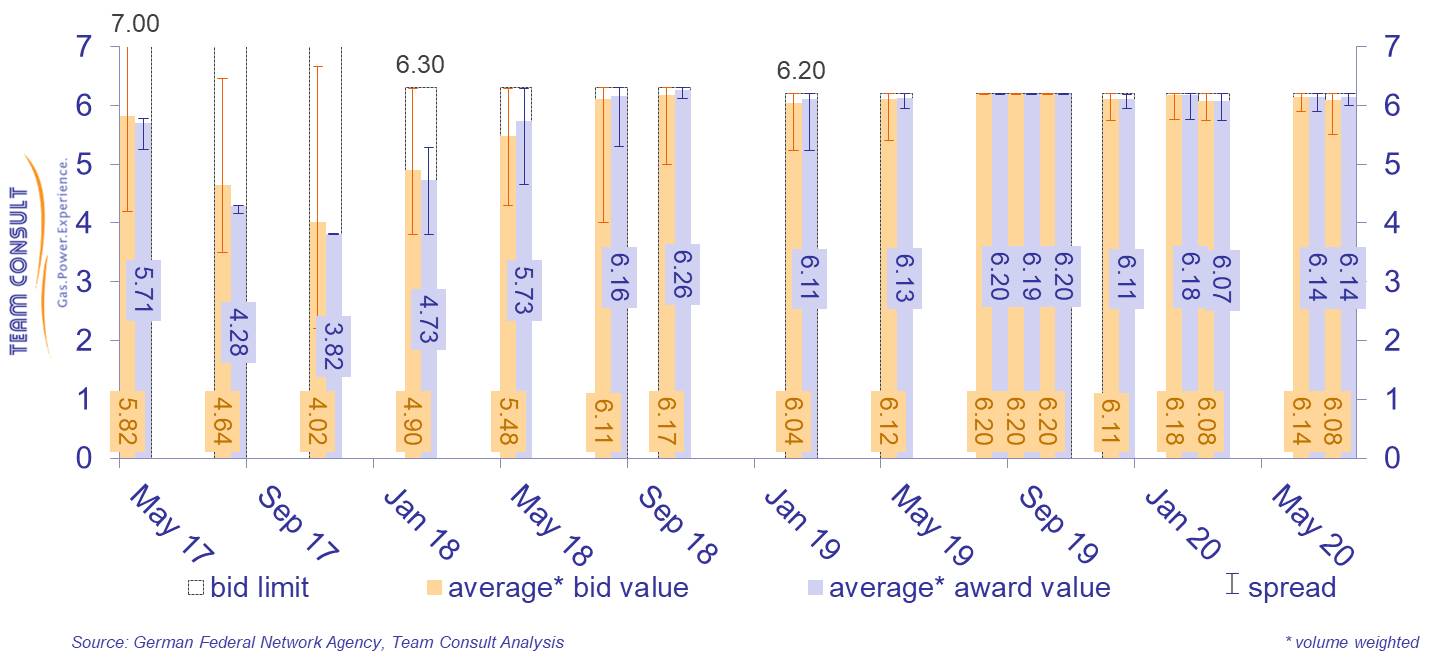

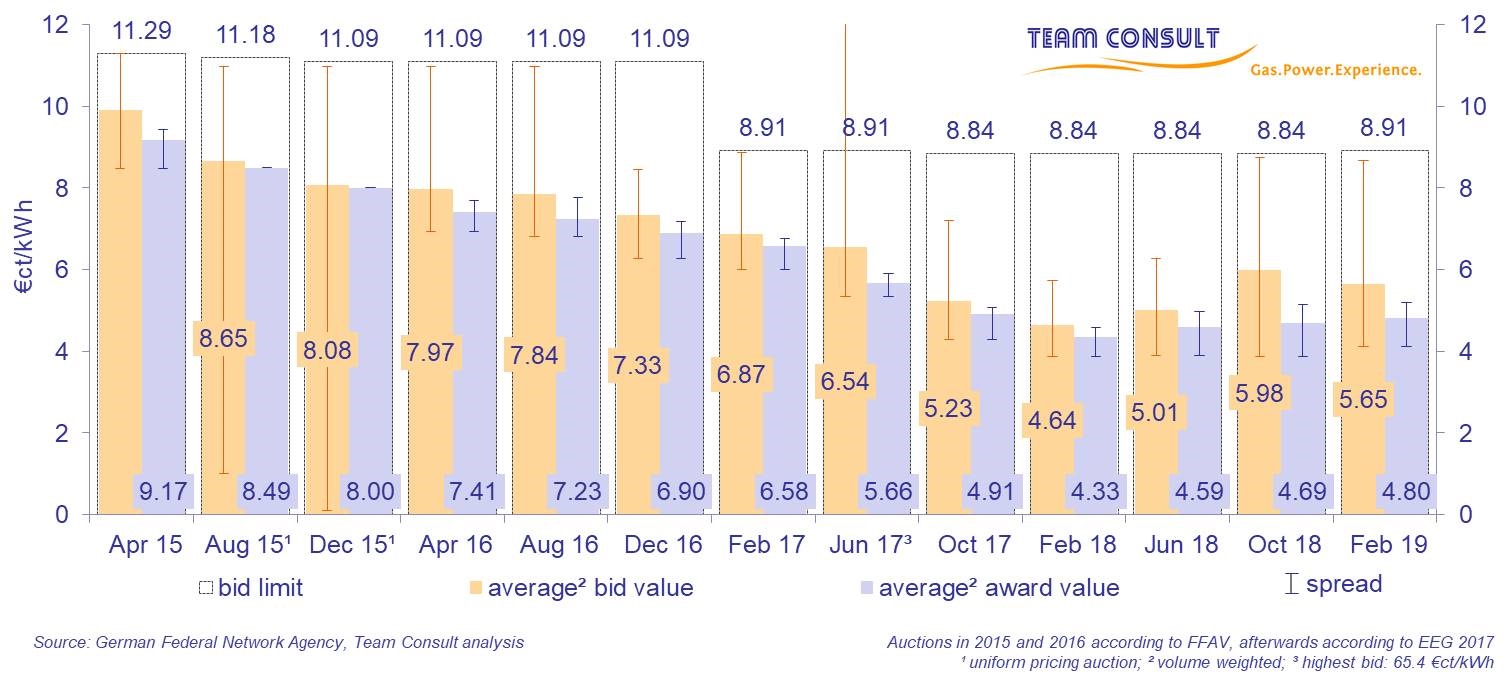

The average award value was 5.18 ct/kWh, slightly below the value of the previous round (5.27 ct/kWh). The lowest awarded bid was 4.69 ct/kWh, while the highest awarded bid was 6.96 ct/kWh, which is 0.53 ct/kWh lower than in the previous tender. In accordance with the EEG 2017, the bidding limit had been set at 7.5 ct/kWh, a value that has remained unchanged since June 2019.

Bid values and awards values for solar power plants during the auctions according to the German Ground-mounted PV Auction Ordinance (FFAV) and according to the Renewable Energy Sources Act (EEG 2017)

Bid values and awards values for solar power plants during the auctions according to the German Ground-mounted PV Auction Ordinance (FFAV) and according to the Renewable Energy Sources Act (EEG 2017)

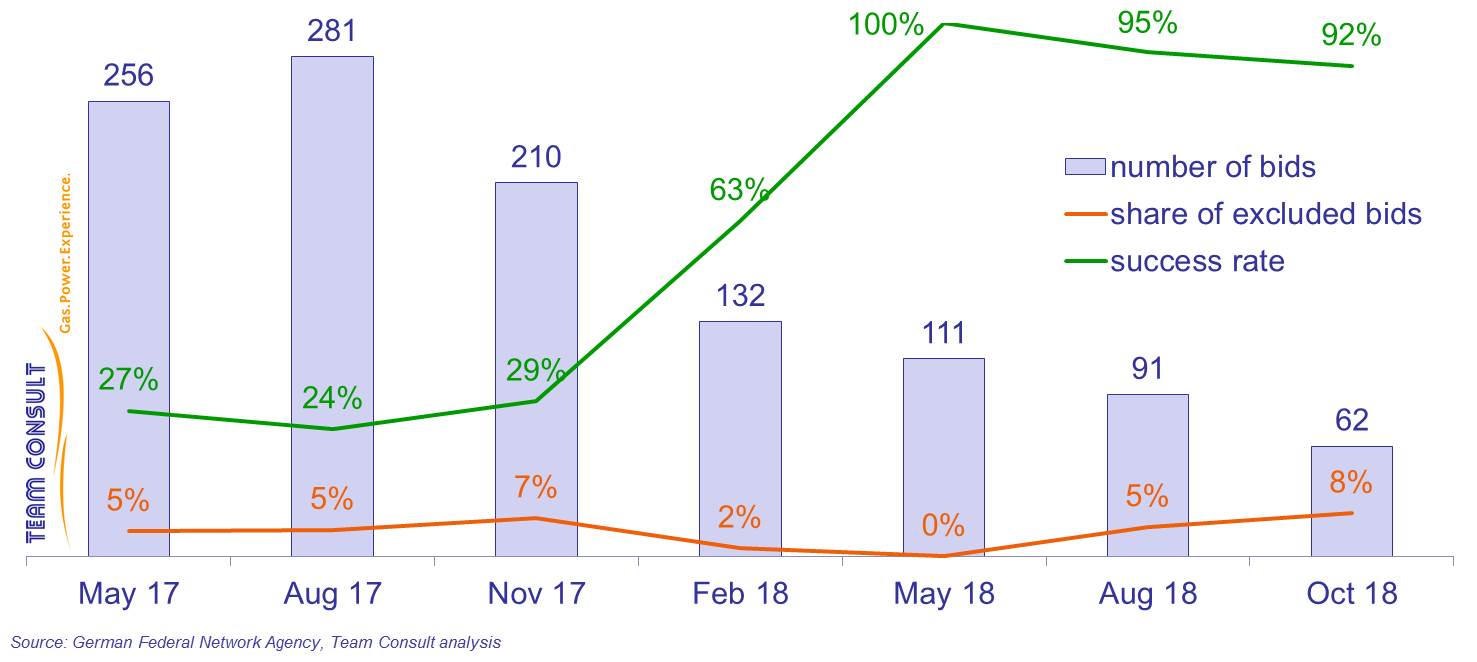

Results of the auctions for onshore wind energy

October 2020

In 2020, there have already been four tenders under the EEG (Renewable Energy Act) for onshore wind in Germany, the last one in July 2020. Due to the coronavirus pandemic, until September 1st, 2020, the award decisions were not published directly on the internet. By this measure, the regulator (Federal Network Agency, BNetzA) extended the deadlines for the realization of the project, for penalties and for the payment of the second security. In addition to wind onshore, this deadline extension also applied to solar, biomass, CHP and innovative CHP tendering procedures. The BNetzA returned to the standard procedure for tenders on September 1st, 2020.

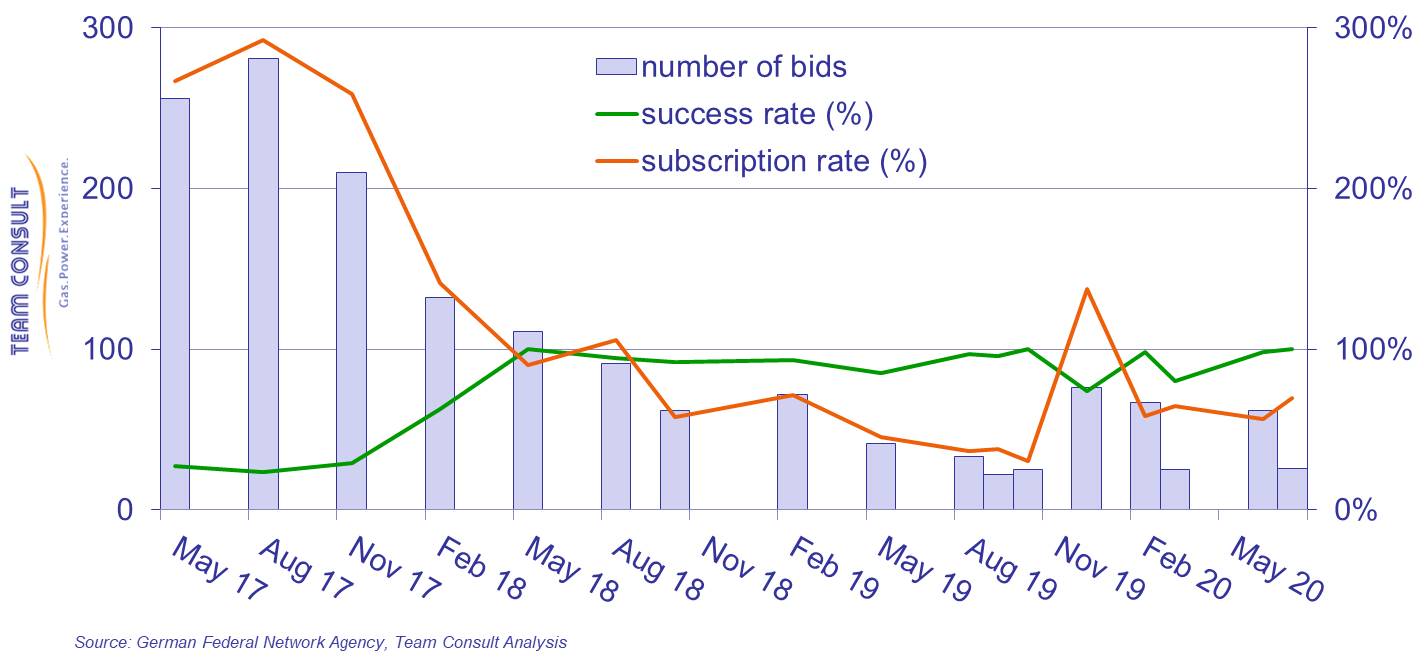

On July 30th, the German Federal Network Agency (BNetzA) published statistical data for the auction for onshore wind energy plants of July 1st, 2020. In this auction, 26 bids were submitted with a total bid volume of 191 MW. The total bid volume thus remained well below the tender volume of 275.2 MW, meaning that the auction was once again substantially under-subscribed with a subscription rate of only 69%. Compared to the previous round (62 bids), the number of bids has decreased significantly. At the same time, the tender volume has decreased significantly by 550.4 MW to 275.2 MW.

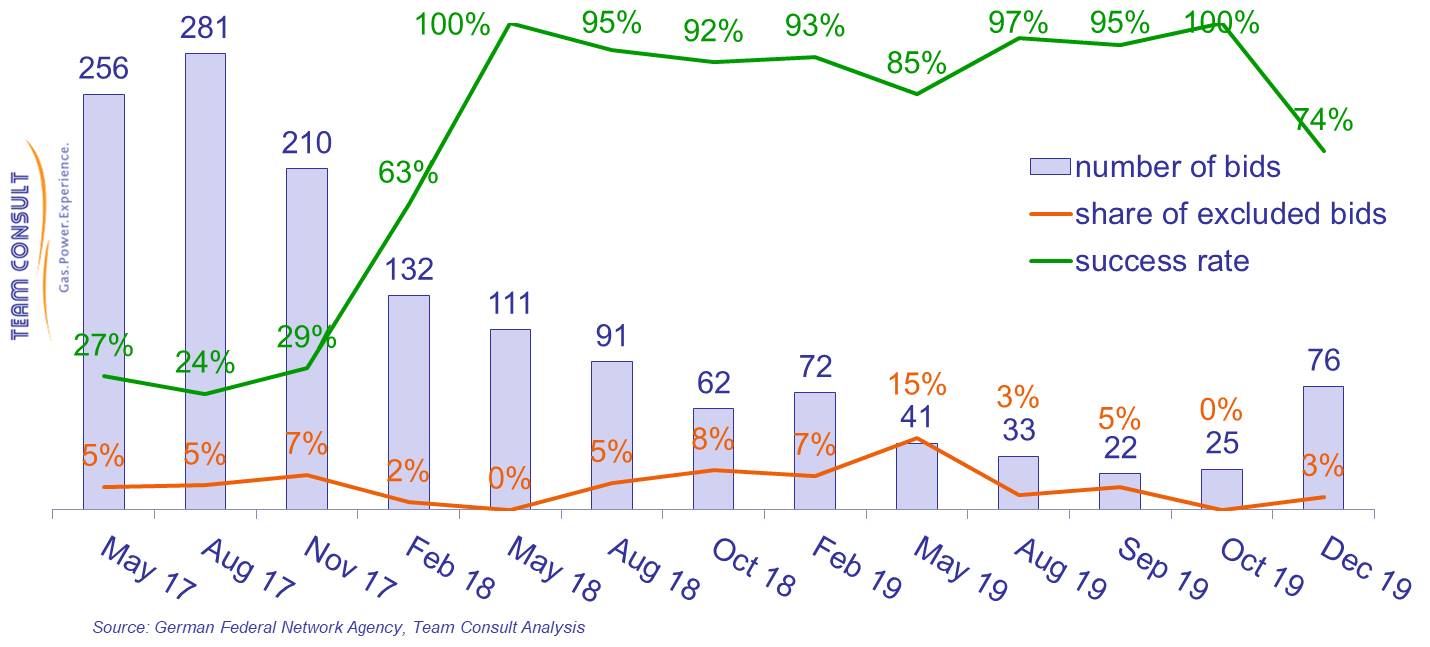

No bids were excluded in the July tender. A total of 26 bids were accepted, resulting in an acceptance rate of 100%. Number of bids, exclusion rate and success rate within the framework of the competitive bidding procedure to determine financial support for onshore wind energy plants in Germany

Number of bids, exclusion rate and success rate within the framework of the competitive bidding procedure to determine financial support for onshore wind energy plants in Germany

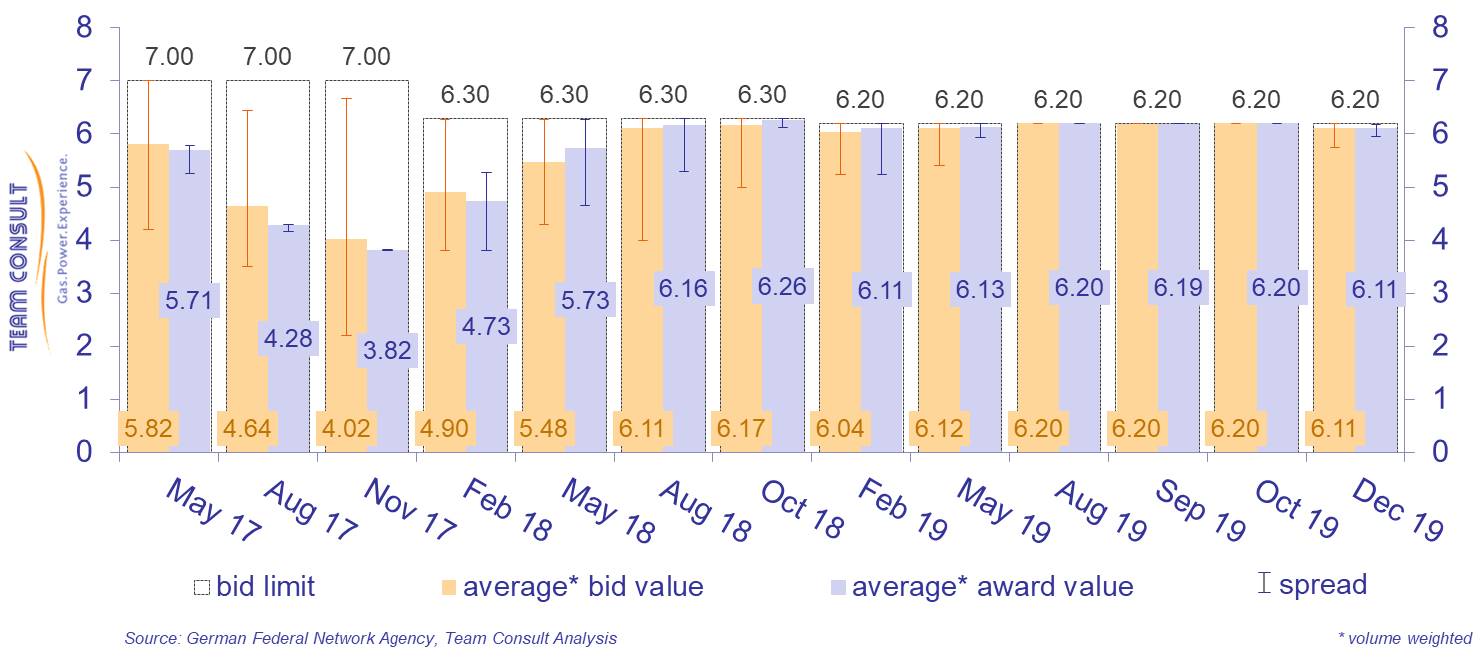

The volume-weighted average price of awarded bids in July 2020 was 6.14 ct/kWh, the same level as in June 2020. Although 100% of the bids were awarded, there is a noticeable difference between the average bid and average award values. This difference is due to the award for one or more projects of a citizen's energy association (Bürgerenergiegesellschaften) in which the price of the awarded bid is determined according to the clearing price procedure, and the amount is based on the other awarded bids and can therefore be higher than the bid values of the citizen's energy associations. Bid values and award values for biomass facilities during the auctions according to the Renewable Energy Sources Act (EEG 2017)

Bid values and award values for biomass facilities during the auctions according to the Renewable Energy Sources Act (EEG 2017)

Review of the FCR auctions with a product duration of one day

September 2020

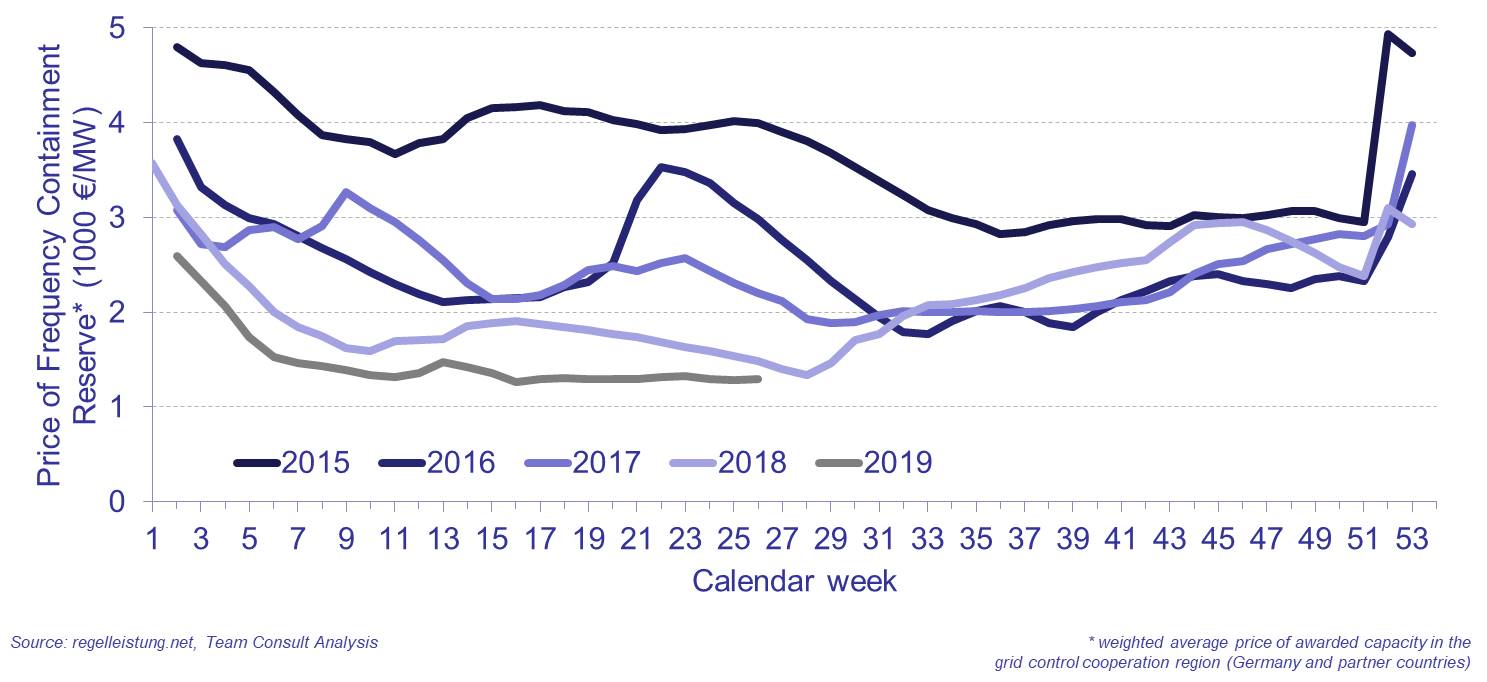

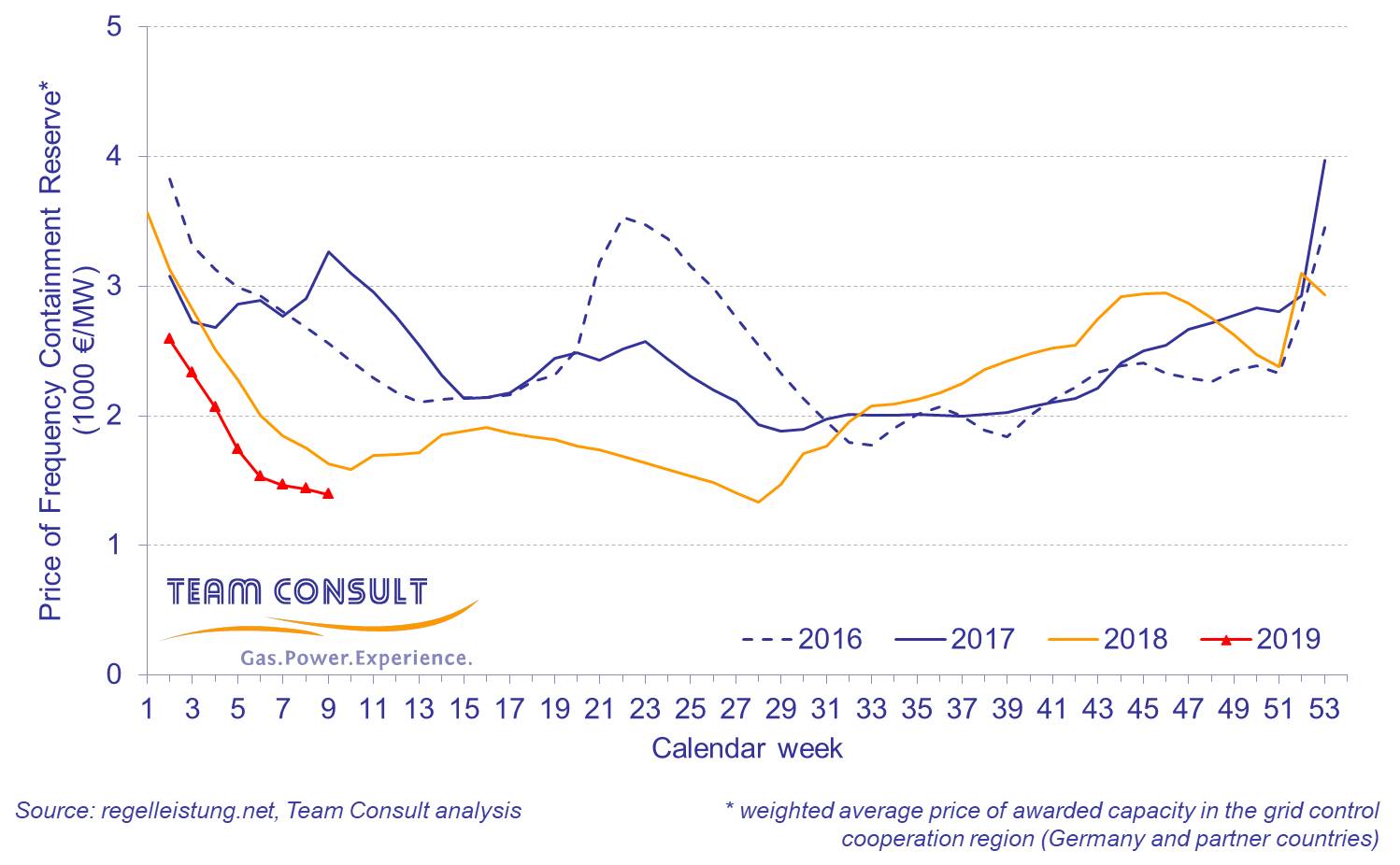

Starting on July 1st 2019, the product duration of the Frequency Containment Reserve (FCR) (or Primärregelleistung, PRL in German) was changed from a duration of one week to only one day. This provision represented an interim arrangement, since on July 1st 2020 the next change occurred which reduced the product duration further. FCR is now auctioned in six blocks with a duration of 4 hours each. Since 2015, prices in the German control energy market have exhibited a trend towards lower remunerations for the provision of power. While in 2015 FCR prices moved between 3000 to 5000 Euro per MW (and per week) of provided power, prices in 2019 moved only slightly above 1000 Euro/MW for the provision of power for one week. Regardless of the long-term trend towards lower FCR prices, a typical intra-year price development pattern could be observed in all years up to 2018 with higher prices at the beginning and at end of the year and lower prices mid-year (“tub form”, see chart above).

Since 2015, prices in the German control energy market have exhibited a trend towards lower remunerations for the provision of power. While in 2015 FCR prices moved between 3000 to 5000 Euro per MW (and per week) of provided power, prices in 2019 moved only slightly above 1000 Euro/MW for the provision of power for one week. Regardless of the long-term trend towards lower FCR prices, a typical intra-year price development pattern could be observed in all years up to 2018 with higher prices at the beginning and at end of the year and lower prices mid-year (“tub form”, see chart above).

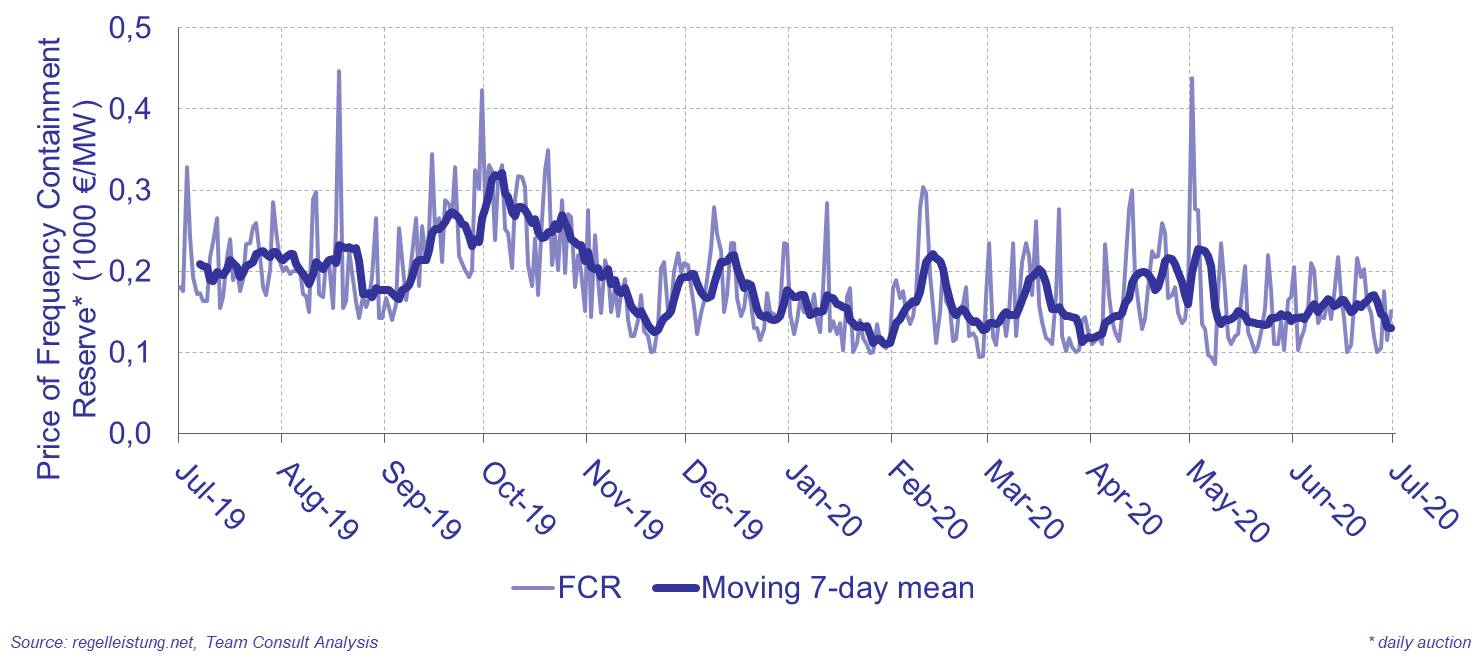

By comparison, in the period from July 2019 to July 2020, FCR prices were in the 100 to 400 Euro/MW range for the provision of power for one day (see chart below). At the same time, the intra-year price development pattern had also changed and moved away from the pre-2019 “tub form”. On the contrary, in November 2019 the prices fell from record high levels of approx. 300 Euro/MW/day to slightly above 100 Euro/MW/day and since then have been moving in the range between 100 and 200 Euro/MW/day.

At the same time, the intra-year price development pattern had also changed and moved away from the pre-2019 “tub form”. On the contrary, in November 2019 the prices fell from record high levels of approx. 300 Euro/MW/day to slightly above 100 Euro/MW/day and since then have been moving in the range between 100 and 200 Euro/MW/day.

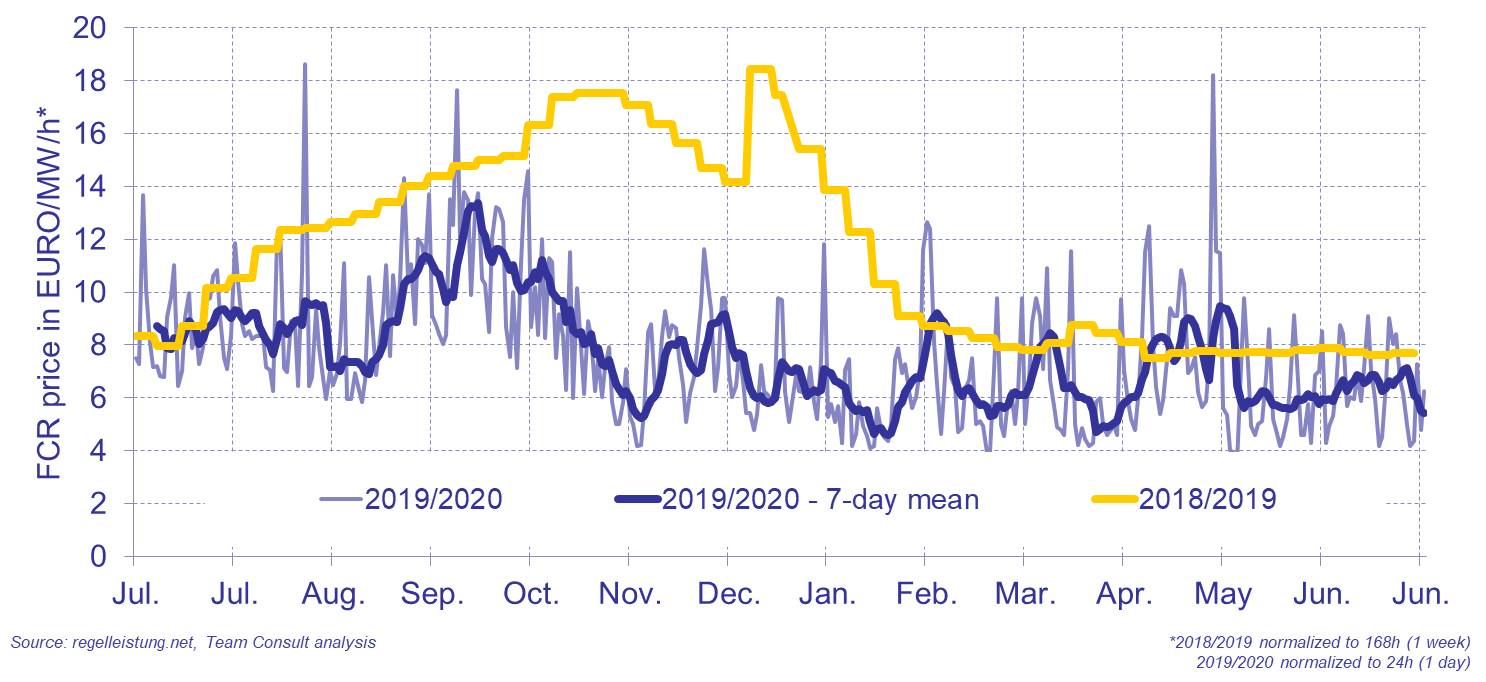

A comparison of prices under the different auction systems is best achieved by a normalization of the FCR price in respect to the product duration. Normalized prices indicate that the weekly product reached prices of more than 12 Euro/MW/h at the end of 2018 and beginning of 2019, as can be seen in the chart below. In contrast, the FCR prices of the daily FCR product in 2019/2020 vary between 12 and 4 Euro/MW/h; they also exhibit a much higher volatility than the prices of the weekly FCR product in 2018/2019. However, eliminating the volatility and looking at the moving 7-day mean of the daily FCR product prices (dark blue line in chart above) shows a price level that is often approx. 2 Euro/MW/h below the weekly FCR product prices of the previous year (and only rarely exceeds the prices of previous year’s weekly product). The most recent difference (2 Euro/MW/h) represents a reduction of approx. 20% in comparison to the prices achieved in the previous year.

However, eliminating the volatility and looking at the moving 7-day mean of the daily FCR product prices (dark blue line in chart above) shows a price level that is often approx. 2 Euro/MW/h below the weekly FCR product prices of the previous year (and only rarely exceeds the prices of previous year’s weekly product). The most recent difference (2 Euro/MW/h) represents a reduction of approx. 20% in comparison to the prices achieved in the previous year.

To conclude, by changing from a weekly to a daily FCR product, a long-standing intra-year price pattern (“tub form”) has been broken. With regard to price levels, it is not clear whether the reduction in 2019/2020 FCR prices vs. 2018/2019 was caused by the change of product duration or is just a continuation of a long-standing trend towards lower FCR prices that already existed before that change was made. In any case, it will be interesting to observe the effects of the most recent change of product duration from one day to the 4-hour product on price levels and patterns in the months to come.

The trend of prices for primary control energy (FCR) and its influence on large scale batteries

April 2020

The provision of primary control energy is still the central source of income and main field of application for large scale batteries in Germany. This remains the case even as the multi-use approach has become the standard for large scale battery operation and reduced the dependency on only one field of application. The multi-use approach combines several single applications, for example next to the provision of control energy, the large scale battery can be employed for power price arbitrage on the spot market and for peak-shaving to reduce grid charges.

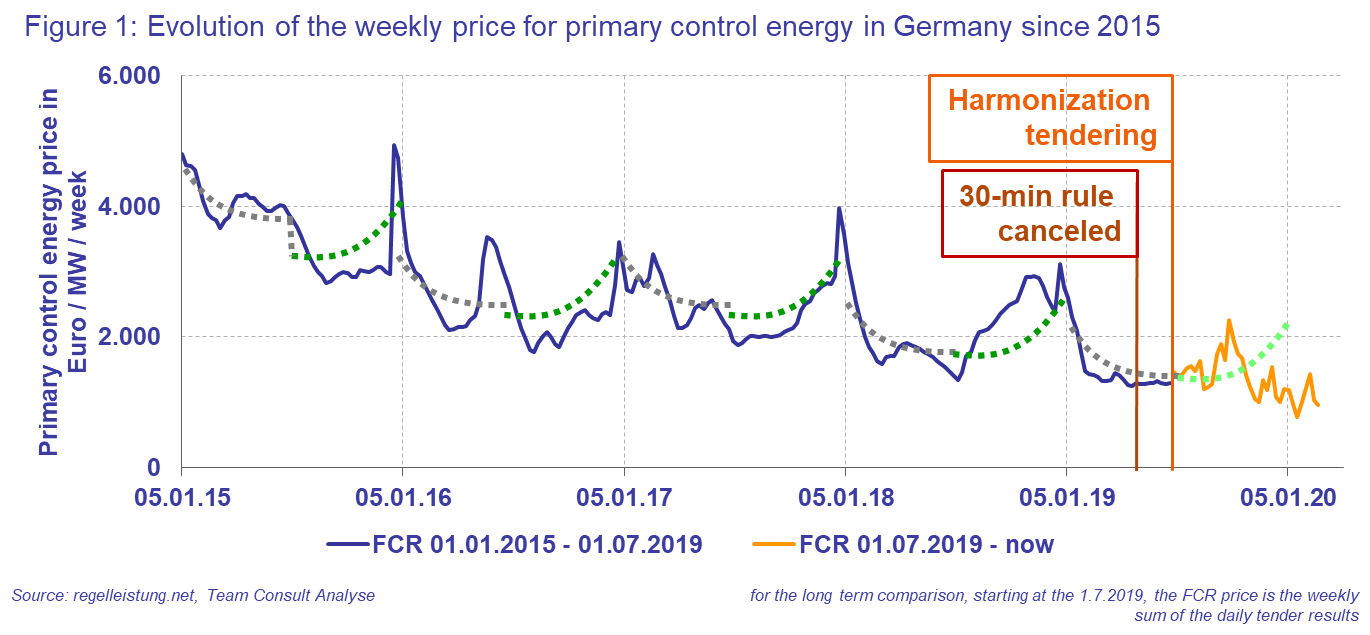

Operators of large scale batteries have been struggling with low prices for control energy for several years. The trend continues in 2020 – primary control energy prices have fallen below 1000 €/MW/week at the beginning of the year. For 2019, the price curve shows a development that deviates from the pattern observed in the past years (i.e. the tub form).

Next to a change in the tender system, which was introduced on July 1st, 2019, the 30-minute rule was overturned by the Federal Network Agency (Bundesnetzagentur) and large scale batteries were treated equally to other systems providing primary control energy. The 30-min rule demanded that large scale batteries provide the primary control energy for up to 30 minutes instead of only 15 mins, as is the case for other systems. Due to this reduction of the duration, the large scale batteries can increase the marketable power of the already existing system, since the working range of the state of charge of the battery increased. The changes in the tender system and the abolishment of the 30-minute rule are influencing the primary control energy prices, while the downward trend of the FCR prices continues.

Large scale battery projects are operating in difficult economic conditions. The increasing number of providers of primary control energy (an increase from 16 providers in 2015 to 31 beginning of 2020) raises the competition in the market. An additional point is the tender deadline of primary and secondary control energy, which will coincide starting from the July 1st, 2020 on. Therefore, providers of control energy, which can provide primary as well as secondary control energy with their systems (such as pumped-hydro storage, gas or lignite coal power plants) are forced to either bid for only one of these control energy products or split their power into two bids for each of these products, since a change after the first unsuccessful bid to the second product is not possible anymore. This might lower achievable control energy prices. However, the before mentioned process may reduce the liquidity in the primary and secondary control energy market which could lead to an increase of control energy prices. For large scale batteries, which so far only provide primary control energy, this means a continuously uncertain market perspective.

Large scale battery projects are operating in difficult economic conditions. The increasing number of providers of primary control energy (an increase from 16 providers in 2015 to 31 beginning of 2020) raises the competition in the market. An additional point is the tender deadline of primary and secondary control energy, which will coincide starting from the July 1st, 2020 on. Therefore, providers of control energy, which can provide primary as well as secondary control energy with their systems (such as pumped-hydro storage, gas or lignite coal power plants) are forced to either bid for only one of these control energy products or split their power into two bids for each of these products, since a change after the first unsuccessful bid to the second product is not possible anymore. This might lower achievable control energy prices. However, the before mentioned process may reduce the liquidity in the primary and secondary control energy market which could lead to an increase of control energy prices. For large scale batteries, which so far only provide primary control energy, this means a continuously uncertain market perspective.

The harmonization of the control energy market is aimed to accomplish a reduction of the operation costs of the European energy system. However, the question arises, if the operators of systems for the provision of control energy can sustainably operate with the current market conditions and prices.

Harmonizing the German control energy market to EU guidelines

March 2020

Control energy is employed by transition system operators (TSO) to balance fluctuations of the grid frequency and available grid power and represents a valuable tool to guarantee the stability of the power grid. The EU directives regarding the development of the European electrical system, which took effect in 2017 (2017/2195: „Electricity Balancing Guideline“, EB GL and 2017/1485: „System Operation Guideline“, SO GL), lead to changes in the German control energy market. The harmonization of the present electrical system in Germany with the guidelines of the EU commission affects the tendering system and certain properties of the different types of control energy.

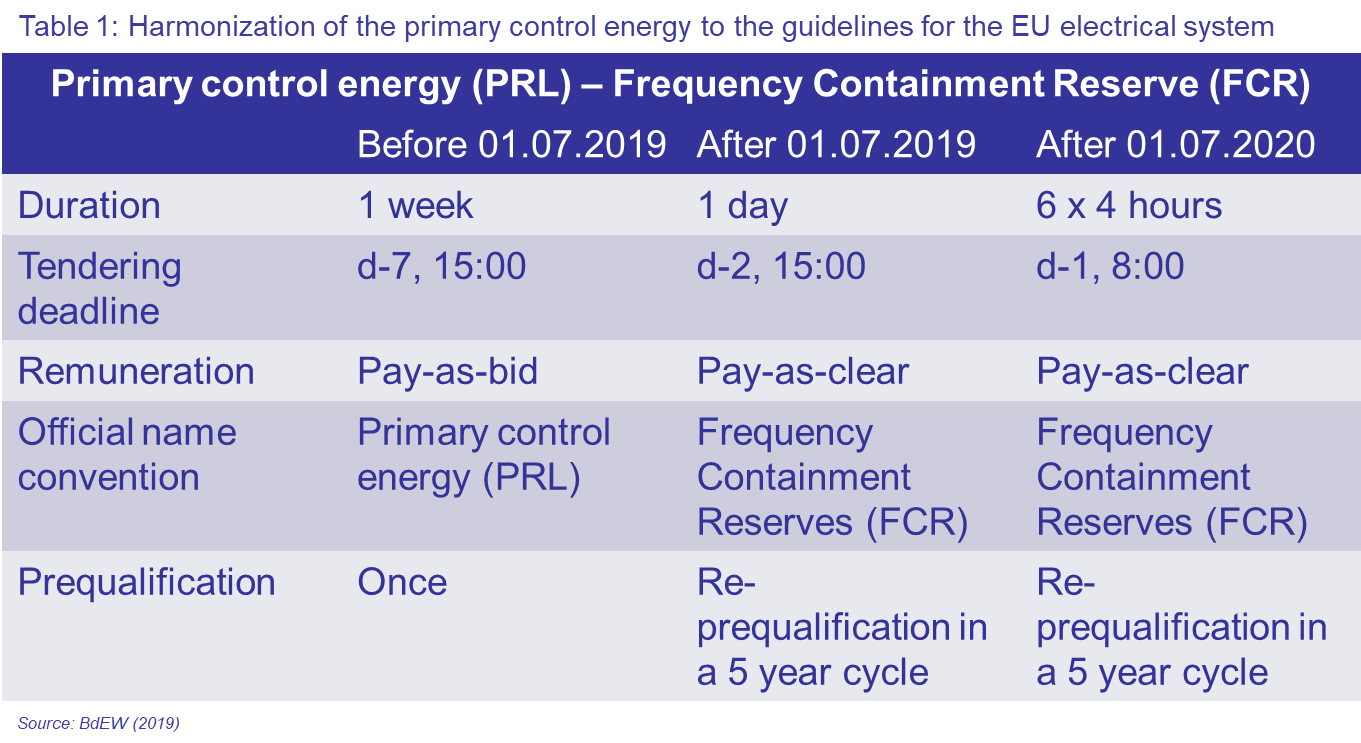

The changes of the primary control energy are summarized in the following table.

Since 01.07.2019, the tendering of the FCR is performed daily with the tendering deadline being set two days in advance. The duration of the FCR drastically decreased from a weekly to a daily product. This tendering system is valid until the 01.07.2020. Starting from this date on, the duration of the FCR is further reduced to four hours. The day is split into six blocks, each with a duration of four hours. The tendering is performed for the following day and the deadline is set to 8:00. Next to the tendering system and product duration, the remuneration method changed significantly, since the bidder is not remunerated for his actual bid (pay-as-bid) for the provision of control energy, but it is based on the “pay-as-clear” method, which means that all bidders are remunerated with the price, which received the last successful bid with the highest price. The Dutch system uses the pay-as-clear method already for a longer time for the remuneration. An additional important point is concerning the prequalification of control energy providing facilities. The prequalification needs to be renewed every five years and affects likewise the already prequalified systems.

Since 01.07.2019, the tendering of the FCR is performed daily with the tendering deadline being set two days in advance. The duration of the FCR drastically decreased from a weekly to a daily product. This tendering system is valid until the 01.07.2020. Starting from this date on, the duration of the FCR is further reduced to four hours. The day is split into six blocks, each with a duration of four hours. The tendering is performed for the following day and the deadline is set to 8:00. Next to the tendering system and product duration, the remuneration method changed significantly, since the bidder is not remunerated for his actual bid (pay-as-bid) for the provision of control energy, but it is based on the “pay-as-clear” method, which means that all bidders are remunerated with the price, which received the last successful bid with the highest price. The Dutch system uses the pay-as-clear method already for a longer time for the remuneration. An additional important point is concerning the prequalification of control energy providing facilities. The prequalification needs to be renewed every five years and affects likewise the already prequalified systems.

Providers of FCR have to adapt their bidding strategy to the changes of the new tendering system. A large part of the providers of FCR can fall back on experiences from the tendering system for secondary and tertiary control energy, since these products follow similar rules. The changes in the tendering system are supposed to increase the competition and decrease the costs for the procurement of control energy. The future will show, if the current development is sustainable and if the providers of FCR are capable of successfully endure these adaptations.

Results of the auctions for onshore wind energy

January 2020

On December 20th, the German Federal Network Agency (BNetzA) published statistical data for the last auction for onshore wind energy plants in 2019. In total 76 bids were submitted in the auction according to the Renewable Energy Sources Act (2017) with a total amount of 686 MW of power, which exceeds the announced tender volume of 500 MW considerably. An oversubscription of the announced tender volume occurred for the last time in August 2018. The number of bids increased considerable compared to the bid before (with only 25 bids), however, compared to the number of bids from the years 2018 and 2017, it remains on a lower level.

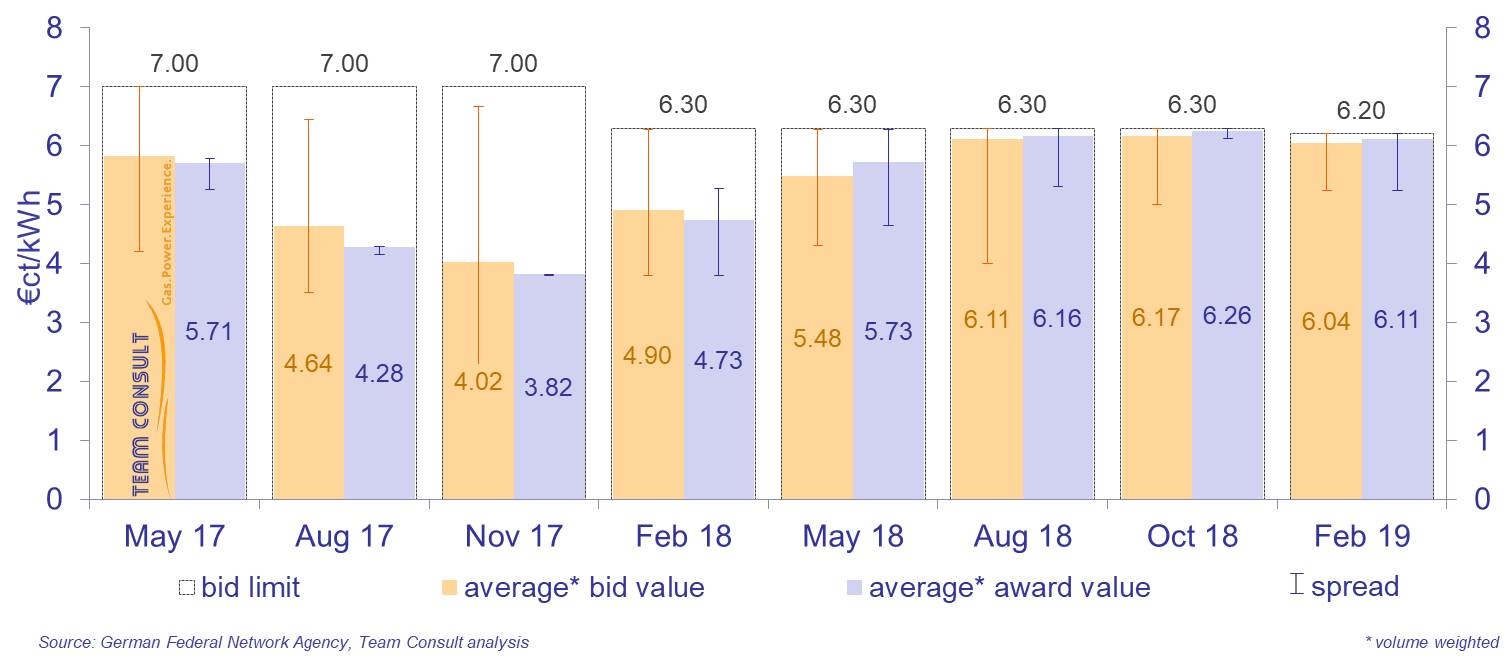

An increase of the number of bids in the last quarter of 2019 could be explained by the restriction of the maximum tender limit for 2020, which remains constant at 6.20 ct/kWh. The unchanged maximum tender limit swept off the hopes of participants for a higher maximum tender limit beginning with February 2020 (which would have been based on August, September and October at 6.70 ct/kWh).

Only two bids were excluded in the December auction, which results in an exclusion rate of 3%. Due to the oversubscription of the announced tender volume, 56 bids received an award, corresponding to a success rate of 74%, as low as in February 2018 for the last time.

The average award value amounted to 6.11 ct/kWh, which is the same level as of beginning of 2019.

Prices for power control reserve

March 2019

Since the beginning of 2019, prices for Frequency Containment Reserve (FCR) have been continuously quoted below the level of the previous year. Average prices have been below 2000 €/MW since the end of January and dropped to a value of 1389 €/MW in the last week of February, thus only marginally above the historical minimum value of 1337 €/MW.

The prolonged price depression has undermined the primary business model of large-scale battery systems, thus causing a stagnation of new projects in the German market.

Results of the auctions for onshore wind energy

February 2019

On February 15th, the German Federal Network Agency (Bundesnetzagentur) published statistical data for the first auction for onshore wind energy plants in 2019 (published in German). 72 bids were submitted to this auction according to the Renewable Energy Sources Act 2017(EEG), which took place in February 2019. The number of bids remains thus low, despite a slight increase with respect to the previous round (62 bids). Five submitted bids had to be excluded from the auction, resulting in an exclusion rate of 7%. All of the remaining 67 bids received an award, corresponding to a success rate of 93%.

The average award value amounted to 6.11 €ct/kWh and was thus again only slightly below the bid limit, which was specified at 6.20 €ct/kWh by the Federal Network Agency.

The average award value amounted to 6.11 €ct/kWh and was thus again only slightly below the bid limit, which was specified at 6.20 €ct/kWh by the Federal Network Agency.

Results of the auctions for photovoltaic installations

February 2019

On February 15th, the German Federal Network Agency (Bundesnetzagentur) published the results of the first auction for photovoltaic (PV) installations in 2019 (published in German). 80 bids were submitted to the auction, which took place in February 2019. This means a slight increase with respect to the previous round (76 bids).

Two of the submitted bids had to be excluded from the auction. The resulting exclusion rate of 3% is thus again very low. In the end, 24 bids received an award, corresponding to a success rate of 30% – significantly less than in previous rounds. The majority of awards (21) were granted to bids for plants on farmland in Bavaria.

The average award value amounted to 4.80 €ct/kWh, slightly above the value of the previous round (4.69 €ct/kWh). The lowest successful bid value was 4.11 €ct/kWh. The bid limit was specified at 8.91 €ct/kWh according to the EEG 2017.

The average award value amounted to 4.80 €ct/kWh, slightly above the value of the previous round (4.69 €ct/kWh). The lowest successful bid value was 4.11 €ct/kWh. The bid limit was specified at 8.91 €ct/kWh according to the EEG 2017.

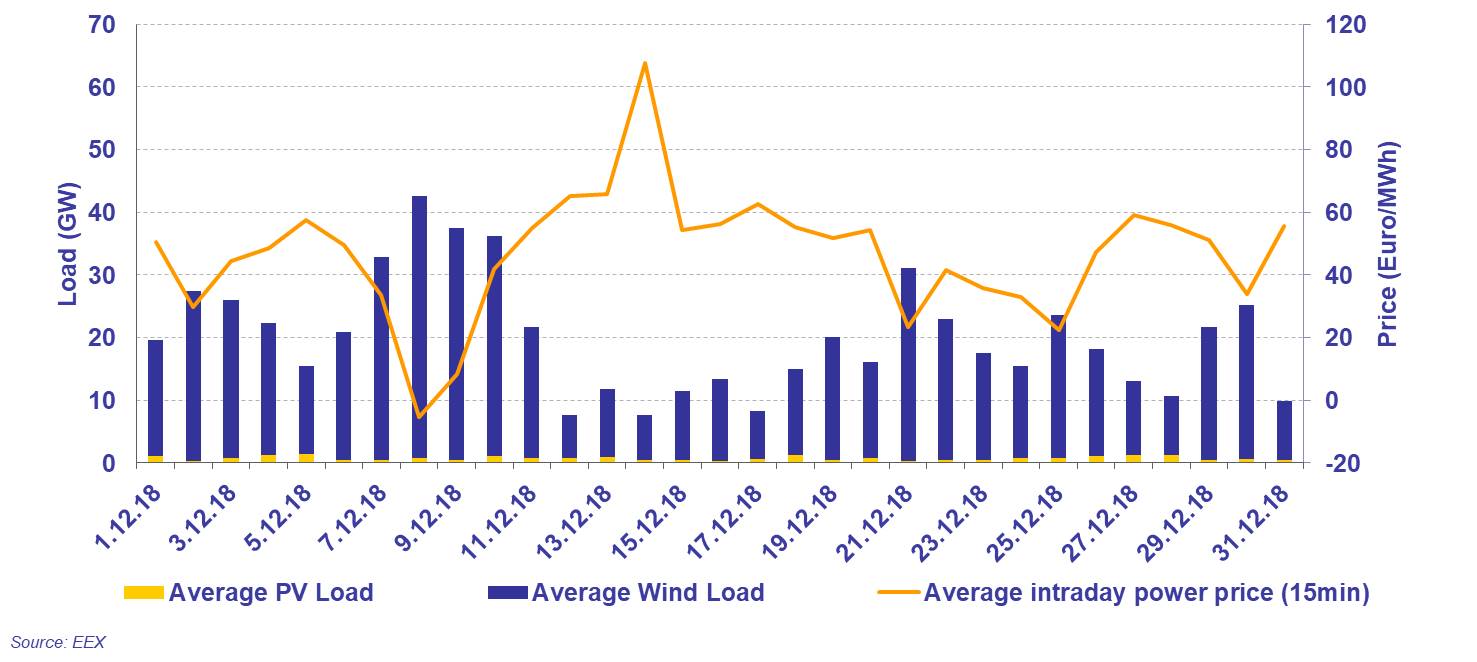

Solar & wind load vs. intraday power price

January 2019

The December is naturally marked by low solar power generation. During the middle of the month wind power production was also relatively low. Between 11th and 20th of December the daily average intraday power prices (15-minute contracts) was continuously above 50 €/MWh with a maximum of more than 100 €/MWh on December 14th.

The December is naturally marked by low solar power generation. During the middle of the month wind power production was also relatively low. Between 11th and 20th of December the daily average intraday power prices (15-minute contracts) was continuously above 50 €/MWh with a maximum of more than 100 €/MWh on December 14th.

On December 9th, however wind power generation was especially high. On that day the average price fell below zero Euro/MWh.

Results of the auctions for onshore wind energy

November 2018

On October 19th, the German Federal Network Agency (Bundesnetzagentur) published statistical data for the fourth auction for onshore wind energy plants in 2018. 62 bids were submitted to this auction according to the Renewable Energy Sources Act (EEG) 2017, which took place in October 2018. This is a significant decrease with respect to the previous round (91 bids), even though the tendered volume of 670 MW remained unchanged. 8% of the submitted bids had to be excluded from the auction. Although a slight increase with respect to the previous round (5%), this is still a comparably low value. All of the remaining 57 bids received an award, corresponding to a success rate of 92%.

The average award value amounted to 6.26 €ct/kWh. This is the highest value since the introduction of the auction scheme in May 2017. The bid limit was specified at 6.30 €ct/kWh according to the EEG 2017.

The average award value amounted to 6.26 €ct/kWh. This is the highest value since the introduction of the auction scheme in May 2017. The bid limit was specified at 6.30 €ct/kWh according to the EEG 2017.

Results of the auctions for photovoltaic installations

November 2018

On October 19th, the German Federal Network Agency (Bundesnetzagentur) published the results of the third auction for photovoltaic (PV) installations in 2018 (published in German). 76 bids were submitted to the auction, which took place in October 2018. For the first time in more than a year, this means an increase with respect to the previous round (59 bids).

Three of the submitted bids had to be excluded from the auction. The resulting exclusion rate of 4% is thus again very low. In the end, 37 bids received an award, corresponding to a success rate of 49% – the highest value so far. However, the required secondary bid bond was only paid in time for 30 bids. In contrast to their above-average success in previous rounds, projects in less-favored areas received only 5 awards in the current auction.

The average award value amounted to 4.69 €ct/kWh and has thus for the first time increased with respect to the previous round (4.59 €ct/kWh). The lowest successful bid value was 3.86 €ct/kWh. The bid limit was specified at 8.75 €ct/kWh according to the EEG 2017.

The average award value amounted to 4.69 €ct/kWh and has thus for the first time increased with respect to the previous round (4.59 €ct/kWh). The lowest successful bid value was 3.86 €ct/kWh. The bid limit was specified at 8.75 €ct/kWh according to the EEG 2017.

Bidding Strategies in Renewable Energy Auctions

October 2018

Download presentation as PDF

Presented at the conference “Auctions for Wind Energy Projects in Germany and France – Experiences, Challenges and Perspectives” of the German-French Office for Energy Transition

Analysis on changes for automatic frequency restoration reserve

July 2018

On 12 July 2018, new tendering procedures for automatic frequency restoration reserve (aFRR) came into effect. Team Consult has analyzed the first auction rounds under the new market design. Among others, we observed a decrease in the average capacity per bid. Moreover, capacity prices increased during the short period in which capacity was allocated based on the new mixed price procedure.

Market participants should be prepared to quickly react to price fluctuations and, if necessary, adjust their bidding strategy in case of a prolonged shift of the significance of capacity and energy price.

These and further conclusions of our analysis can be found here (PDF download, in German). If you are interested in an English version of our analysis, please do not hesitate to contact us.

Team Consult’s merit order model used to assess developments on the German electricity market

February 2018

International commodity price reporting agency ICIS consulted Team Consult about our view on current developments on the German power market. Price modeling based on our in-house merit order model confirmed the current market interpretation that forward prices do not contain a risk premium for a potential accelerated coal-phase out. “It seems that power contracts account for definite developments such as the nuclear phase-out, but not necessarily for uncertain changes such as an accelerated coal phase-out,” Team Consult’s senior consultant Dr. David Heinze was quoted in the ICIS market assessment.