Gas Storage

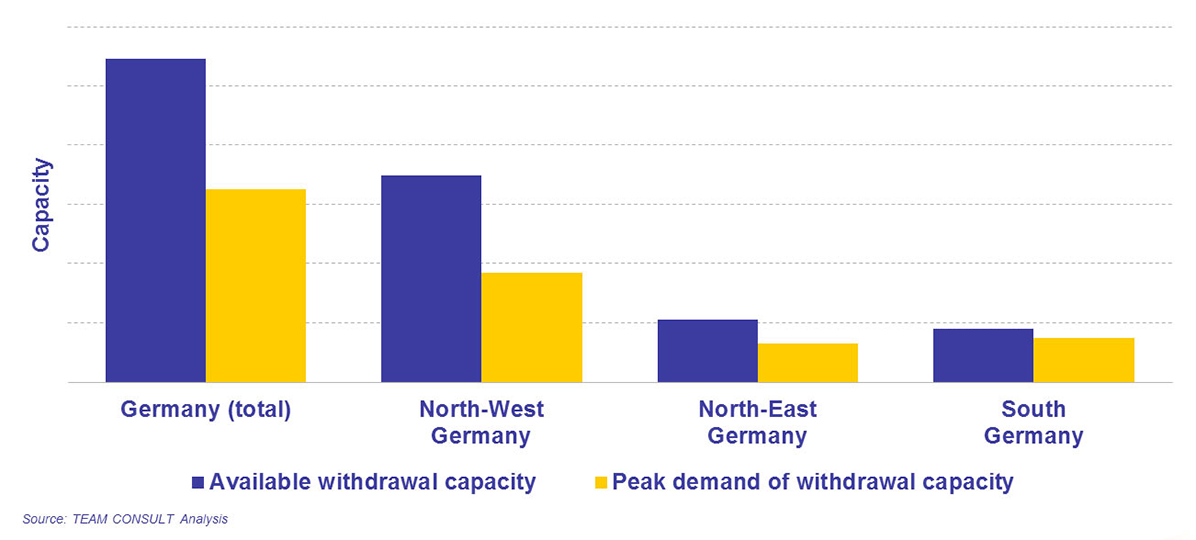

In the last years, operators of German and European gas storages have faced many challenges. The market was and still is characterised by excess capacities. This applies not only to the available working gas volume (WGV) but also to the injection and withdrawal capacity. In the figure below, the situation is illustrated for the available withdrawal capacity in Germany.

[Available withdrawal capacity and peak demand of withdrawal capacity (Illustration)]

Intense competition, changing market conditions and the combination of low variable and high capital costs – as it is typical in the asset business – has led to market prices that are, in many cases, nowhere near enough to cover the full costs of service. At the same time, the general perception is that gas storages carry substantial value, not only for fulfilling their “traditional” functions of providing seasonal swing and covering demand peaks. Gas storages also represent an insurance against unforeseen events by e.g. providing additional volumes and capacity in case of extreme weather events and production or transport failure. At the moment, however, this value cannot be monetised in the marketing of storage capacities.

Uncertain prospects

Different developments in the European gas market have opposing effects on the storage market and lead to great uncertainty regarding the future of storage assets. In the short- to mid-term, the European gas production is going to further decline and, thereby, the seasonal production swing. This is considered to increase the need for storage. On the other hand, the trend towards lower gas consumption reduces the need for storage. In the long-term, gas storages are sometimes expected to have a key role in the context of energy system integration – by offering a long-term and large-scale storage option for excess power production from renewable energies. To what extent gas storages will be used in the energy transition, largely depends on the conditions set by future energy policy and regulation.

Pressing questions

Under these circumstances, a number of key questions arise for storage system operators, storage users, storage owners, investors and, not least, for political actors:

- What are the factors influencing the development of the storage markets in Germany and Europe?

- How will storage utilisation, prices, revenues and costs develop?

- Which storage facilities would most likely overcome a consolidation phase?

- Are there undervalued storage assets which are worth acquiring?

- Are write-downs necessary for certain storage facilities and, if so, to what extent?

- Which are the storage products that will be profitable in the future?

- How should the political framework be set in order to ensure that neither a situation of excess nor shortage of gas storage capacity occurs in the future?

- How can the storage industry bring their concerns into the political discussion?

Consulting services

In this context, we offer the following consulting services:

- Benchmarking of gas storages

- Evaluation of investment and divestment projects

- Due diligence for investors

- Support in price revisions and arbitration proceedings concerning storage or flexibility service contracts

- Market analyses and development scenarios for the gas storage market

- Strategy development for storage operators

- Strategy development for storage operators

Publications

Current filling levels of natural gas storages in Germany

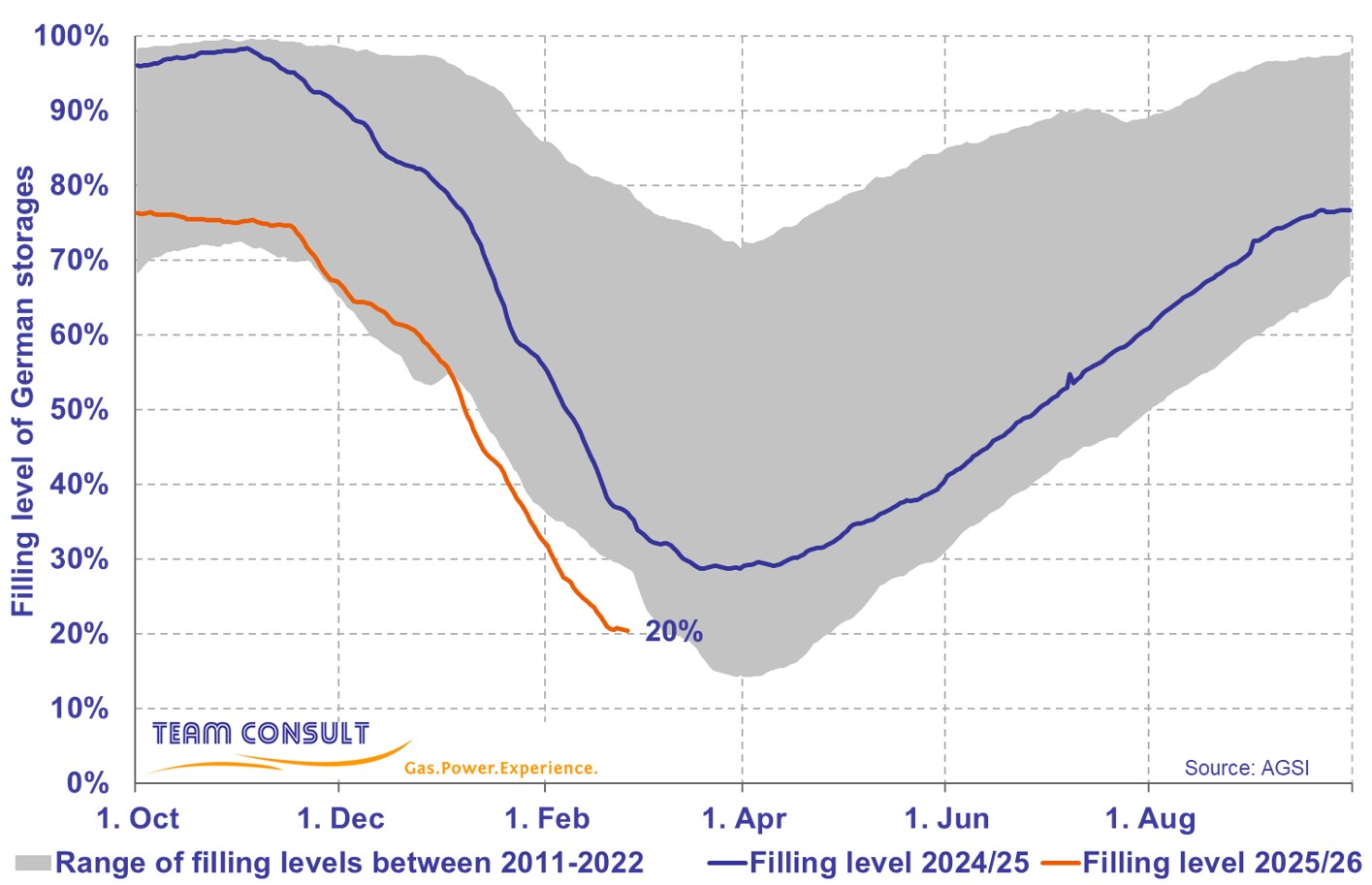

February 2025

Current filling levels of natural gas storages in Germany

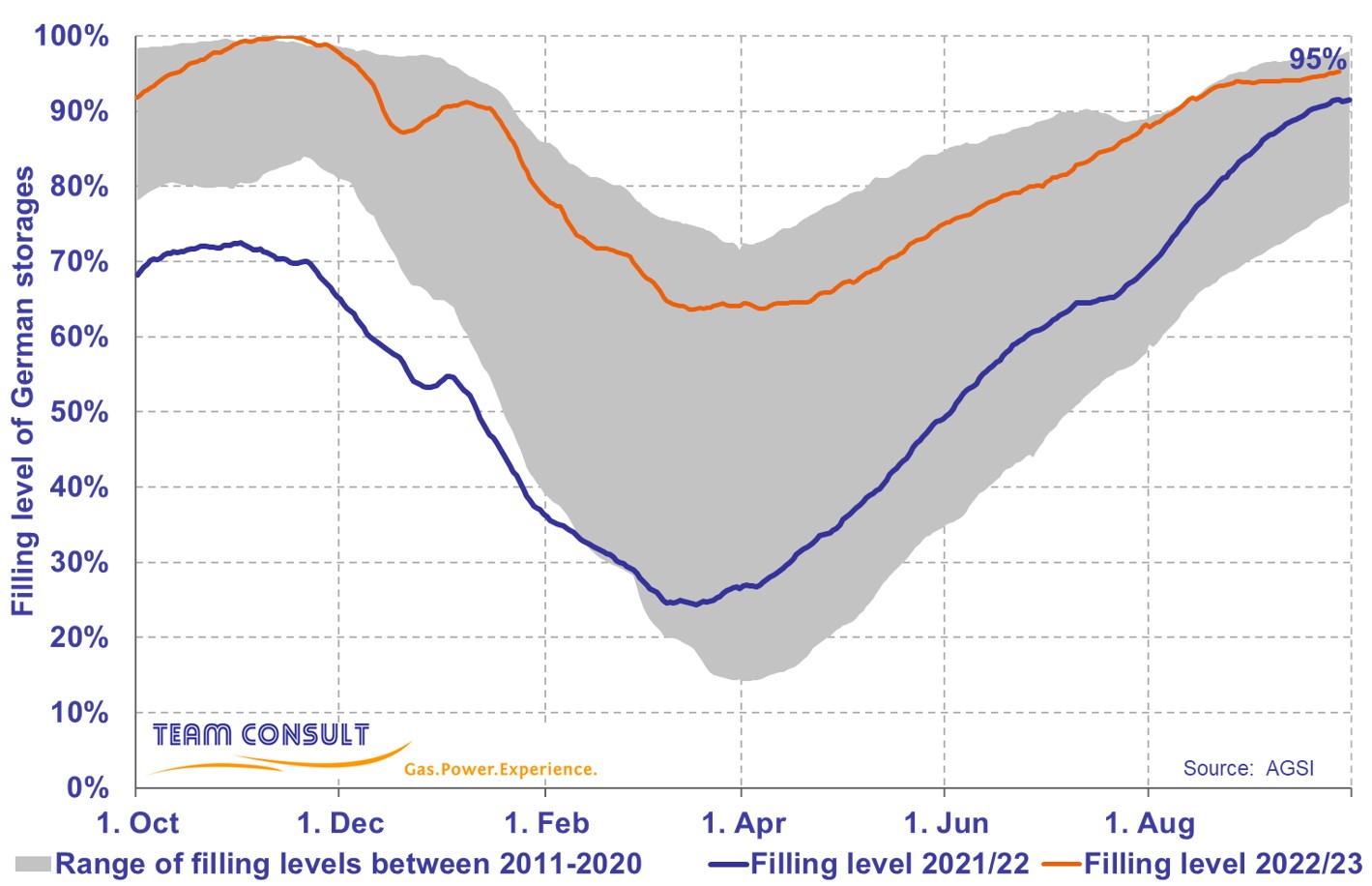

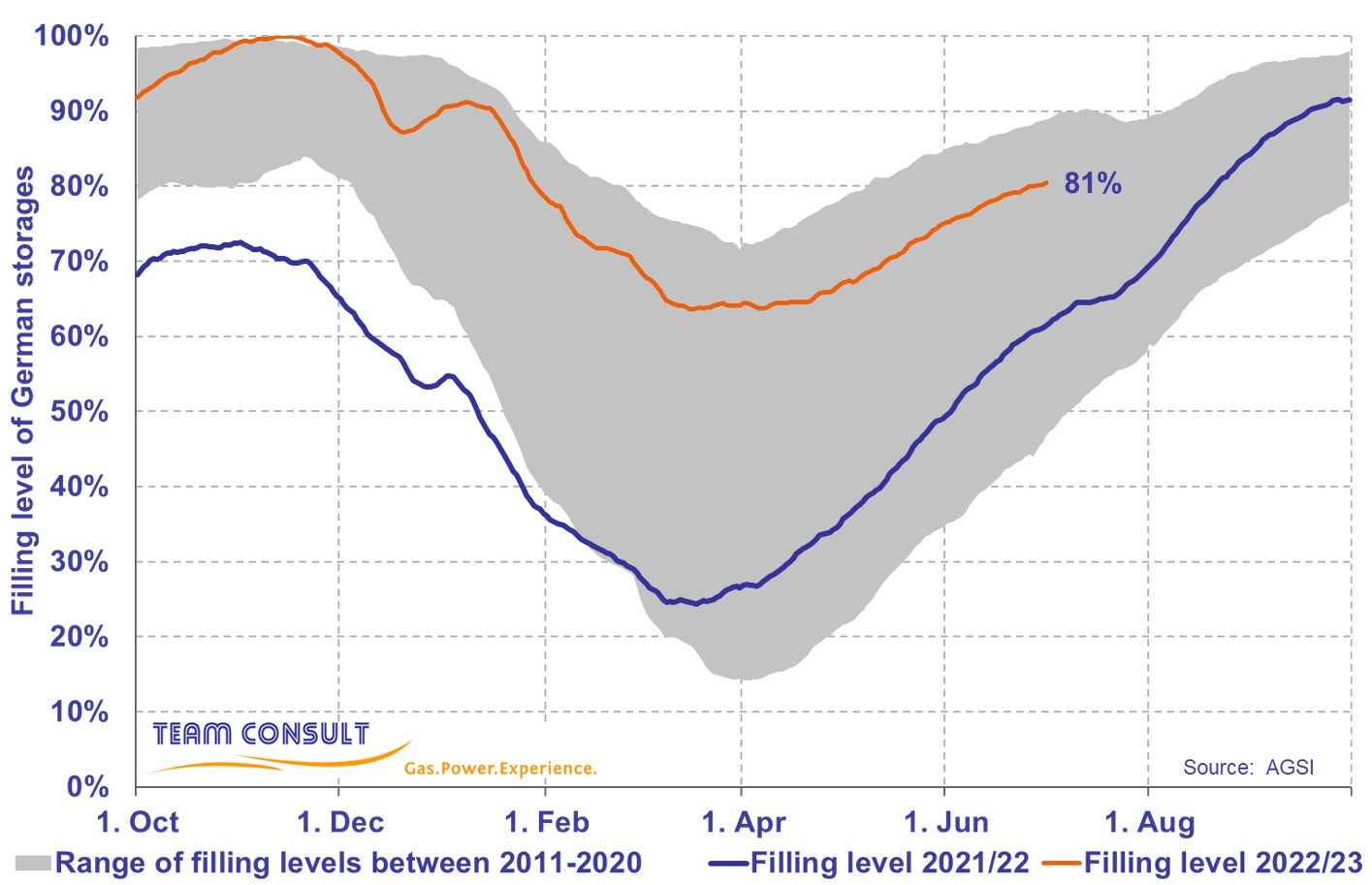

September 2023

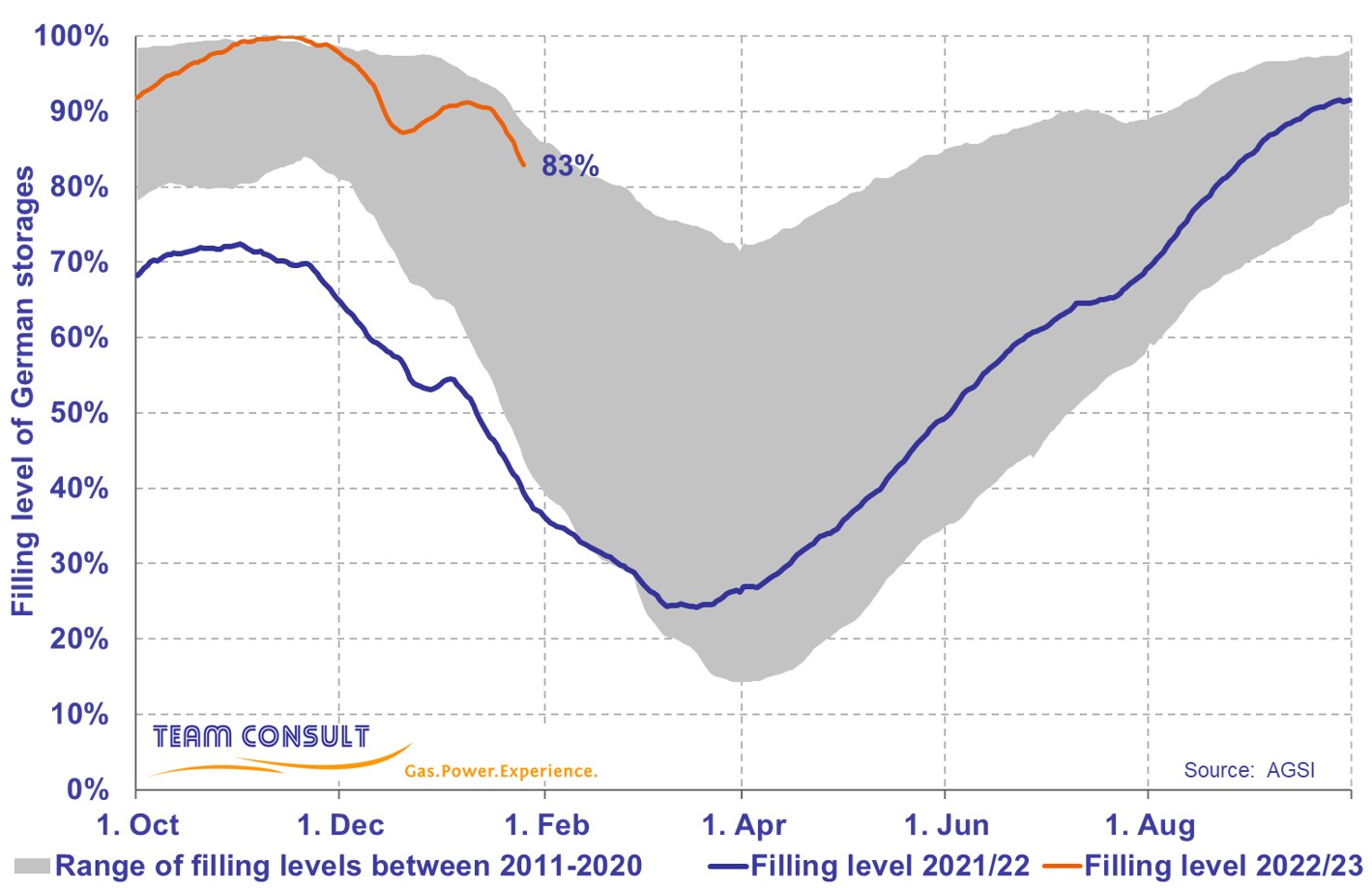

Current filling levels of natural gas storages in Germany

June 2023

Current filling levels of natural gas storages in Germany

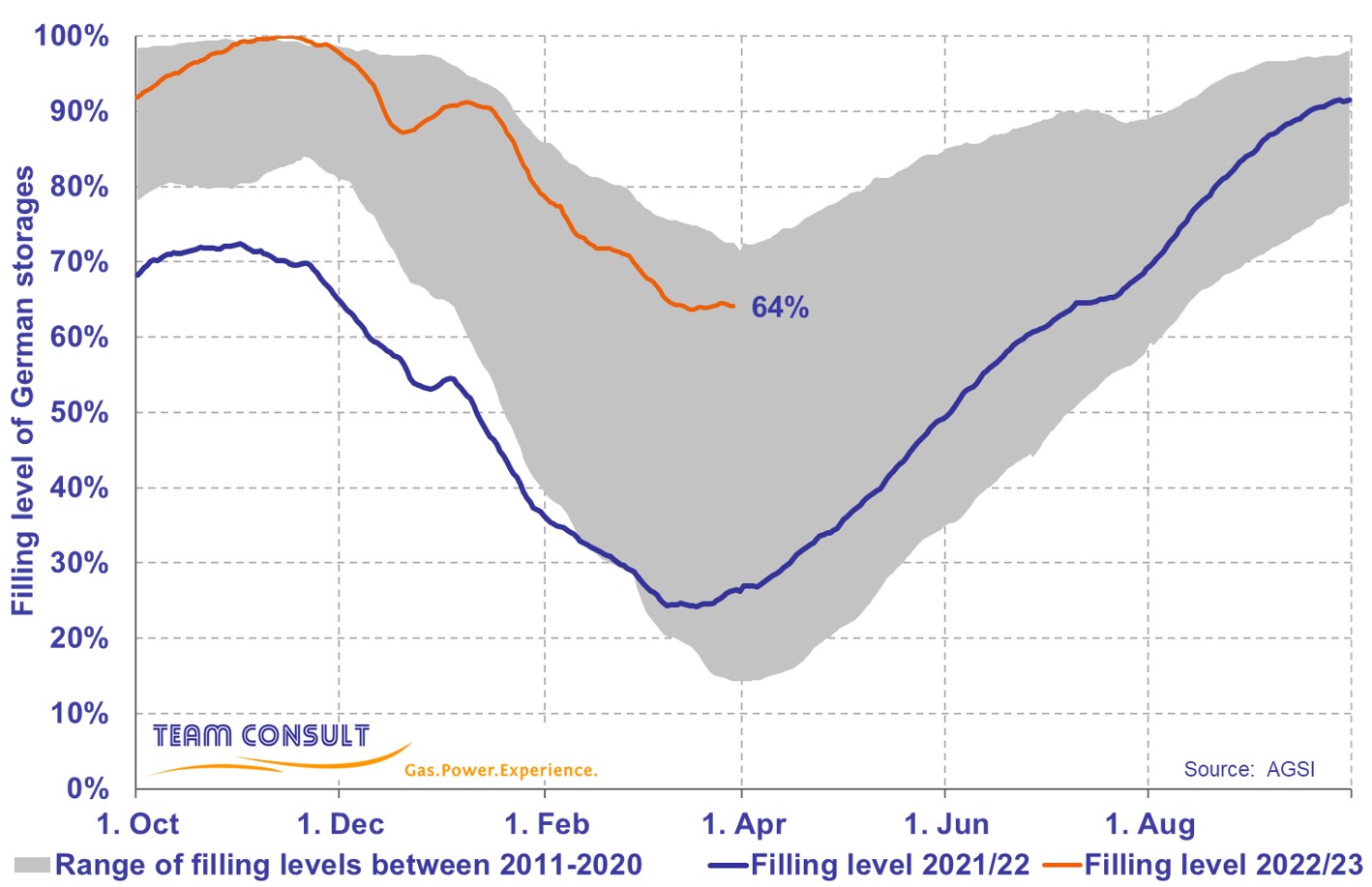

March 2023

Current filling levels of natural gas storages in Germany

January 2023

Current filling levels of natural gas storages in Germany

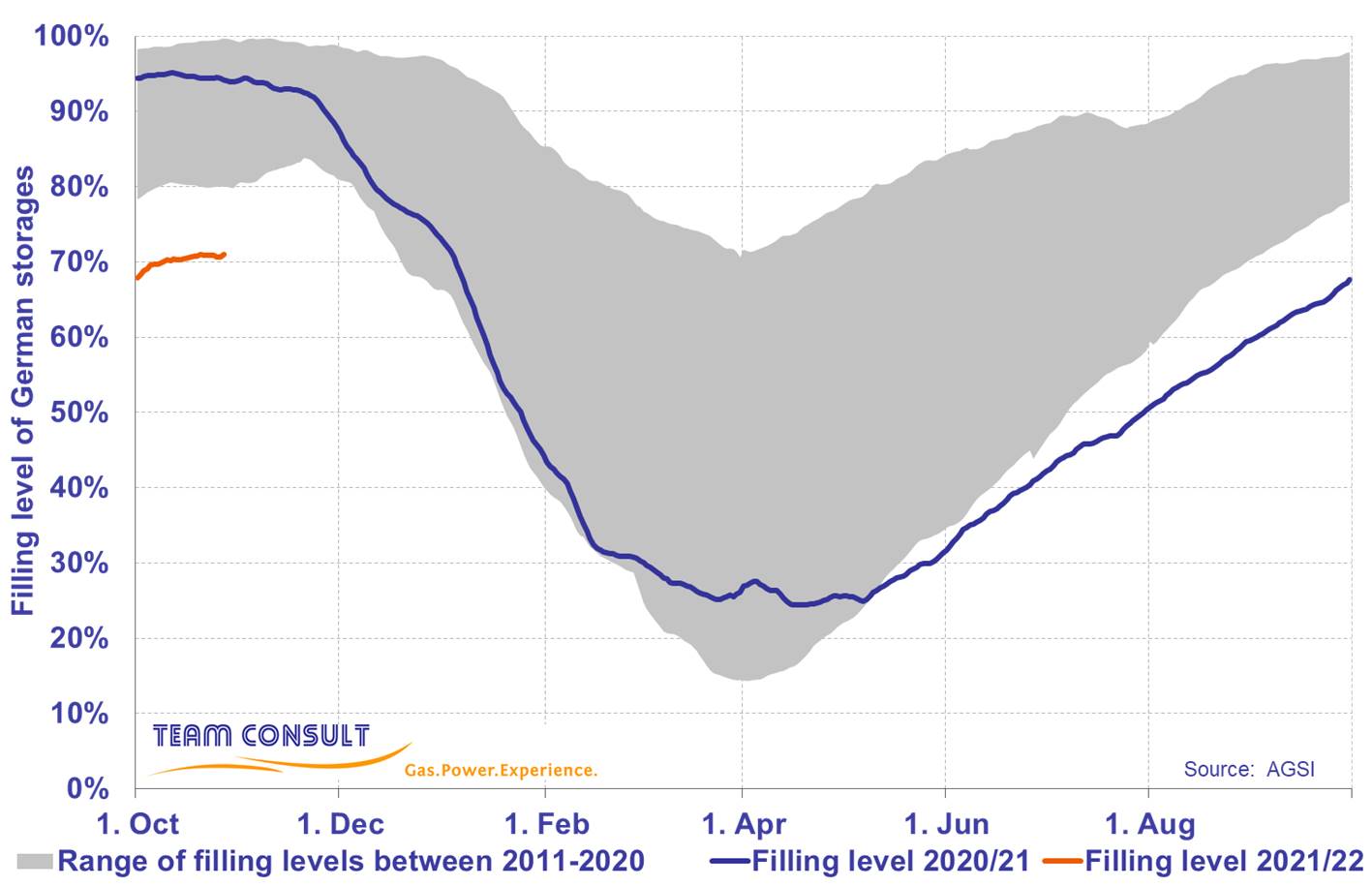

October 2021

Current filling levels of natural gas storages in Germany

July 2021

Current filling levels of natural gas storages in Germany

April 2021

Current filling levels of natural gas storages in Germany

March 2021

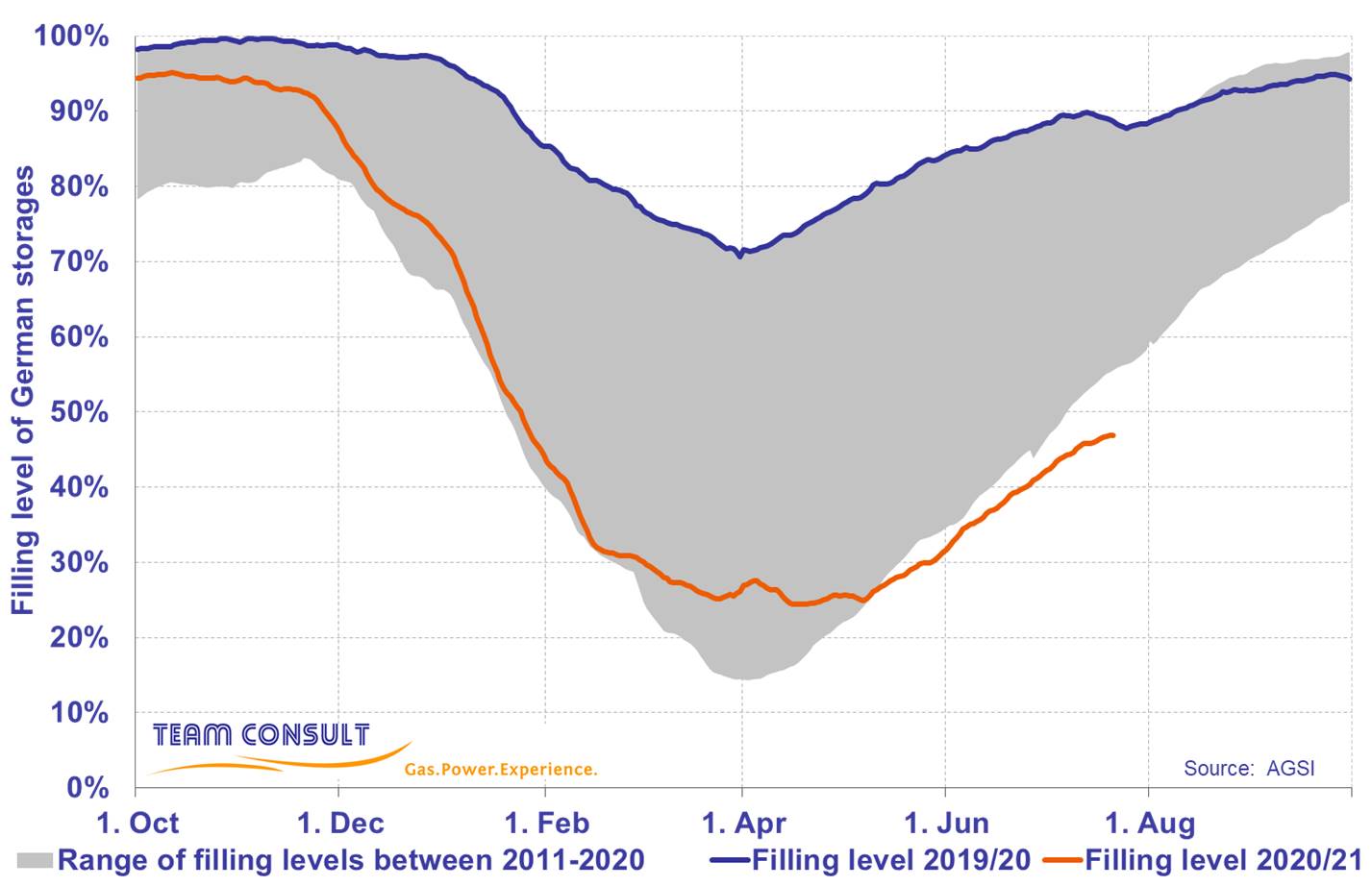

Current filling levels of natural gas storages

September 2020

Current filling levels of natural gas storages

June 2020

What happens with the German gas storage filling levels?

February 2020

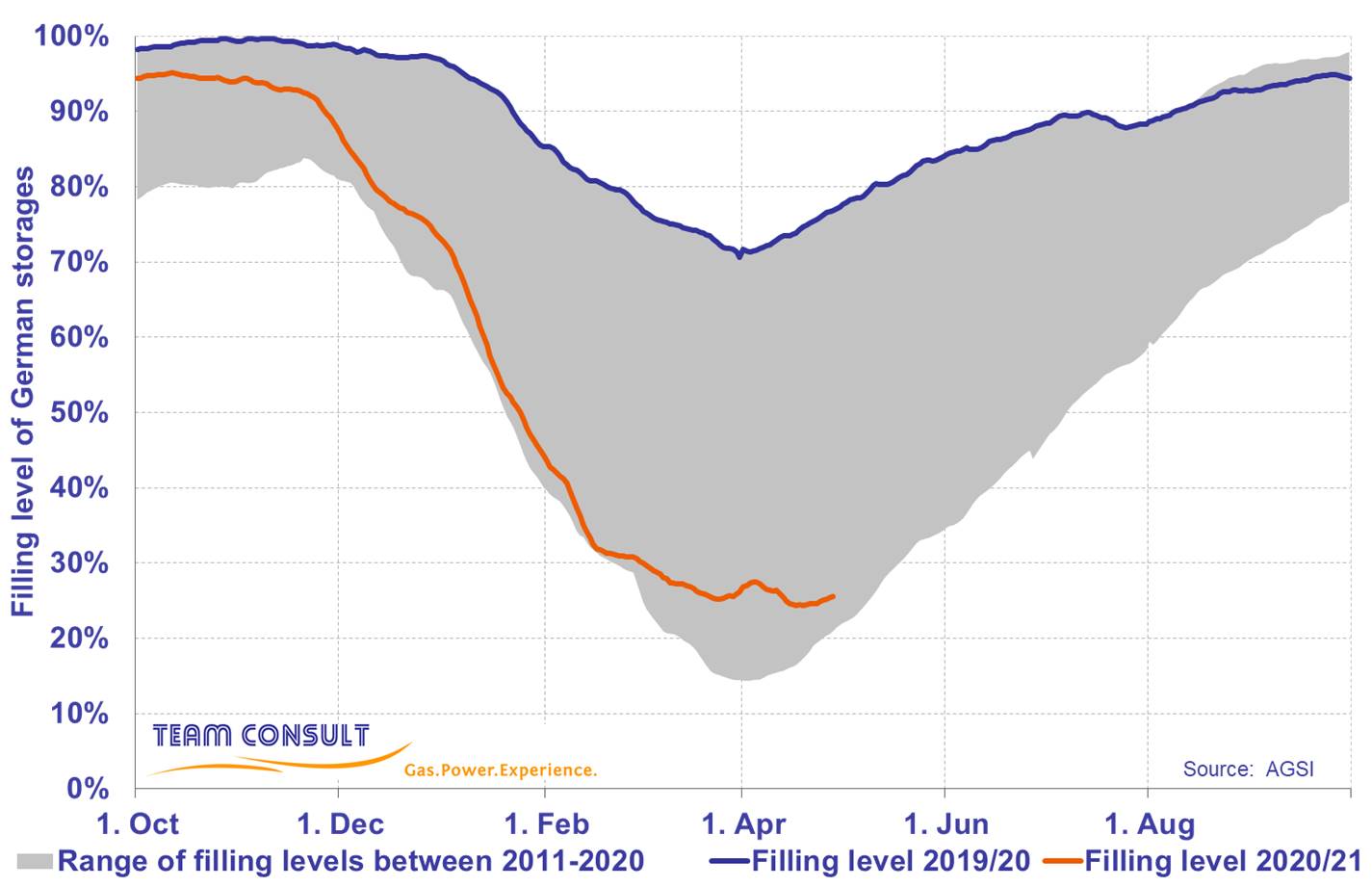

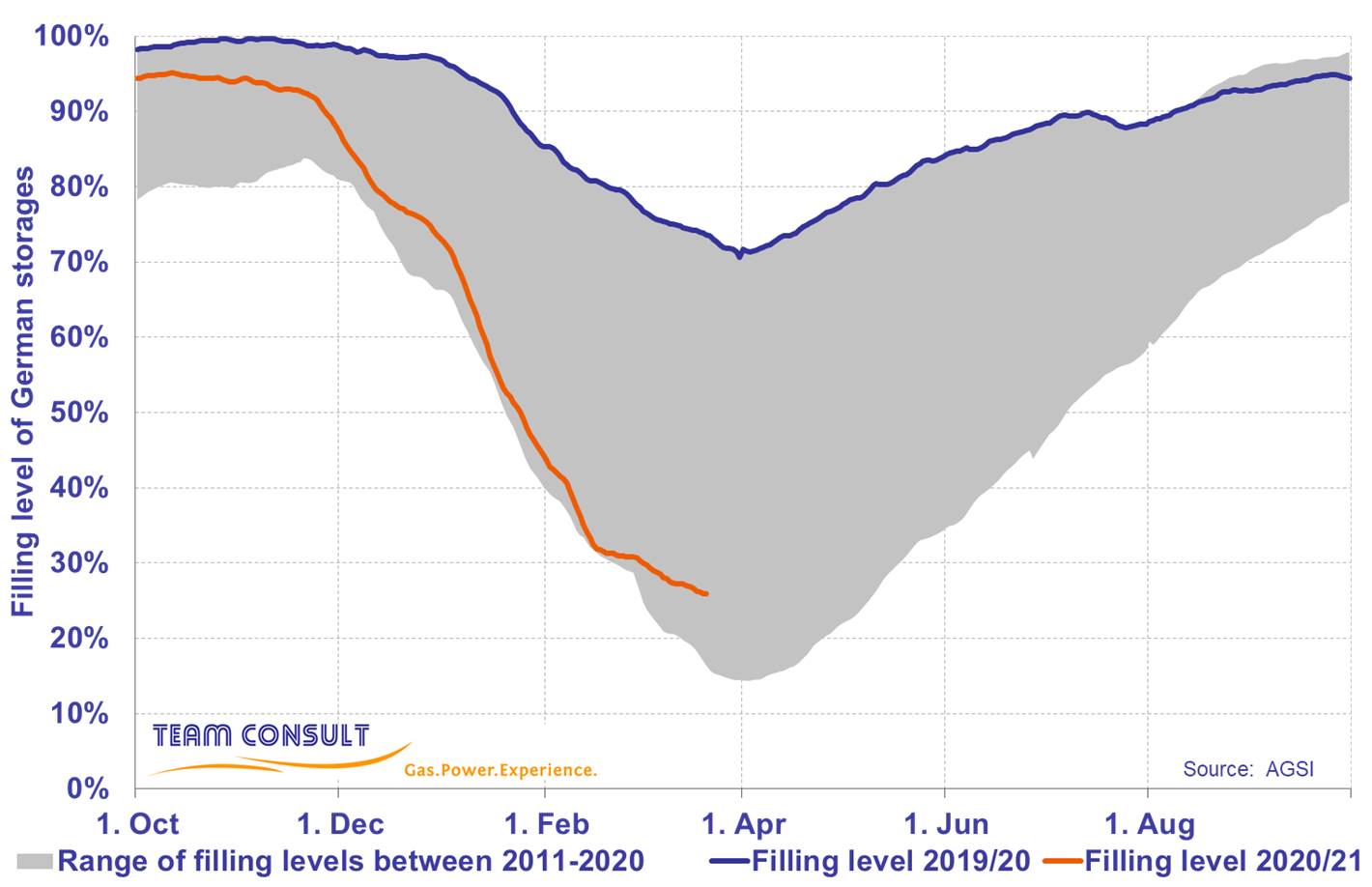

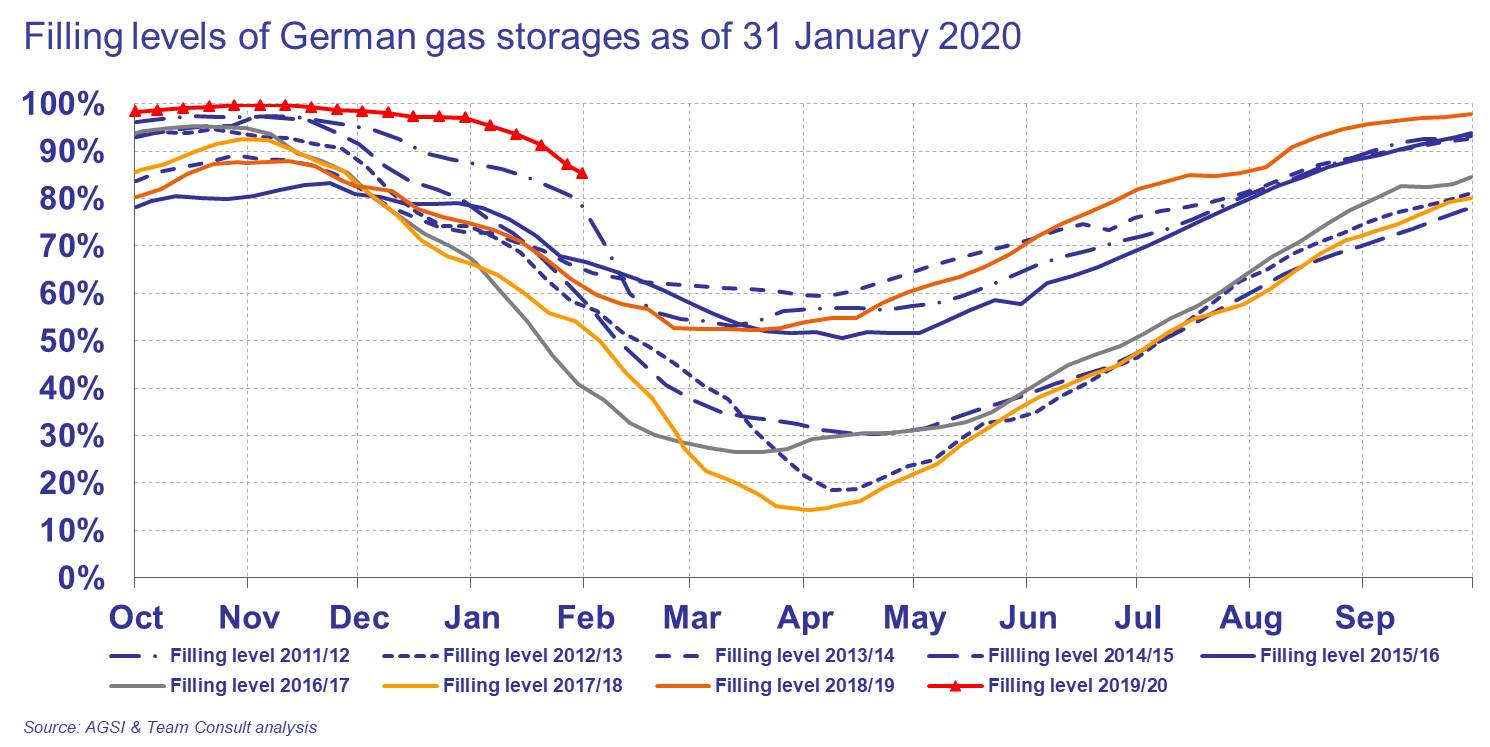

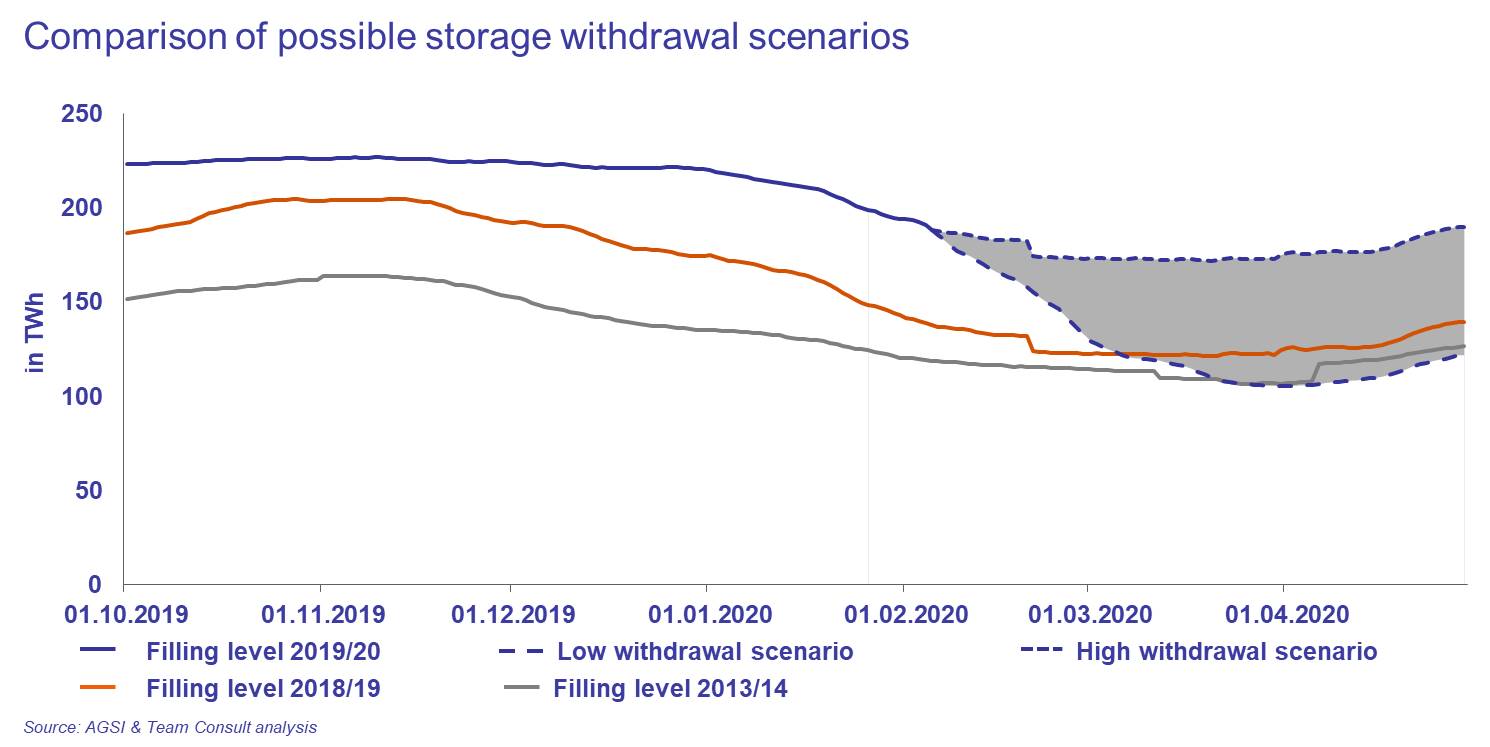

Preparations for possible supply disruptions caused by a suspension of gas transits via Ukraine were one of the reasons for the high injections into German gas storages throughout the past injection season. At the beginning of the current withdrawal season German gas storage filling levels reached a historic high at above 99% (226 TWh on the basis of AGSI data).

Due to the lack of a cold spell in the current winter 2019/20 storage withdrawals were so far only modest. As a result the filling level of German storages still stood at 87% at the beginning of February. Typically, the filling level is around 55% to 65% at this time of the year.

On the supply side, gas flows from Russia through the Nord Stream pipeline and entries via Mallnow remained constant over the past weeks. Despite an agreement on the transit of gas via Ukraine, gas flows via Ukraine were reduced markedly. Because of low seasonal gas demand and high deliveries from north-west European LNG terminals the supply situation is not affected.

To provide an outlook on the possible storage filling levels at the beginning of April the daily withdrawals of the years 2017/18 (high withdrawals) and 2018/19 (low withdrawals) were used as benchmarks.

- Under the assumption that high storage withdrawals occur throughout the remainder of the winter, a storage filling level of about 100 TWh can be expected.

- By contrast, continued low storage withdrawals would lead to a storage filling level of about 170 TWh by the end of winter.

By contrast, continued low storage withdrawals would lead to a storage filling level of about 170 TWh by the In the latter case a lower gas demand in the coming summer can be expected. Provided that the supply situation remains good this situation will increase the pressure on wholesale gas prices so that even historically low prices would not come as a surprise. A similar situation occurred in the years 2014 and 2019 which were marked by high storage levels at the end of winter. This led to low wholesale prices during the summer. Under these preconditions a high utilisation of gas fired power plants can be expected.end of winter.

Filling levels of natural gas storages in January 2019

February 2019

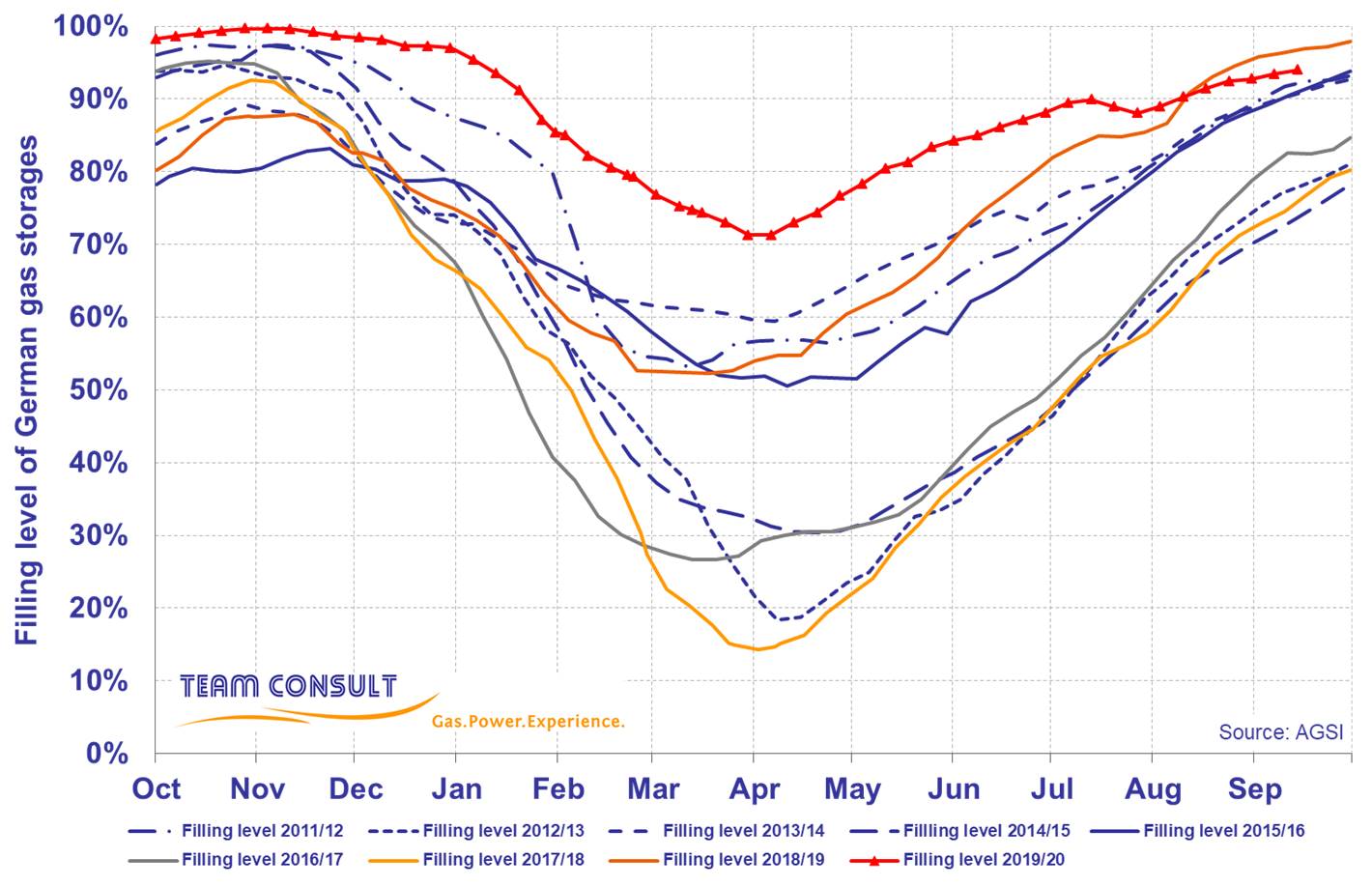

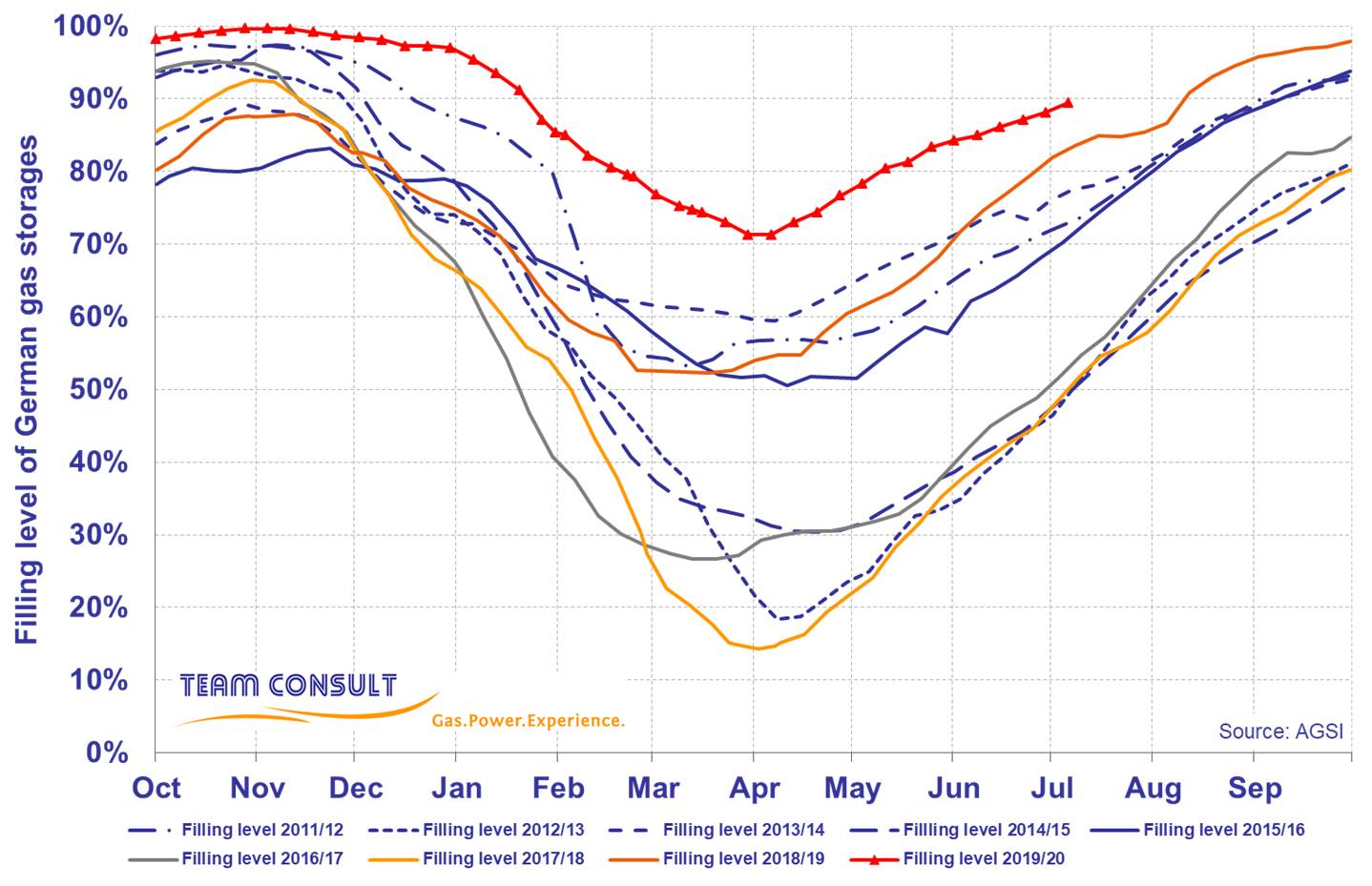

At the beginning of January, German gas storage facilities had an aggregated filling level of 75 percent (174 TWh), a good 9 percentage points above the previous year's level. Over the course of the month, the level fell by 12 percentage points to 61 percent (142 TWh). This figure was still a good 9 percentage points above the level at the same time last year.

Looking at the daily withdrawals, January showed a divided picture. In the first half of the month, up to 1.4 TWh per day were withdrawn at peak times. In the second half of the month, temperatures dropped and withdrawals increased significantly, peaking at up to 2.1 TWh per day.