Hydrogen economy

Hydrogen will play a key role in the decarbonisation of the energy system. It can be stored in large quantities and over long periods and can thus make a crucial contribution to the resilience of the energy system. Various options are available for transporting hydrogen: pipelines, ships, trains and trucks are possible means of transport. Hydrogen can be transported in the gaseous or liquid form, or (after chemical conversion) in the form of derivatives such as ammonia, synthetic methane, synthetic methanol or LOHC (liquid organic hydrogen carrier).

Challenges for hydrogen ramp-up

The main challenge in establishing the hydrogen economy is the need to build the entire value chain from scratch. This is especially true for green hydrogen, which is produced exclusively from renewable electricity by means of water electrolysis. First, the necessary power generation capacities (wind, PV) must be built. Depending on the location of the electrolysers, new power lines and water treatment infrastructure (e.g. desalination plants) may also be required. To enable international hydrogen trading, transport logistics (ship or pipeline transport) must be established, and further downstream distribution structures and facilities for hydrogen use must be set up. The success of this process requires the coordination of many decisions made by individual actors, gradually forming a new sector of the energy industry.

Such a build-up requires a lot of capital and, thus, appropriate financial resources and experienced investors. Due to the longevity of the assets, stable political conditions, including at the international level, are essential to secure the high investments. Energy policy is thus faced with the challenge of initiating a ramp-up that, until economies of scale are achieved and the necessary technologies have matured, does not yet offer a self-sustaining business model in a purely market-based setting and therefore requires public support and regulatory backing. However, the basic features of the future market design and self-sustaining business models should become apparent as quickly as possible, and regulation should not be too fragmented or erratic.

Implications for market actors

The development of the hydrogen economy is an opportunity for established market participants to expand their existing business model and for newcomers to enter the energy market. In this context, the following questions may arise:

- How does regulation influence the profitability of projects?

- What locations are particularly suitable for hydrogen production?

- How will the ramp-up of hydrogen affect the expansion and conversion of the electricity and gas network infrastructure?

- How should the commercial interfaces between different market participants be structured contractually, e.g. regarding pricing and offtake commitments and the distribution of opportunities and risks?

- How can the investments required for the ramp-up of hydrogen (in infrastructure, power generation plants, electrolysers, marketing) be reasonably coordinated?

- What sectors and applications have the best prospects regarding the commercial use of hydrogen?

- What role will the different hydrogen production pathways play over time?

- Is a specific project eligible for public funding and, if so, under what mechanism?

- What are the prospects for hydrogen imports in terms of timing, geography and volume?

Consulting services

- Market forecasts, e.g. of hydrogen supply and demand ramp-up in terms of quantities and time

- Analysis of the regulatory environment and its significance for specific investment projects

- Assessment of the prospects for hydrogen imports, e.g. in terms of possible countries of origin

- Market analyses and scenarios for hydrogen storage

- Investigations into the impact of infrastructure repurposing on the respective network charges

- Analysis of the potential role of hydrogen in heat supply, e.g. in the context of municipal heat planning

- Development of terms and conditions for hydrogen supply contracts

- Strategy development for the transformation of molecules-based infrastructures

Publications

H2 Market Radar (8th edition, October 2025)

The newest edition of our H2 market radar is now available for download here.

The key takeaways are:

- In Northwest Europe, 128 electrolysis plants with a combined capacity of 503 MWel are now in operation. A further 327 projects are in the planning stages (28.5 GWel) or are already under construction (867 MWel).

- Underground hydrogen storages will have an important role in the future. The majority of research and commercial projects are located in Europe.

- The production costs of green hydrogen in 2030 will significantly vary globally, depending on the regional conditions (such as wind, solar radiation, specific CAPEX and interest rates).

- Many hydrogen projects are being reassessed, leading to cancellations in some cases. Reasons include, e.g., a declining willingness to take risks on the part of large corporations, difficulties in the conclusion of long-term purchase contracts and very demanding regulatory requirements regarding the renewable electricity used.

H2 Market Radar (7th edition, November 2024)

The 7th edition of our H2 Market Radar is now available for download here.

The key takeaways are:

- In Northwest Europe, 110 electrolysis facilities with a combined capacity of 207 MWel are now in operation. A further 297 projects are in the planning stages or are already under construction.

- The approval of the German hydrogen core network has paved the way for the construction of the transport infrastructure.

- Of the four corridors planned for the import of hydrogen to Germany and Northwest Europe the construction of a major part of the Northwestern corridor was cancelled in September. This is a setback for the further hydrogen ramp-up.

- The results of the first auction of the European Hydrogen Bank show that the buyers of hydrogen from the eligible projects are prepared to pay a substantial premium compared to grey hydrogen.

H2 Market Radar (6th edition, February 2024)

The 6th edition of our H2 Market Radar is now available for download here...

The key takeaways are:

- Our ongoing market observations show that 92 facilities with a combined capacity of 125 MWel are now in operation in Northwest Europe. In addition, over 260 projects for the production of hydrogen are currently pursued in the region.

- According to the IEA, global H2-consumption reached 95 Mt in 2022. Most of the hydrogen was consumed in traditional sectors such as industry or refining. Consumption in new applications such as fuel or high-temperature heating is still in its infancy.

- The global pipeline of projects could increase low carbon hydrogen production capacity to 90 Mt/a under the optimistic assumption that all projects will be realized. Capacities currently planned for the MENA region will not suffice to fulfil European import targets for 2030.

- The actual project pipeline shows the highest dynamics in Europe, North- & South America and in South-East-Asia/Oceania while the MENA region and Sub-Saharan Africa are lagging despite their relative favorable preconditions.

Hydrogen Market Radar (5th edition, January 2023)

January 2023

Although short-term security of supply considerations have dominated last year’s agenda, longer-term prospects such as hydrogen projects have progressed further. The newest edition of our Hydrogen Market Radar underpins these developments. The document is can be downloaded here.

- Over 300 projects for the production of hydrogen are currently pursued in Northwest Europe. 67 plants with a combined capacity of 100 MWel are now in operation.

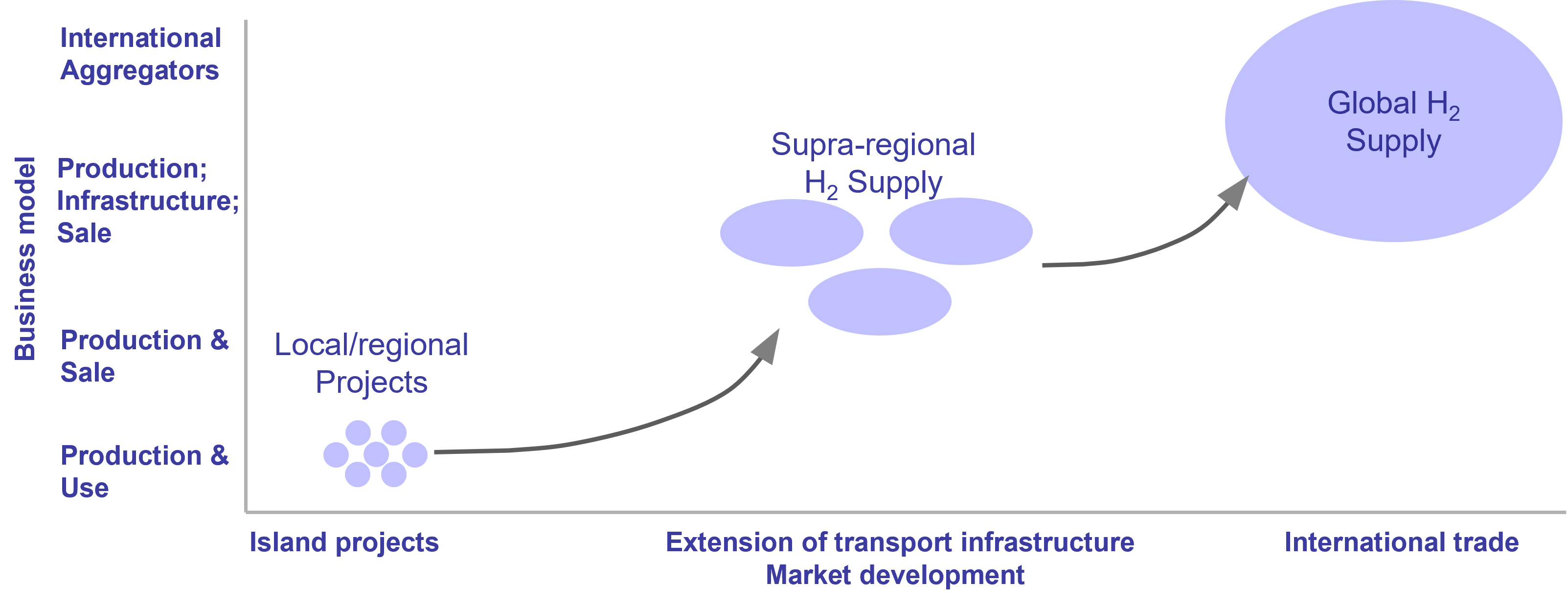

- The hydrogen market is still in the phase of island projects. The intended infrastructure expansion aims at a supra-regional supply and should enable global hydrogen trade in the long run.

- Two thirds of the projects planned in Germany with a production capacity of 30 MW or more are aimed at the supraregional marketing of hydrogen.

- At the international level, a short-term use of hydrogen is intended primarily in the transport sector.

H2 Market Radar (Volume 4 - July 2021)

July 2021

The momentum surrounding the topic of hydrogen is ongoing. This applies not only to the debate regarding future applications and the question of the right “colour” of hydrogen, but fortunately also to the H2 project landscape.

Since our last edition, not only have 50 new projects been initiated in Northwest Europe, but 10 projects with an H2-production capacity of 16 MWh/h have started operations.

When it comes to the use of hydrogen in the heating market, political opinions differ widely. This is reflected in the many studies that have taken up this topic in recent months as well as statements issued by various stakeholders.

Within the scope of its own commissioned work, Team Consult has also dealt intensively with this topic and comes to the conclusion, that when considering economic and technological aspects, a complete transition of the heating sector is not possible without a substantial contribution from hydrogen.

More details on the topics addressed can be found in the latest edition of our H2-Market Radar here.

H2 Market Radar (Volume 3 - February 2021)

February 2021

The dynamic market development of hydrogen projects observed last year has continued nationally and internationally. This is also shown in the development of the number of projects in Northwest Europe.

Since we published our first edition of the H2-Market Radar in June 2020, the number of H2-projects in the region increased from 80 to more than 130. 7 plants became operational during this period.

Since Germany’s national hydrogen strategy was published last year, the German federal states are in a kind of competition to offer the best investment conditions for the development of the future hydrogen infrastructure. Especially the northern federal states have recognized the value of a cooperative approach and agreed on a common agenda and quantitate targets.

In our last edition we showed that many projects are aimed at the transport sector. This fits in with the observation that the growth of the H2 filling station network has gained momentum with Germany taking the lead.

We hope you enjoy reading our third volume and we are looking forward to your feedback. You can find the new issue here.

H2 Market Radar (Volume 2 - October 2020)

October 2020

At the beginning of July 2020 we published the first volume of our H2 Market Radar. The reactions were very encouraging and showed that there is a tremendous need for information on the dynamic in this sector. The focus of our Radar will continue to track developments and progress in the field of hydrogen and to present them in an easily understandable and coherent format.

At the beginning of the 3rd quarter the EU presented hydrogen as a central element of the “Green Deal” and further member states adopted national hydrogen strategies. A comparison of the ambitions at the EU and the national level shows, that the national targets for the production of hydrogen are not yet sufficient by a wide margin to reach the goal set out by the EU to produce 10 Mt of hydrogen per year by 2030.

The project landscape in Northwest Europe continues to be dynamic. Since the publication of the first volume we have identified about 30 further projects – of which almost half can be attributed to Germany. Particularly in Germany it can be observed that the announcement of the national strategy in June led to a dynamic reaction on the level of the federal states – we will continue to monitor these developments and will come back to them in one of the next issues.

Even though many projects initially focused on building up hydrogen production and infrastructure, it is worth looking at the planned areas of application. It can be observed that across all countries the transport and industrial sector present the most important areas of application of the current projects. Between 70% and 80% of projects identified are aiming at using hydrogen in these sectors.

We hope you enjoy reading our second volume and we are looking forward to your feedback. You can find the new issue here.

H2 Market Radar

July 2020

Hydrogen is currently one of the most discussed topics regarding the transition of the energy systems. The main reason is the expectation that hydrogen will be a key component in decarbonizing those sectors for which no other carbon-neutral option is available.

In the second quarter of this year, the Netherlands, Norway and Germany published their national hydrogen strategies. A common denominator of these strategies is that – in addition to national efforts – they are banking on international cooperation. This is perfectly complemented by the European Commission’s announcement that it will publish its own strategy very soon.

A number of projects for the production and use of hydrogen have been initiated in the last five years. However, only a limited number of hydrogen facilities exist today with capacities mostly in the one-digit megawatt range – therefore it is still a long way to achieve a total capacity around five gigawatt (which is the objective of the German hydrogen strategy for 2030).

Our H2 Market Radar follows the developments and progress in the hydrogen sector and illustrates these developments in a straightforward manner. As a start, we focus on Northwest Europe, since due to new large offshore wind parks and its well-developed gas infrastructure, this region has excellent preconditions for building up an integrated hydrogen business.

Our first edition shows, that the at current project plans would lead to an expansion of hydrogen production capacity by a factor of more than one hundred. You find the edition here.